| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907992000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911909150 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911902500 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3911100000 | Doc | 61.1% | CN | US | 2025-05-12 |

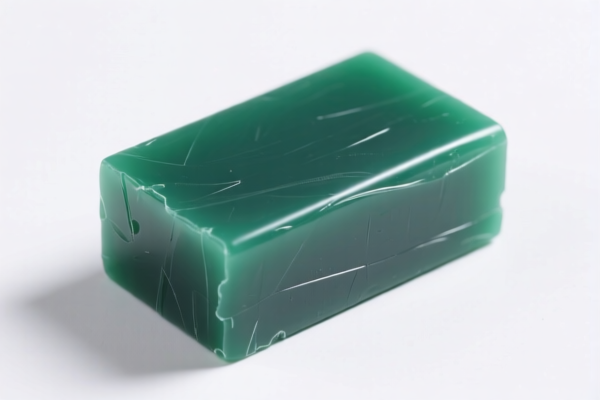

- HS CODE: 3907992000

- Product Description: Thermoplastic polyester resin raw material

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: No anti-dumping duties or special tariffs on iron/aluminum apply.

- Action Required: Confirm the exact chemical composition and whether it falls under the polyester resin category.

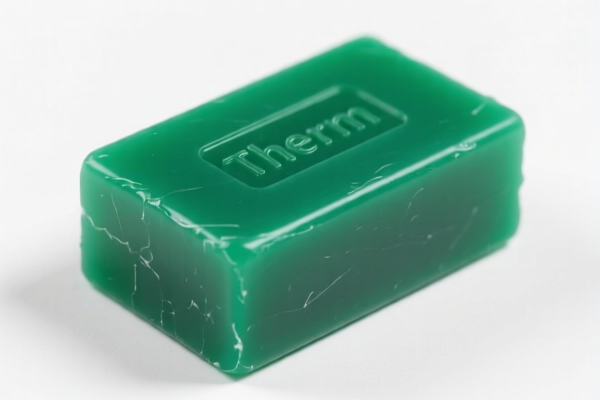

- HS CODE: 3911909110

- Product Description: Thermoplastic petroleum resin raw material

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: No anti-dumping duties or special tariffs on iron/aluminum apply.

- Action Required: Verify if the product is classified as a "raw material" or finished product, as this may affect classification.

- HS CODE: 3911909150

- Product Description: Thermosetting synthetic resin raw material

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: No anti-dumping duties or special tariffs on iron/aluminum apply.

- Action Required: Ensure the product is not misclassified as a thermoplastic resin.

- HS CODE: 3911902500

- Product Description: Thermoplastic petroleum resin

- Total Tax Rate: 61.1%

- Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: No anti-dumping duties or special tariffs on iron/aluminum apply.

- Action Required: Confirm the exact type of petroleum resin and its intended use.

- HS CODE: 3911100000

- Product Description: Thermoplastic petroleum resin

- Total Tax Rate: 61.1%

- Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: No anti-dumping duties or special tariffs on iron/aluminum apply.

- Action Required: Verify if the product is classified under the correct subheading (e.g., 3911100000 vs. 3911902500).

General Advice:

- Be cautious of the April 11, 2025 tariff increase, which applies to all the above HS codes.

- Ensure the material composition and product form (raw material vs. finished product) are accurately described in the customs declaration.

- If importing from countries with anti-dumping duties, check for additional charges.

- Always verify the HS code with the latest customs database or a qualified customs broker.

- HS CODE: 3907992000

- Product Description: Thermoplastic polyester resin raw material

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: No anti-dumping duties or special tariffs on iron/aluminum apply.

- Action Required: Confirm the exact chemical composition and whether it falls under the polyester resin category.

- HS CODE: 3911909110

- Product Description: Thermoplastic petroleum resin raw material

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: No anti-dumping duties or special tariffs on iron/aluminum apply.

- Action Required: Verify if the product is classified as a "raw material" or finished product, as this may affect classification.

- HS CODE: 3911909150

- Product Description: Thermosetting synthetic resin raw material

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: No anti-dumping duties or special tariffs on iron/aluminum apply.

- Action Required: Ensure the product is not misclassified as a thermoplastic resin.

- HS CODE: 3911902500

- Product Description: Thermoplastic petroleum resin

- Total Tax Rate: 61.1%

- Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: No anti-dumping duties or special tariffs on iron/aluminum apply.

- Action Required: Confirm the exact type of petroleum resin and its intended use.

- HS CODE: 3911100000

- Product Description: Thermoplastic petroleum resin

- Total Tax Rate: 61.1%

- Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: No anti-dumping duties or special tariffs on iron/aluminum apply.

- Action Required: Verify if the product is classified under the correct subheading (e.g., 3911100000 vs. 3911902500).

General Advice:

- Be cautious of the April 11, 2025 tariff increase, which applies to all the above HS codes.

- Ensure the material composition and product form (raw material vs. finished product) are accurately described in the customs declaration.

- If importing from countries with anti-dumping duties, check for additional charges.

- Always verify the HS code with the latest customs database or a qualified customs broker.

Customer Reviews

No reviews yet.