| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907992000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911902500 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

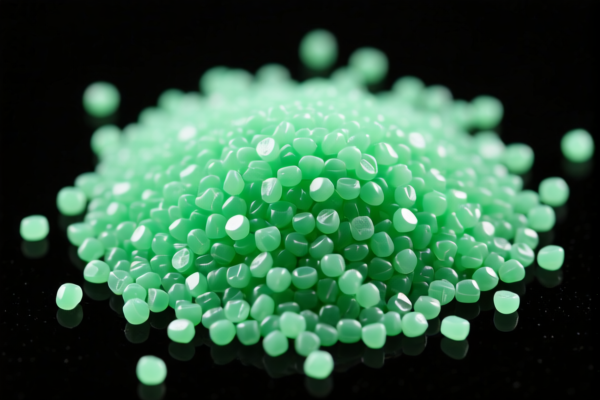

Here is the structured and professional breakdown of the HS codes and associated tariff information for Thermoplastic Resin Granules Raw Material, based on your input:

🔍 HS Code Classification Overview

1. HS Code: 3907992000

Product Description: Thermoplastic Polyester Resin Raw Material

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- No anti-dumping duties or special tariffs on iron/aluminum apply.

- This product is subject to the April 11 Special Tariff (30.0%) after April 11, 2025.

2. HS Code: 3911909110

Product Description:

- Thermoplastic Petroleum Resin Raw Material

- Thermoplastic Petroleum Resin Granules

- Thermoplastic Petroleum Resin

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is used for multiple product descriptions (raw material, granules, and resin).

- Subject to April 11 Special Tariff (30.0%) after April 11, 2025.

- No anti-dumping duties on iron or aluminum apply.

3. HS Code: 3911902500

Product Description: Thermoplastic Petroleum Resin

Total Tax Rate: 61.1%

Tariff Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is specific to thermoplastic petroleum resin.

- Subject to April 11 Special Tariff (30.0%) after April 11, 2025.

- No anti-dumping duties on iron or aluminum apply.

📌 Proactive Advice for Importers

- Verify Material Specifications: Ensure the product is correctly classified under the appropriate HS code (e.g., raw material vs. finished granules).

- Check Unit Price and Composition: Tariff rates may vary based on the product's chemical composition and form.

- Confirm Required Certifications: Some products may require specific documentation (e.g., Material Safety Data Sheets, origin certificates).

- Monitor April 11, 2025, Policy Changes: Be aware of the 30.0% additional tariff that will apply after this date.

- Review Anti-Dumping Duty Rules: While not applicable to this product category, it's good practice to confirm for other materials.

📅 Important Dates to Note

- April 11, 2025: A 30.0% additional tariff will be applied to all the above HS codes.

- No Anti-Dumping Duties: Not applicable for this product category.

Let me know if you need help with customs documentation or further classification details. Here is the structured and professional breakdown of the HS codes and associated tariff information for Thermoplastic Resin Granules Raw Material, based on your input:

🔍 HS Code Classification Overview

1. HS Code: 3907992000

Product Description: Thermoplastic Polyester Resin Raw Material

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- No anti-dumping duties or special tariffs on iron/aluminum apply.

- This product is subject to the April 11 Special Tariff (30.0%) after April 11, 2025.

2. HS Code: 3911909110

Product Description:

- Thermoplastic Petroleum Resin Raw Material

- Thermoplastic Petroleum Resin Granules

- Thermoplastic Petroleum Resin

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is used for multiple product descriptions (raw material, granules, and resin).

- Subject to April 11 Special Tariff (30.0%) after April 11, 2025.

- No anti-dumping duties on iron or aluminum apply.

3. HS Code: 3911902500

Product Description: Thermoplastic Petroleum Resin

Total Tax Rate: 61.1%

Tariff Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is specific to thermoplastic petroleum resin.

- Subject to April 11 Special Tariff (30.0%) after April 11, 2025.

- No anti-dumping duties on iron or aluminum apply.

📌 Proactive Advice for Importers

- Verify Material Specifications: Ensure the product is correctly classified under the appropriate HS code (e.g., raw material vs. finished granules).

- Check Unit Price and Composition: Tariff rates may vary based on the product's chemical composition and form.

- Confirm Required Certifications: Some products may require specific documentation (e.g., Material Safety Data Sheets, origin certificates).

- Monitor April 11, 2025, Policy Changes: Be aware of the 30.0% additional tariff that will apply after this date.

- Review Anti-Dumping Duty Rules: While not applicable to this product category, it's good practice to confirm for other materials.

📅 Important Dates to Note

- April 11, 2025: A 30.0% additional tariff will be applied to all the above HS codes.

- No Anti-Dumping Duties: Not applicable for this product category.

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.