| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3911903500 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3911909150 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911904500 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3908902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3911100000 | Doc | 61.1% | CN | US | 2025-05-12 |

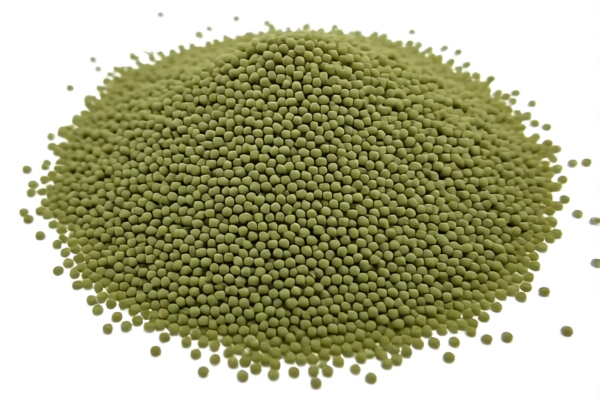

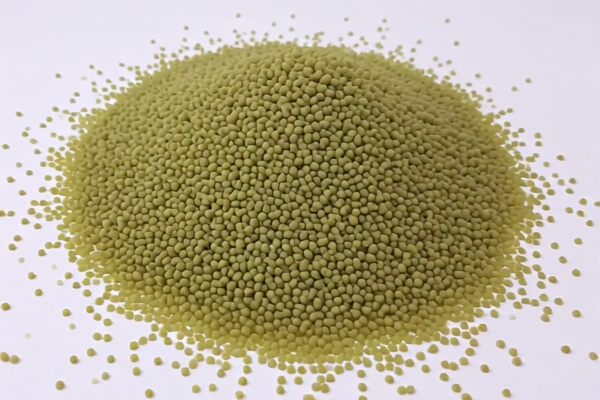

Product Name: Thermosetting Petroleum Resin Polyamide Graft Copolymer

Classification Analysis and Tax Information:

- HS CODE: 3911909150

- Description: Thermosetting Petroleum Resin

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is specific to thermosetting petroleum resins and may be suitable if the product is primarily a thermosetting resin.

-

HS CODE: 3911100000

- Description: Thermosetting Petroleum Resin

- Total Tax Rate: 61.1%

- Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is also for thermosetting petroleum resins, but with a slightly lower base tariff than 3911909150.

-

HS CODE: 3911903500

- Description: Petroleum Resin Copolymer

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for petroleum resin copolymers, which may be more appropriate if the product is a graft copolymer.

-

HS CODE: 3908902000

- Description: Polyamide Copolymer Resin

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for polyamide graft copolymer resins, which may be the most accurate if the product is a polyamide graft copolymer.

-

HS CODE: 3911904500

- Description: Petroleum Resin-Based Thermosetting Material

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for thermosetting materials based on petroleum resins, which may be suitable if the product is a composite or modified resin.

Key Tax Rate Changes (April 11, 2025):

- All listed HS codes will see an increase in total tax rate from 55.0% to 60.8% or 61.5%, depending on the base tariff.

- Additional tariffs (25.0%) are already in effect.

Proactive Advice:

- Verify the exact chemical composition and structure of the product to ensure the most accurate HS code classification.

- Check the unit price and material specifications to determine if any preferential tariff rates apply.

- Confirm if any certifications (e.g., REACH, RoHS, or customs documentation) are required for import.

- Review the product's end-use to determine if it qualifies for any special tariff exemptions or preferential trade agreements.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Product Name: Thermosetting Petroleum Resin Polyamide Graft Copolymer

Classification Analysis and Tax Information:

- HS CODE: 3911909150

- Description: Thermosetting Petroleum Resin

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is specific to thermosetting petroleum resins and may be suitable if the product is primarily a thermosetting resin.

-

HS CODE: 3911100000

- Description: Thermosetting Petroleum Resin

- Total Tax Rate: 61.1%

- Breakdown:

- Base Tariff: 6.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is also for thermosetting petroleum resins, but with a slightly lower base tariff than 3911909150.

-

HS CODE: 3911903500

- Description: Petroleum Resin Copolymer

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for petroleum resin copolymers, which may be more appropriate if the product is a graft copolymer.

-

HS CODE: 3908902000

- Description: Polyamide Copolymer Resin

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for polyamide graft copolymer resins, which may be the most accurate if the product is a polyamide graft copolymer.

-

HS CODE: 3911904500

- Description: Petroleum Resin-Based Thermosetting Material

- Total Tax Rate: 60.8%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for thermosetting materials based on petroleum resins, which may be suitable if the product is a composite or modified resin.

Key Tax Rate Changes (April 11, 2025):

- All listed HS codes will see an increase in total tax rate from 55.0% to 60.8% or 61.5%, depending on the base tariff.

- Additional tariffs (25.0%) are already in effect.

Proactive Advice:

- Verify the exact chemical composition and structure of the product to ensure the most accurate HS code classification.

- Check the unit price and material specifications to determine if any preferential tariff rates apply.

- Confirm if any certifications (e.g., REACH, RoHS, or customs documentation) are required for import.

- Review the product's end-use to determine if it qualifies for any special tariff exemptions or preferential trade agreements.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.