| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3911903500 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3911902500 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3911100000 | Doc | 61.1% | CN | US | 2025-05-12 |

| 3911909110 | Doc | 61.5% | CN | US | 2025-05-12 |

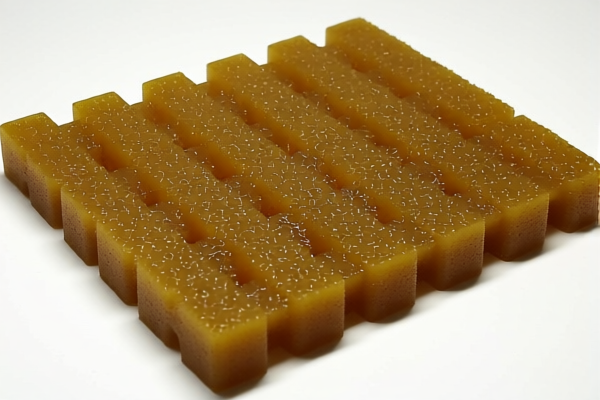

Product Name: Thermosetting Petroleum Resin Polyolefin Graft Copolymer

Classification Task: HS Code Interpretation and Tariff Analysis

✅ HS Code Interpretation:

Based on the product description, "Thermosetting Petroleum Resin Polyolefin Graft Copolymer" is a thermosetting (not thermoplastic) petroleum resin with a graft copolymer structure. This is not covered under the HS codes listed for thermoplastic petroleum resins (e.g., 3911902500, 3911100000, etc.), which are explicitly for thermoplastic materials.

However, the provided HS codes are for thermoplastic petroleum resins. Since your product is thermosetting, it may fall under a different classification. The most likely HS code is:

🔢 HS CODE: 3911909110

Description:

- Other petroleum resins, not elsewhere specified or included

- Includes thermosetting resins (if not otherwise classified)

- Not thermoplastic (as per the description)

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tariff Rate: 61.5%

⚠️ Important Notes and Alerts:

- Time-sensitive policy:

- Additional tariffs of 30.0% will apply after April 11, 2025.

-

Ensure your customs clearance is completed before this date to avoid higher costs.

-

Anti-dumping duties:

-

Not applicable for this product category (no specific anti-dumping duties listed for petroleum resins in this classification).

-

Certifications and Documentation:

- Verify the material composition and technical specifications to ensure it is correctly classified as a thermosetting resin.

- Confirm whether certifications (e.g., REACH, RoHS, or specific import permits) are required for the destination country.

📌 Proactive Advice:

- Double-check the product's physical and chemical properties to confirm it is thermosetting and not thermoplastic.

- Consult with a customs broker or classification expert if the product is a graft copolymer or contains other additives, as this may affect the HS code.

- Review the latest HS code updates from the customs authority of the importing country to ensure compliance.

- Keep records of material specifications and supplier documentation for customs audits.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Name: Thermosetting Petroleum Resin Polyolefin Graft Copolymer

Classification Task: HS Code Interpretation and Tariff Analysis

✅ HS Code Interpretation:

Based on the product description, "Thermosetting Petroleum Resin Polyolefin Graft Copolymer" is a thermosetting (not thermoplastic) petroleum resin with a graft copolymer structure. This is not covered under the HS codes listed for thermoplastic petroleum resins (e.g., 3911902500, 3911100000, etc.), which are explicitly for thermoplastic materials.

However, the provided HS codes are for thermoplastic petroleum resins. Since your product is thermosetting, it may fall under a different classification. The most likely HS code is:

🔢 HS CODE: 3911909110

Description:

- Other petroleum resins, not elsewhere specified or included

- Includes thermosetting resins (if not otherwise classified)

- Not thermoplastic (as per the description)

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tariff Rate: 61.5%

⚠️ Important Notes and Alerts:

- Time-sensitive policy:

- Additional tariffs of 30.0% will apply after April 11, 2025.

-

Ensure your customs clearance is completed before this date to avoid higher costs.

-

Anti-dumping duties:

-

Not applicable for this product category (no specific anti-dumping duties listed for petroleum resins in this classification).

-

Certifications and Documentation:

- Verify the material composition and technical specifications to ensure it is correctly classified as a thermosetting resin.

- Confirm whether certifications (e.g., REACH, RoHS, or specific import permits) are required for the destination country.

📌 Proactive Advice:

- Double-check the product's physical and chemical properties to confirm it is thermosetting and not thermoplastic.

- Consult with a customs broker or classification expert if the product is a graft copolymer or contains other additives, as this may affect the HS code.

- Review the latest HS code updates from the customs authority of the importing country to ensure compliance.

- Keep records of material specifications and supplier documentation for customs audits.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.