| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3921902100 | Doc | 61.5% | CN | US | 2025-05-12 |

| 7019140000 | Doc | 59.3% | CN | US | 2025-05-12 |

| 7019905150 | Doc | 59.3% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

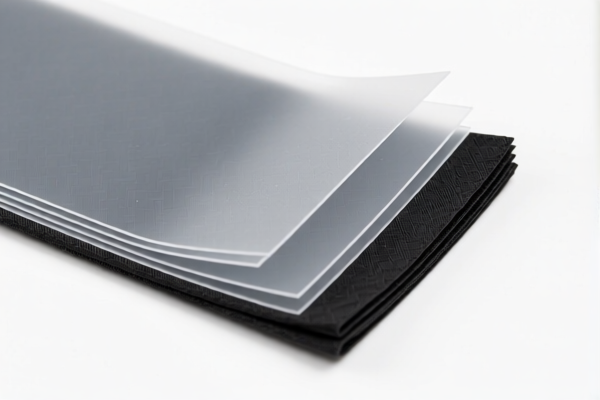

Here is the classification and tariff information for Thin Textile Reinforced Plastic Sheets, based on the provided HS codes and tax details:

✅ HS CODE: 3921904010

Product Description: Applicable to paper-reinforced plastic sheets, flexible plastic sheets reinforced with paper, etc.

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes: This code is suitable for products reinforced with paper. Ensure the product description matches this classification.

✅ HS CODE: 3921902100

Product Description: Applicable to cotton-reinforced plastic sheets, etc.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is suitable for products reinforced with cotton. Verify the material composition before classification.

✅ HS CODE: 7019140000

Product Description: Applicable to glass fiber-reinforced plastic sheets, etc.

- Base Tariff Rate: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.3%

- Notes: This code is suitable for glass fiber-reinforced plastic sheets. Confirm the reinforcement material is glass fiber.

✅ HS CODE: 7019905150

Product Description: Applicable to glass fiber-reinforced plastic sheets, etc.

- Base Tariff Rate: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.3%

- Notes: This code is also for glass fiber-reinforced plastic sheets. Check if the product falls under this specific category or if a more detailed code is available.

✅ HS CODE: 3920995000

Product Description: Applicable to plastic textured sheets, etc.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes: This code is for textured plastic sheets that are not reinforced with textiles. Ensure the product is not reinforced with textile materials.

📌 Important Reminders:

- Verify the material composition of the product (e.g., paper, cotton, glass fiber) to ensure correct HS code classification.

- Check the unit price and certifications required (e.g., import permits, technical specifications).

- Be aware of the April 11, 2025, special tariff which applies to all the above codes and may significantly increase the total tax burden.

- Anti-dumping duties may apply if the product is imported from countries under such measures (check with customs or a trade compliance expert).

If you provide more details about the material composition, thickness, and intended use, I can help you further narrow down the most accurate HS code. Here is the classification and tariff information for Thin Textile Reinforced Plastic Sheets, based on the provided HS codes and tax details:

✅ HS CODE: 3921904010

Product Description: Applicable to paper-reinforced plastic sheets, flexible plastic sheets reinforced with paper, etc.

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes: This code is suitable for products reinforced with paper. Ensure the product description matches this classification.

✅ HS CODE: 3921902100

Product Description: Applicable to cotton-reinforced plastic sheets, etc.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is suitable for products reinforced with cotton. Verify the material composition before classification.

✅ HS CODE: 7019140000

Product Description: Applicable to glass fiber-reinforced plastic sheets, etc.

- Base Tariff Rate: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.3%

- Notes: This code is suitable for glass fiber-reinforced plastic sheets. Confirm the reinforcement material is glass fiber.

✅ HS CODE: 7019905150

Product Description: Applicable to glass fiber-reinforced plastic sheets, etc.

- Base Tariff Rate: 4.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.3%

- Notes: This code is also for glass fiber-reinforced plastic sheets. Check if the product falls under this specific category or if a more detailed code is available.

✅ HS CODE: 3920995000

Product Description: Applicable to plastic textured sheets, etc.

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

- Notes: This code is for textured plastic sheets that are not reinforced with textiles. Ensure the product is not reinforced with textile materials.

📌 Important Reminders:

- Verify the material composition of the product (e.g., paper, cotton, glass fiber) to ensure correct HS code classification.

- Check the unit price and certifications required (e.g., import permits, technical specifications).

- Be aware of the April 11, 2025, special tariff which applies to all the above codes and may significantly increase the total tax burden.

- Anti-dumping duties may apply if the product is imported from countries under such measures (check with customs or a trade compliance expert).

If you provide more details about the material composition, thickness, and intended use, I can help you further narrow down the most accurate HS code.

Customer Reviews

No reviews yet.