| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5902100000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 5902900000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5902100000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 5902900000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5902100000 | Doc | 60.8% | CN | US | 2025-05-12 |

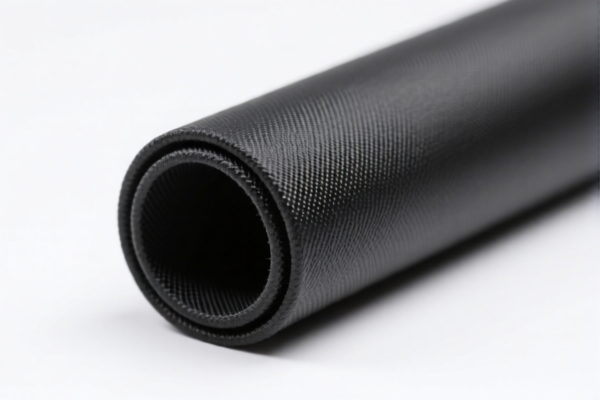

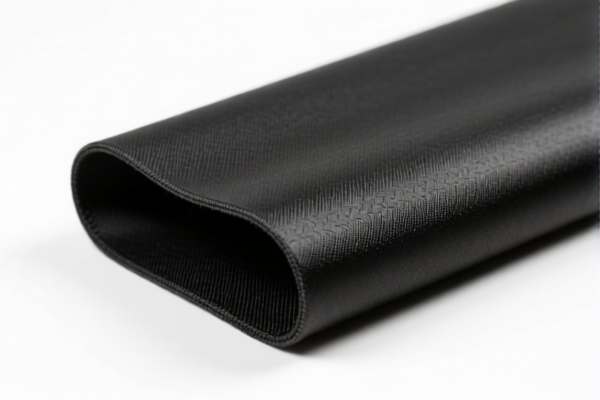

Product Name: Tire Grade Polyamide Raw Material

Classification: Tire Cord Fabric Made of High-Strength Polyamide, Polyester, or Rayon Fibers

HS CODEs:

- 5902100000 – High-strength polyamide, polyester, or rayon fiber tire cord fabric

- 5902900000 – Other high-strength polyamide, polyester, or rayon fiber tire cord fabric

🔍 Key Tax Rate Overview

- For HS CODE 5902100000:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Total Tax Rate: 60.8%

-

For HS CODE 5902900000:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 55.0%

⏰ Time-Sensitive Policy Alert

- April 2, 2025: Additional tariffs of 30.0% will be imposed on both HS CODEs.

- This is a special tariff and not related to anti-dumping duties or other trade measures.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is classified correctly under either 5902100000 or 5902900000 based on fiber type and application.

- Check Unit Price and Certification: Confirm whether any additional documentation or certifications (e.g., technical specifications, origin certificates) are required for customs clearance.

- Monitor Tariff Changes: Be aware of the April 2, 2025 deadline for the special tariff increase. Consider adjusting import timelines or pricing accordingly.

- Consult with Customs Broker: For complex classifications or large shipments, seek professional customs advice to avoid delays or penalties.

📊 Summary Table

| HS CODE | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.2) | Total Tax Rate |

|---|---|---|---|---|---|

| 5902100000 | High-strength polyamide tire cord fabric | 5.8% | 25.0% | 30.0% | 60.8% |

| 5902900000 | Other high-strength tire cord fabric | 0.0% | 25.0% | 30.0% | 55.0% |

Let me know if you need help with classification confirmation or tariff calculation for a specific shipment.

Product Name: Tire Grade Polyamide Raw Material

Classification: Tire Cord Fabric Made of High-Strength Polyamide, Polyester, or Rayon Fibers

HS CODEs:

- 5902100000 – High-strength polyamide, polyester, or rayon fiber tire cord fabric

- 5902900000 – Other high-strength polyamide, polyester, or rayon fiber tire cord fabric

🔍 Key Tax Rate Overview

- For HS CODE 5902100000:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Total Tax Rate: 60.8%

-

For HS CODE 5902900000:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 55.0%

⏰ Time-Sensitive Policy Alert

- April 2, 2025: Additional tariffs of 30.0% will be imposed on both HS CODEs.

- This is a special tariff and not related to anti-dumping duties or other trade measures.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is classified correctly under either 5902100000 or 5902900000 based on fiber type and application.

- Check Unit Price and Certification: Confirm whether any additional documentation or certifications (e.g., technical specifications, origin certificates) are required for customs clearance.

- Monitor Tariff Changes: Be aware of the April 2, 2025 deadline for the special tariff increase. Consider adjusting import timelines or pricing accordingly.

- Consult with Customs Broker: For complex classifications or large shipments, seek professional customs advice to avoid delays or penalties.

📊 Summary Table

| HS CODE | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.2) | Total Tax Rate |

|---|---|---|---|---|---|

| 5902100000 | High-strength polyamide tire cord fabric | 5.8% | 25.0% | 30.0% | 60.8% |

| 5902900000 | Other high-strength tire cord fabric | 0.0% | 25.0% | 30.0% | 55.0% |

Let me know if you need help with classification confirmation or tariff calculation for a specific shipment.

Customer Reviews

No reviews yet.