| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919101050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919905010 | Doc | 60.8% | CN | US | 2025-05-12 |

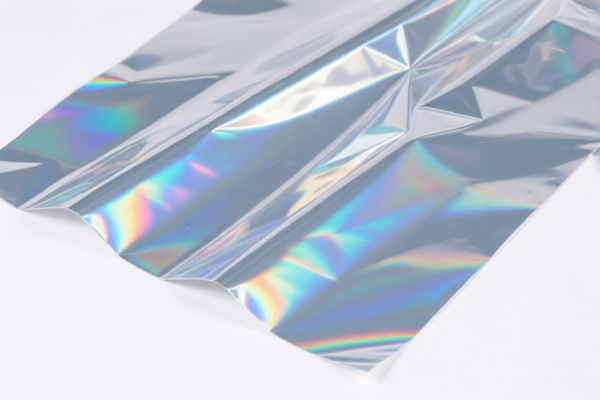

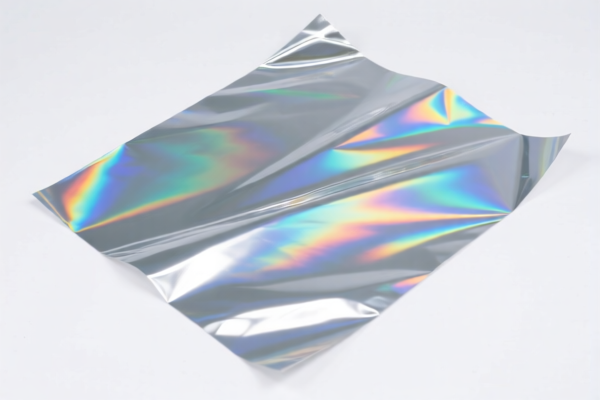

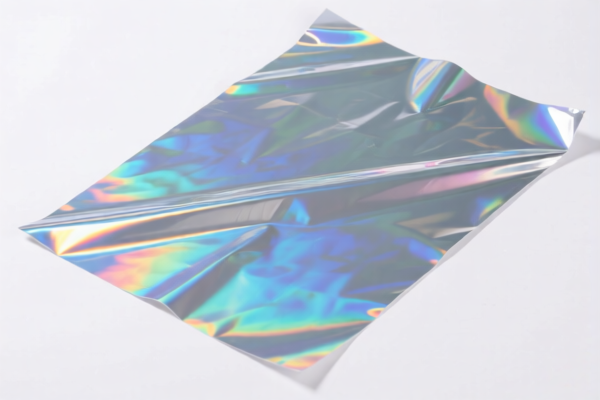

Product Name: Traffic Safety Reflectorized Plastic Sheet

Classification HS Code:

- 3919101050 (for self-adhesive plastic sheets, films, foils, tapes, strips, etc., with reflective surfaces made of glass beads, width ≤ 20 cm, in rolls)

- 3919905010 (for reflective sheets, including reflective plastic sheets and protective reflective plastic sheets)

🔍 Key Classification and Tax Information:

- HS Code 3919101050

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Total Tax Rate: 61.5%

-

HS Code 3919905010

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 60.8%

⏰ Time-Sensitive Policy Alert:

- April 2, 2025: Additional tariffs of 30.0% will be imposed on both HS codes.

- No Anti-dumping duties are currently listed for this product category (iron/aluminum-related duties do not apply here).

📌 Proactive Advice for Importers:

- Verify the product's exact specifications: Confirm whether the reflective surface is made of glass beads (for HS 3919101050) or other reflective materials (for HS 3919905010).

- Check the width of the product: If it is ≤ 20 cm and in roll form, it may fall under HS 3919101050.

- Review required certifications: Ensure compliance with local safety and traffic regulations (e.g., CE, RoHS, or specific reflective performance standards).

- Monitor tax updates: Stay informed about any changes in tariff rates or policy adjustments after April 2, 2025.

Let me know if you need help determining which HS code applies to your specific product.

Product Name: Traffic Safety Reflectorized Plastic Sheet

Classification HS Code:

- 3919101050 (for self-adhesive plastic sheets, films, foils, tapes, strips, etc., with reflective surfaces made of glass beads, width ≤ 20 cm, in rolls)

- 3919905010 (for reflective sheets, including reflective plastic sheets and protective reflective plastic sheets)

🔍 Key Classification and Tax Information:

- HS Code 3919101050

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

-

Total Tax Rate: 61.5%

-

HS Code 3919905010

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 60.8%

⏰ Time-Sensitive Policy Alert:

- April 2, 2025: Additional tariffs of 30.0% will be imposed on both HS codes.

- No Anti-dumping duties are currently listed for this product category (iron/aluminum-related duties do not apply here).

📌 Proactive Advice for Importers:

- Verify the product's exact specifications: Confirm whether the reflective surface is made of glass beads (for HS 3919101050) or other reflective materials (for HS 3919905010).

- Check the width of the product: If it is ≤ 20 cm and in roll form, it may fall under HS 3919101050.

- Review required certifications: Ensure compliance with local safety and traffic regulations (e.g., CE, RoHS, or specific reflective performance standards).

- Monitor tax updates: Stay informed about any changes in tariff rates or policy adjustments after April 2, 2025.

Let me know if you need help determining which HS code applies to your specific product.

Customer Reviews

No reviews yet.