| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919101050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919905010 | Doc | 60.8% | CN | US | 2025-05-12 |

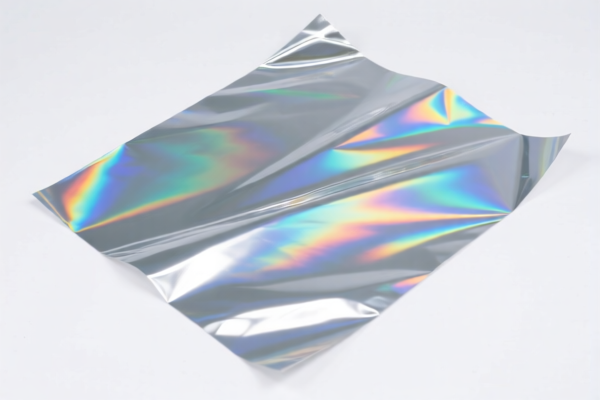

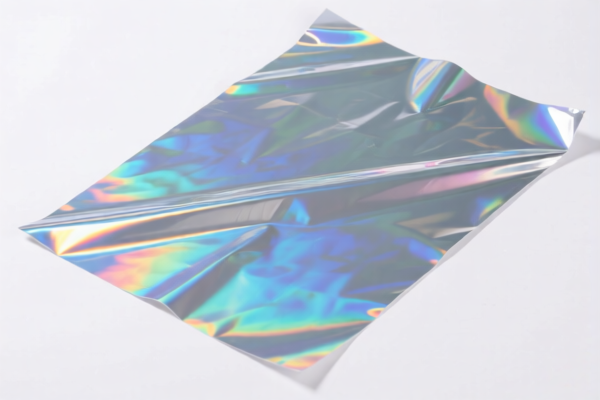

Product Name: Traffic Sign Reflectorized Plastic Sheet

Classification HS Code:

- 3919101050 – Self-adhesive plastic products with glass bead reflective surfaces, suitable for traffic signs, tapes, and films.

- 3919905010 – Reflective sheets or stickers for traffic signs, classified as reflective sheets.

🔍 Tariff Overview and Key Tax Rate Changes

- Base Tariff Rate:

- 3919101050: 6.5%

-

3919905010: 5.8%

-

Additional Tariffs (Currently in Effect):

-

Both HS codes are subject to an additional 25.0% tariff.

-

Special Tariff After April 11, 2025:

-

An additional 30.0% tariff will be imposed on both HS codes after April 11, 2025.

-

Anti-dumping duties on iron and aluminum:

- Not applicable for these plastic products.

📌 Proactive Advice for Importers

- Verify Material and Unit Price: Ensure the product is indeed made of plastic with a reflective surface (e.g., glass beads) and not metal or other materials, which may fall under different HS codes.

- Check Required Certifications: Confirm if certifications such as CE, ISO, or specific traffic sign compliance standards are required for import and use in your region.

- Monitor Tariff Updates: Be aware that the 30.0% additional tariff will take effect after April 11, 2025, which could significantly increase the total import cost.

- Consult Customs Broker: For accurate classification and to avoid delays, consider working with a customs broker or using a customs compliance service.

Let me know if you need help with customs documentation or further classification details.

Product Name: Traffic Sign Reflectorized Plastic Sheet

Classification HS Code:

- 3919101050 – Self-adhesive plastic products with glass bead reflective surfaces, suitable for traffic signs, tapes, and films.

- 3919905010 – Reflective sheets or stickers for traffic signs, classified as reflective sheets.

🔍 Tariff Overview and Key Tax Rate Changes

- Base Tariff Rate:

- 3919101050: 6.5%

-

3919905010: 5.8%

-

Additional Tariffs (Currently in Effect):

-

Both HS codes are subject to an additional 25.0% tariff.

-

Special Tariff After April 11, 2025:

-

An additional 30.0% tariff will be imposed on both HS codes after April 11, 2025.

-

Anti-dumping duties on iron and aluminum:

- Not applicable for these plastic products.

📌 Proactive Advice for Importers

- Verify Material and Unit Price: Ensure the product is indeed made of plastic with a reflective surface (e.g., glass beads) and not metal or other materials, which may fall under different HS codes.

- Check Required Certifications: Confirm if certifications such as CE, ISO, or specific traffic sign compliance standards are required for import and use in your region.

- Monitor Tariff Updates: Be aware that the 30.0% additional tariff will take effect after April 11, 2025, which could significantly increase the total import cost.

- Consult Customs Broker: For accurate classification and to avoid delays, consider working with a customs broker or using a customs compliance service.

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.