| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3906902000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 3907610050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

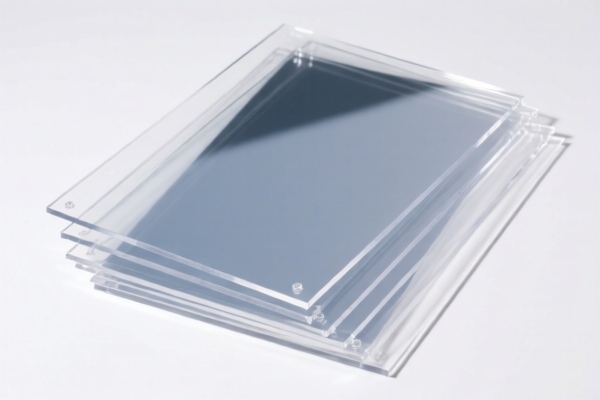

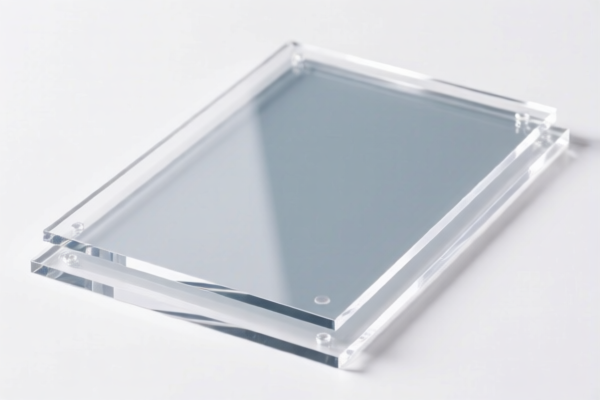

Product Name: Transparent Acrylic Lead Sheet

Classification: Plastic sheets, plates, films, foils, and strips (non-cellular, not reinforced), laminated, supported, or otherwise combined with other materials, based on acrylic polymers.

✅ HS CODE Classification Summary:

- HS CODE: 3920.59.80.00

- Description: Other plastic sheets, plates, films, foils, and strips, non-cellular and not reinforced, laminated, supported, or otherwise combined with other materials, based on acrylic polymers, other, other.

-

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920.51.50.50

- Description: Other plastic sheets, plates, films, foils, and strips, non-cellular and not reinforced, laminated, supported, or otherwise combined with other materials, based on acrylic polymers, other, other.

-

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3906.90.20.00

- Description: Primary forms of acrylic resins and other acrylic polymers.

-

Total Tax Rate: 61.3%

- Base Tariff Rate: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3907.61.00.50

- Description: Other primary forms of acrylic polymers.

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Key Tax Rate Changes:

- Base Tariff: Ranges from 6.3% to 6.5%, depending on the specific HS code.

- Additional Tariff: 25.0% applied universally.

- Special Tariff after April 11, 2025: 30.0% added on top of the base and additional tariffs.

- Total Tax Rate: 61.3% to 61.5%, depending on the product category.

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: This is a time-sensitive policy. Ensure your customs clearance is completed before April 11, 2025, if possible, to avoid the additional 30% tariff.

- Material Verification: Confirm the exact composition of the product (e.g., whether it is a composite of acrylic and lead or a modified acrylic sheet) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Unit Price: Be aware that the total tax rate is applied to the FOB value or customs valuation, which may affect the final cost.

✅ Proactive Advice:

- Consult a customs broker or HS code expert to confirm the most accurate classification for your specific product.

- Keep documentation (e.g., material specifications, invoices, and technical data sheets) ready for customs inspection.

- Monitor policy updates related to import tariffs, especially around the April 11, 2025 deadline.

Let me know if you need help with HS code selection or customs documentation!

Product Name: Transparent Acrylic Lead Sheet

Classification: Plastic sheets, plates, films, foils, and strips (non-cellular, not reinforced), laminated, supported, or otherwise combined with other materials, based on acrylic polymers.

✅ HS CODE Classification Summary:

- HS CODE: 3920.59.80.00

- Description: Other plastic sheets, plates, films, foils, and strips, non-cellular and not reinforced, laminated, supported, or otherwise combined with other materials, based on acrylic polymers, other, other.

-

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3920.51.50.50

- Description: Other plastic sheets, plates, films, foils, and strips, non-cellular and not reinforced, laminated, supported, or otherwise combined with other materials, based on acrylic polymers, other, other.

-

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3906.90.20.00

- Description: Primary forms of acrylic resins and other acrylic polymers.

-

Total Tax Rate: 61.3%

- Base Tariff Rate: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3907.61.00.50

- Description: Other primary forms of acrylic polymers.

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Key Tax Rate Changes:

- Base Tariff: Ranges from 6.3% to 6.5%, depending on the specific HS code.

- Additional Tariff: 25.0% applied universally.

- Special Tariff after April 11, 2025: 30.0% added on top of the base and additional tariffs.

- Total Tax Rate: 61.3% to 61.5%, depending on the product category.

📌 Important Notes and Recommendations:

- April 11, 2025 Special Tariff: This is a time-sensitive policy. Ensure your customs clearance is completed before April 11, 2025, if possible, to avoid the additional 30% tariff.

- Material Verification: Confirm the exact composition of the product (e.g., whether it is a composite of acrylic and lead or a modified acrylic sheet) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., RoHS, REACH, or specific import permits) are required for the product in the destination country.

- Unit Price: Be aware that the total tax rate is applied to the FOB value or customs valuation, which may affect the final cost.

✅ Proactive Advice:

- Consult a customs broker or HS code expert to confirm the most accurate classification for your specific product.

- Keep documentation (e.g., material specifications, invoices, and technical data sheets) ready for customs inspection.

- Monitor policy updates related to import tariffs, especially around the April 11, 2025 deadline.

Let me know if you need help with HS code selection or customs documentation!

Customer Reviews

No reviews yet.