| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907400000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920610000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3907992000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3902900010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907700000 | Doc | 61.5% | CN | US | 2025-05-12 |

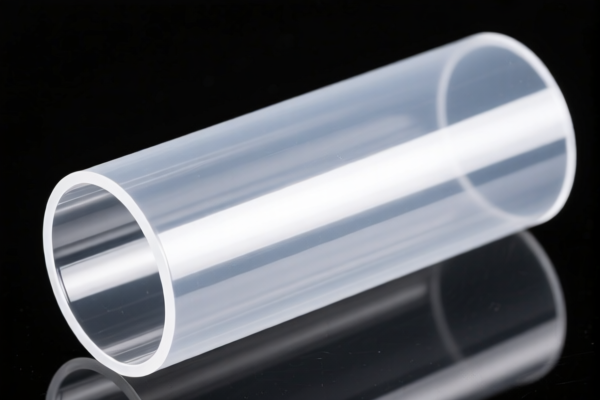

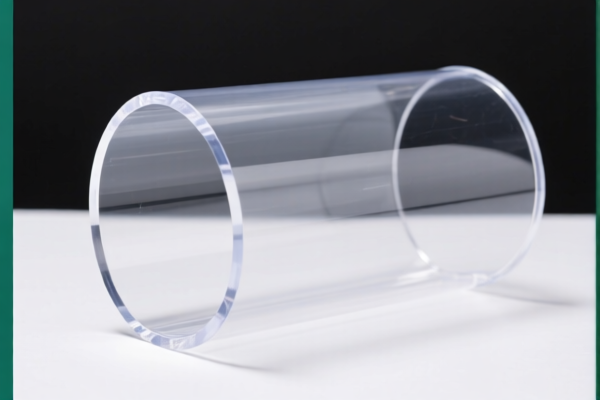

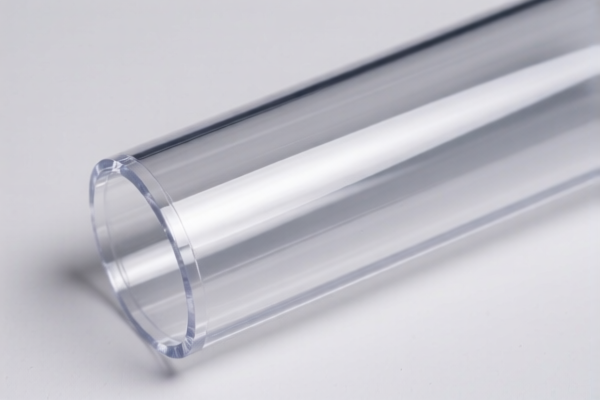

Product Name: Transparent Polycarbonate Resin

Classification: Based on the provided HS codes and descriptions, the product may fall under several classifications depending on its specific form and composition. Below is a detailed breakdown of the relevant HS codes and associated tariff information.

🔍 HS Code Classification Overview

- HS Code 3907400000

- Description: Transparent polycarbonate resin

- Total Tax Rate: 60.8%

- Tariff Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most direct classification for general transparent polycarbonate resin.

-

HS Code 3920610000

- Description: Transparent polycarbonate film, sheets, etc.

- Total Tax Rate: 60.8%

- Tariff Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Applicable if the product is in sheet or film form.

-

HS Code 3907992000

- Description: Transparent liquid crystal polyester resin

- Total Tax Rate: 55.0%

- Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for a specific type of resin (liquid crystal polyester), not standard polycarbonate.

-

HS Code 3902900010

- Description: Transparent polybutylene resin

- Total Tax Rate: 61.5%

- Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for polybutylene resin, which is a different polymer from polycarbonate.

-

HS Code 3907700000

- Description: Transparent polylactic acid (PLA) resin

- Total Tax Rate: 61.5%

- Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for biodegradable polylactic acid resin, not standard polycarbonate.

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for these HS codes, but it is advisable to check the latest customs announcements for any updates. -

Material Verification:

Ensure the product is transparent polycarbonate resin and not a different polymer (e.g., polybutylene, PLA, or liquid crystal polyester), as this will affect the correct HS code. -

Certifications Required:

Depending on the country of import, certifications such as REACH, RoHS, or material safety data sheets (MSDS) may be required. Confirm with the customs authority or a compliance expert.

✅ Proactive Advice

- Verify the exact chemical composition of the product to ensure correct HS code classification.

- Check the physical form (resin, film, sheet) to determine the most appropriate HS code.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

- Consult a customs broker or compliance expert if the product is part of a larger shipment or involves multiple materials.

Let me know if you need help determining the most accurate HS code for your specific product.

Product Name: Transparent Polycarbonate Resin

Classification: Based on the provided HS codes and descriptions, the product may fall under several classifications depending on its specific form and composition. Below is a detailed breakdown of the relevant HS codes and associated tariff information.

🔍 HS Code Classification Overview

- HS Code 3907400000

- Description: Transparent polycarbonate resin

- Total Tax Rate: 60.8%

- Tariff Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most direct classification for general transparent polycarbonate resin.

-

HS Code 3920610000

- Description: Transparent polycarbonate film, sheets, etc.

- Total Tax Rate: 60.8%

- Tariff Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: Applicable if the product is in sheet or film form.

-

HS Code 3907992000

- Description: Transparent liquid crystal polyester resin

- Total Tax Rate: 55.0%

- Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for a specific type of resin (liquid crystal polyester), not standard polycarbonate.

-

HS Code 3902900010

- Description: Transparent polybutylene resin

- Total Tax Rate: 61.5%

- Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for polybutylene resin, which is a different polymer from polycarbonate.

-

HS Code 3907700000

- Description: Transparent polylactic acid (PLA) resin

- Total Tax Rate: 61.5%

- Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for biodegradable polylactic acid resin, not standard polycarbonate.

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for these HS codes, but it is advisable to check the latest customs announcements for any updates. -

Material Verification:

Ensure the product is transparent polycarbonate resin and not a different polymer (e.g., polybutylene, PLA, or liquid crystal polyester), as this will affect the correct HS code. -

Certifications Required:

Depending on the country of import, certifications such as REACH, RoHS, or material safety data sheets (MSDS) may be required. Confirm with the customs authority or a compliance expert.

✅ Proactive Advice

- Verify the exact chemical composition of the product to ensure correct HS code classification.

- Check the physical form (resin, film, sheet) to determine the most appropriate HS code.

- Plan for the April 11, 2025 tariff increase to avoid unexpected costs.

- Consult a customs broker or compliance expert if the product is part of a larger shipment or involves multiple materials.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.