| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919102030 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919905040 | Doc | 60.8% | CN | US | 2025-05-12 |

| 4202322000 | Doc | 75.0% | CN | US | 2025-05-12 |

| 3919102030 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3919905040 | Doc | 60.8% | CN | US | 2025-05-12 |

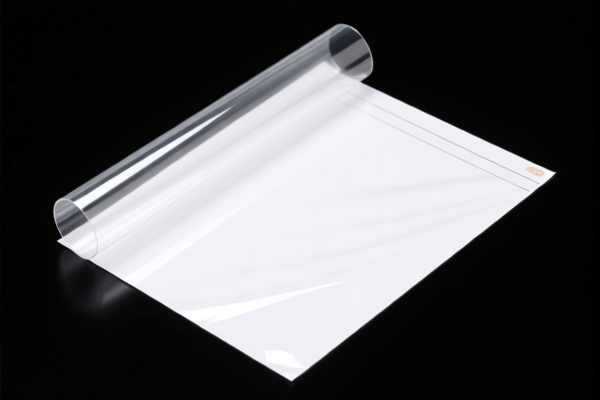

Here is the structured customs compliance analysis for the Transparent Protective Film product based on the provided HS codes and tax details:

✅ HS CODE: 3919102030

Product Description: Transparent protective film, classified under Chapter 39 (Plastics and articles thereof), and matches the description of HS code 3919.10.9000.

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

✅ HS CODE: 3919905040

Product Description: Transparent plastic protective film, classified under "Other" categories, and matches the description of 3919905040, which includes transparent adhesive tapes.

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

✅ HS CODE: 4202322000

Product Description: Transparent protective cover, typically carried on person, with a plastic surface, matching the description of 4202322000.

- Base Tariff Rate: 20.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 75.0%

📌 Key Notes and Recommendations:

-

Tariff Changes After April 11, 2025:

A 30.0% additional tariff will be applied to all the above HS codes. Ensure your import timeline is planned accordingly. -

Material and Certification Requirements:

- Verify the material composition (e.g., whether it's PVC, PE, or other plastics) to ensure correct HS code classification.

-

Confirm if certifications (e.g., RoHS, REACH, or others) are required for import into the destination country.

-

Unit Price and Classification:

- The unit price may affect whether the product is classified under a different HS code (e.g., if it's considered a "product" or a "consumable").

-

Double-check the product description and intended use (e.g., for screens, desks, or personal items) to avoid misclassification.

-

Anti-Dumping Duties:

- Currently, no specific anti-dumping duties are listed for these HS codes, but be aware of potential changes based on trade policies.

🛑 Proactive Advice:

- Consult a customs broker or import compliance expert to confirm the most accurate HS code and applicable duties for your specific product.

- Keep documentation (e.g., product specifications, invoices, and certificates) ready for customs inspection.

Let me know if you need help with HS code verification or import cost calculations. Here is the structured customs compliance analysis for the Transparent Protective Film product based on the provided HS codes and tax details:

✅ HS CODE: 3919102030

Product Description: Transparent protective film, classified under Chapter 39 (Plastics and articles thereof), and matches the description of HS code 3919.10.9000.

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

✅ HS CODE: 3919905040

Product Description: Transparent plastic protective film, classified under "Other" categories, and matches the description of 3919905040, which includes transparent adhesive tapes.

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

✅ HS CODE: 4202322000

Product Description: Transparent protective cover, typically carried on person, with a plastic surface, matching the description of 4202322000.

- Base Tariff Rate: 20.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 75.0%

📌 Key Notes and Recommendations:

-

Tariff Changes After April 11, 2025:

A 30.0% additional tariff will be applied to all the above HS codes. Ensure your import timeline is planned accordingly. -

Material and Certification Requirements:

- Verify the material composition (e.g., whether it's PVC, PE, or other plastics) to ensure correct HS code classification.

-

Confirm if certifications (e.g., RoHS, REACH, or others) are required for import into the destination country.

-

Unit Price and Classification:

- The unit price may affect whether the product is classified under a different HS code (e.g., if it's considered a "product" or a "consumable").

-

Double-check the product description and intended use (e.g., for screens, desks, or personal items) to avoid misclassification.

-

Anti-Dumping Duties:

- Currently, no specific anti-dumping duties are listed for these HS codes, but be aware of potential changes based on trade policies.

🛑 Proactive Advice:

- Consult a customs broker or import compliance expert to confirm the most accurate HS code and applicable duties for your specific product.

- Keep documentation (e.g., product specifications, invoices, and certificates) ready for customs inspection.

Let me know if you need help with HS code verification or import cost calculations.

Customer Reviews

No reviews yet.