Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917310000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3923900080 | Doc | 58.0% | CN | US | 2025-05-12 |

| 3917390020 | Doc | 33.1% | CN | US | 2025-05-12 |

| 3917400050 | Doc | 60.3% | CN | US | 2025-05-12 |

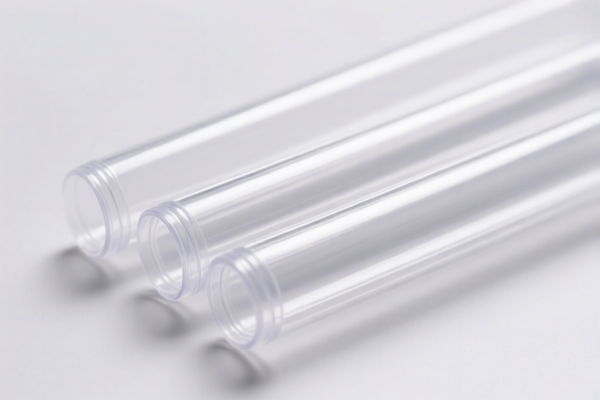

Here is the structured classification and tariff information for transparent plastic hoses, based on the provided HS codes and tax details:

✅ Product Classification: Transparent Plastic Hoses

🔍 HS CODE: 3917320050

- Description: Transparent plastic hoses fall under the category of "plastic tubes, plastic tube fittings, and flexible plastic tubes and fittings," which aligns with the description of this HS code.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for general transparent plastic hoses, not specifically PVC-based.

🔍 HS CODE: 3917310000

- Description: Plastic hoses fit under this HS code, which covers "other tubes, flexible plastic tubes, and plastic hose fittings."

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general category for flexible plastic hoses.

🔍 HS CODE: 3923900080

- Description: This is a catch-all code under Chapter 39 ("Plastics and articles thereof") and includes plastic hoses as part of "plastic and plastic articles."

- Total Tax Rate: 58.0%

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a broader category and may be used if the product doesn't fit more specific codes.

✅ HS CODE: 3917390020 (Recommended for PVC Hoses)

- Description: Specifically for PVC (polyvinyl chloride) transparent soft tubes and fittings. This is the most accurate code if the product is made of PVC.

- Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the lowest tax rate among the options, so it's ideal if the product is explicitly PVC-based.

🔍 HS CODE: 3917400050

- Description: Plastic pipe and hose, which includes flexible plastic hoses. This code exists and is applicable.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may be used for more specialized or industrial-grade plastic hoses.

📌 Proactive Advice for Importers:

- Verify Material: If the hose is made of PVC, use HS CODE 3917390020 to benefit from the lowest tax rate.

- Check Unit Price: Ensure the declared value is accurate to avoid discrepancies during customs inspection.

- Certifications: Confirm if any certifications (e.g., RoHS, REACH, or specific industry standards) are required for import.

- April 11, 2025 Deadline: Be aware that additional tariffs of 30% will apply after this date for all the listed HS codes.

- Anti-Dumping Duties: Not applicable for plastic hoses, but always check for any specific anti-dumping measures on the product type.

📊 Summary of Tax Rates (after April 11, 2025):

| HS Code | Total Tax Rate | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) |

|---|---|---|---|---|

| 3917320050 | 58.1% | 3.1% | 25.0% | 30.0% |

| 3917310000 | 58.1% | 3.1% | 25.0% | 30.0% |

| 3923900080 | 58.0% | 3.0% | 25.0% | 30.0% |

| 3917390020 | 33.1% | 3.1% | 0.0% | 30.0% |

| 3917400050 | 60.3% | 5.3% | 25.0% | 30.0% |

If you provide more details (e.g., material, size, use case), I can help you further narrow down the most accurate HS code and tax rate. Here is the structured classification and tariff information for transparent plastic hoses, based on the provided HS codes and tax details:

✅ Product Classification: Transparent Plastic Hoses

🔍 HS CODE: 3917320050

- Description: Transparent plastic hoses fall under the category of "plastic tubes, plastic tube fittings, and flexible plastic tubes and fittings," which aligns with the description of this HS code.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for general transparent plastic hoses, not specifically PVC-based.

🔍 HS CODE: 3917310000

- Description: Plastic hoses fit under this HS code, which covers "other tubes, flexible plastic tubes, and plastic hose fittings."

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general category for flexible plastic hoses.

🔍 HS CODE: 3923900080

- Description: This is a catch-all code under Chapter 39 ("Plastics and articles thereof") and includes plastic hoses as part of "plastic and plastic articles."

- Total Tax Rate: 58.0%

- Base Tariff: 3.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a broader category and may be used if the product doesn't fit more specific codes.

✅ HS CODE: 3917390020 (Recommended for PVC Hoses)

- Description: Specifically for PVC (polyvinyl chloride) transparent soft tubes and fittings. This is the most accurate code if the product is made of PVC.

- Total Tax Rate: 33.1%

- Base Tariff: 3.1%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the lowest tax rate among the options, so it's ideal if the product is explicitly PVC-based.

🔍 HS CODE: 3917400050

- Description: Plastic pipe and hose, which includes flexible plastic hoses. This code exists and is applicable.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code may be used for more specialized or industrial-grade plastic hoses.

📌 Proactive Advice for Importers:

- Verify Material: If the hose is made of PVC, use HS CODE 3917390020 to benefit from the lowest tax rate.

- Check Unit Price: Ensure the declared value is accurate to avoid discrepancies during customs inspection.

- Certifications: Confirm if any certifications (e.g., RoHS, REACH, or specific industry standards) are required for import.

- April 11, 2025 Deadline: Be aware that additional tariffs of 30% will apply after this date for all the listed HS codes.

- Anti-Dumping Duties: Not applicable for plastic hoses, but always check for any specific anti-dumping measures on the product type.

📊 Summary of Tax Rates (after April 11, 2025):

| HS Code | Total Tax Rate | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) |

|---|---|---|---|---|

| 3917320050 | 58.1% | 3.1% | 25.0% | 30.0% |

| 3917310000 | 58.1% | 3.1% | 25.0% | 30.0% |

| 3923900080 | 58.0% | 3.0% | 25.0% | 30.0% |

| 3917390020 | 33.1% | 3.1% | 0.0% | 30.0% |

| 3917400050 | 60.3% | 5.3% | 25.0% | 30.0% |

If you provide more details (e.g., material, size, use case), I can help you further narrow down the most accurate HS code and tax rate.

Customer Reviews

No reviews yet.