Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917320050 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917400095 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3917310000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3926909910 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3917400080 | Doc | 60.3% | CN | US | 2025-05-12 |

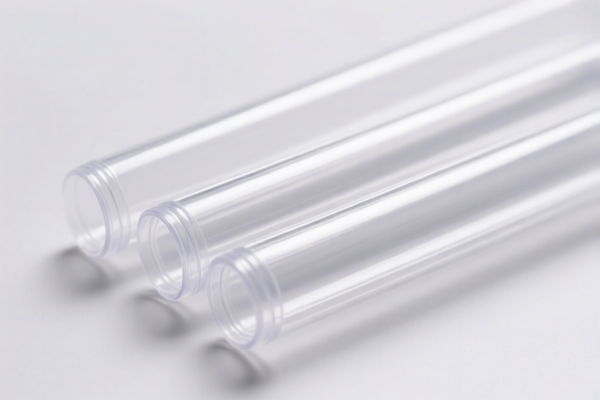

Here is the structured classification and tariff information for transparent plastic tubes, based on the provided HS codes and tax details:

✅ Product Classification: Transparent Plastic Tubes

🔍 HS CODE: 3917320050

- Description: Transparent plastic soft tubes, falling under the category of plastic tubes, fittings, and soft tubes.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes: This code is suitable for general-purpose transparent soft plastic tubes.

🔍 HS CODE: 3917400095

- Description: Transparent plastic fittings, falling under the category of "other fittings" under HS 3917400095.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes: Applicable for transparent fittings such as connectors, elbows, etc.

🔍 HS CODE: 3917310000

- Description: Transparent high-pressure plastic tubes, which are classified under HS 3917 for plastic tubes.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes: Suitable for tubes designed for high-pressure applications.

🔍 HS CODE: 3926909910

- Description: Transparent plastic tubes used in laboratories, falling under the category of "other plastic articles."

- Total Tax Rate: 42.8%

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes: This code is more favorable for lab-grade transparent plastic tubes.

🔍 HS CODE: 3917400080

- Description: Transparent plastic pipe fittings, including connectors, elbows, and flanges.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes: Applicable for transparent fittings used in plastic piping systems.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm the exact material (e.g., PVC, PE, PP) and whether it is considered "transparent" or "colored."

- Product Use: If the tubes are for laboratory use, HS 3926909910 may be more appropriate and offer a lower tax rate.

- Unit Price and Certification: Check if any certifications (e.g., FDA, ISO) are required for import, especially for medical or food-grade products.

- Tariff Changes After April 11, 2025: All listed codes will be subject to an additional 30% tariff after this date. Plan accordingly for cost estimation.

- Anti-Dumping Duties: Not applicable for plastic tubes unless specified by the importing country (e.g., China).

✅ Proactive Advice

- Double-check the product description to ensure it matches the HS code description.

- Consult a customs broker if the product is used in specialized applications (e.g., medical, industrial, or lab use).

- Keep records of material specifications, usage, and certifications to support customs declarations.

Let me know if you need help selecting the most appropriate HS code for your specific product. Here is the structured classification and tariff information for transparent plastic tubes, based on the provided HS codes and tax details:

✅ Product Classification: Transparent Plastic Tubes

🔍 HS CODE: 3917320050

- Description: Transparent plastic soft tubes, falling under the category of plastic tubes, fittings, and soft tubes.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes: This code is suitable for general-purpose transparent soft plastic tubes.

🔍 HS CODE: 3917400095

- Description: Transparent plastic fittings, falling under the category of "other fittings" under HS 3917400095.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes: Applicable for transparent fittings such as connectors, elbows, etc.

🔍 HS CODE: 3917310000

- Description: Transparent high-pressure plastic tubes, which are classified under HS 3917 for plastic tubes.

- Total Tax Rate: 58.1%

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes: Suitable for tubes designed for high-pressure applications.

🔍 HS CODE: 3926909910

- Description: Transparent plastic tubes used in laboratories, falling under the category of "other plastic articles."

- Total Tax Rate: 42.8%

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes: This code is more favorable for lab-grade transparent plastic tubes.

🔍 HS CODE: 3917400080

- Description: Transparent plastic pipe fittings, including connectors, elbows, and flanges.

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Notes: Applicable for transparent fittings used in plastic piping systems.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm the exact material (e.g., PVC, PE, PP) and whether it is considered "transparent" or "colored."

- Product Use: If the tubes are for laboratory use, HS 3926909910 may be more appropriate and offer a lower tax rate.

- Unit Price and Certification: Check if any certifications (e.g., FDA, ISO) are required for import, especially for medical or food-grade products.

- Tariff Changes After April 11, 2025: All listed codes will be subject to an additional 30% tariff after this date. Plan accordingly for cost estimation.

- Anti-Dumping Duties: Not applicable for plastic tubes unless specified by the importing country (e.g., China).

✅ Proactive Advice

- Double-check the product description to ensure it matches the HS code description.

- Consult a customs broker if the product is used in specialized applications (e.g., medical, industrial, or lab use).

- Keep records of material specifications, usage, and certifications to support customs declarations.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.