| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3822190080 | Doc | 30.0% | CN | US | 2025-05-12 |

| 4823901000 | Doc | 55.0% | CN | US | 2025-05-12 |

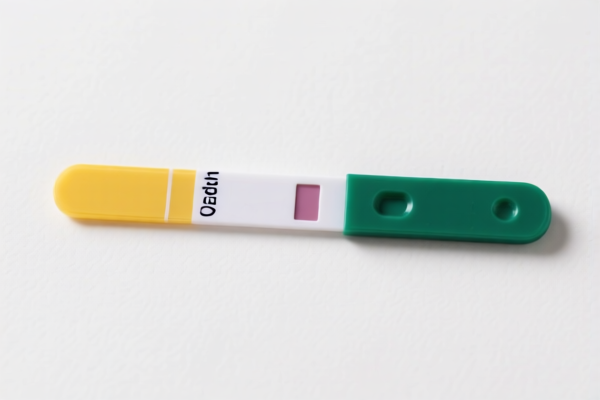

Okay, let's break down the classification and tax implications for your declared goods, "URINALYSIS STRIPS," based on the provided information. We'll go through each item individually, explaining the HS codes and associated duties.

Important Note: HS code classification is complex and relies on the precise composition and intended use of the product. This analysis is based solely on the descriptions you've provided. Final determination rests with customs officials.

Item 1: Medicaments (excluding specific headings) for therapeutic or prophylactic uses, put up in measured doses or retail packings

- Description: Medicaments (excluding goods of heading 3002, 3005 or 3006) consisting of mixed or unmixed products for therapeutic or prophylactic uses, put up in measured doses (including those in the form of transdermal administration systems) or in forms or packings for retail sale: Other: Other Other: Preparations primarily affecting the electrolytic, caloric or water balance: Other

-

HS Code: (Currently blank -

"")- Understanding the HS Code Structure: HS codes are hierarchical. The first two digits generally indicate the chapter, the next two the subheading, and so on. Without a complete HS code, it's difficult to provide precise details. However, based on the description, this likely falls under Chapter 30: Pharmaceutical products.

- Potential HS Codes to Consider: Depending on the exact composition and intended use, possibilities include:

- 3002: Medicaments consisting of mixed or unmixed products for therapeutic or prophylactic uses, put up in measured doses (including those in the form of transdermal administration systems) or in forms or packings for retail sale. (If it's a finished dosage form)

- 3004: Medicaments consisting of mixed or unmixed products for therapeutic or prophylactic uses, not put up in measured doses.

- Tax Implications: Tax rates for Chapter 30 vary significantly based on the specific product. It's crucial to determine the correct HS code to accurately assess duties.

- Recommendation: You must determine the precise HS code for this item. Provide a detailed composition list and intended use to a customs broker or consult the customs tariff schedule. Also, confirm if the product requires any specific import licenses or registration.

Item 2: Diagnostic or laboratory reagents on a backing, prepared diagnostic or laboratory reagents

- Description: Diagnostic or laboratory reagents on a backing, prepared diagnostic or laboratory reagents whether or not on a backing, whether or not put up in the form of kits, other than those of heading 3006; certified reference materials: Diagnostic or laboratory reagents on a backing, prepared diagnostic or laboratory reagents whether or not on a backing, whether or not put up in the form of kits: Other Other: Other

-

HS Code: 3822.19.00.80

- Understanding the HS Code:

- 38: Chemical products.

- 22: Miscellaneous chemical products.

- 19: Diagnostic reagents.

- 00.80: Other diagnostic reagents.

- Tax Implications:

- Basic Duty: 0.0%

- Additional Duty: 0.0%

- Additional Duty (after April 2, 2025): 30%

- Total Tax: 30.0%

- Recommendation: Confirm the exact composition of the reagent strips. While this HS code appears appropriate, variations in composition could lead to a different classification. Also, be prepared for a 30% additional duty after April 2, 2025.

- Understanding the HS Code:

Item 3: Paper, paperboard, cellulose wadding, and webs of cellulose fibers

- Description: Other paper, paperboard, cellulose wadding and webs of cellulose fibers, cut to size or shape; other articles of paper pulp, paper, paperboard, cellulose wadding or webs of cellulose fibers: Other: Of paper pulp

-

HS Code: 4823.90.10.00

- Understanding the HS Code:

- 48: Paper and paperboard; articles of paper pulp, paperboard, cellulose wadding and webs of cellulose fibers.

- 23: Paper and paperboard; articles of paper pulp, paperboard, cellulose wadding and webs of cellulose fibers, not containing cellulose fibers.

- 90: Other paper and paperboard.

- 10.00: Other paper and paperboard.

- Tax Implications:

- Basic Duty: 0.0%

- Additional Duty: 25.0%

- Additional Duty (after April 2, 2025): 30%

- Total Tax: 55.0%

- Recommendation: Confirm the material composition. If the strips contain any plastic or other non-paper components, this HS code may be incorrect. Be prepared for a 55% total tax rate.

- Understanding the HS Code:

General Recommendations:

- Detailed Product Specifications: For all items, maintain detailed specifications, including composition, intended use, and manufacturing process.

- Customs Broker: Consider engaging a licensed customs broker in China. They can provide expert guidance on HS code classification, import regulations, and documentation requirements.

- Import Licenses/Registration: Verify if any import licenses or product registration are required for these types of products in China.

- April 2, 2025, Duty Changes: Be aware of the upcoming duty changes on April 2, 2025, and factor them into your cost calculations.

- Material and Value Verification: Customs may scrutinize the declared material composition and value. Ensure accuracy to avoid potential issues.

Disclaimer: I am an AI chatbot and cannot provide definitive legal or customs advice. This information is for general guidance only. Always consult with a qualified customs professional for specific advice related to your situation.

Customer Reviews

No reviews yet.