| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3812397000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3812396000 | Doc | 61.5% | CN | US | 2025-05-12 |

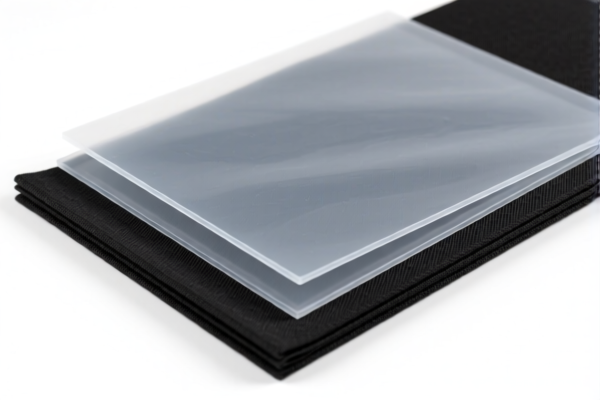

Product Classification: UV Resistant Textile Plastic Sheets

Customs Compliance Analysis and Tax Overview

🔍 HS Code Classification Overview

Below are the HS codes and corresponding tax details for UV-resistant textile plastic sheets, based on their composition and specifications:

📦 1. HS Code: 3921902900

Description:

- UV-resistant textile plastic film or sheet, combined with other materials

- Weight > 1.492 kg/m²

Tariff Summary:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 59.4%

Key Notes:

- Applicable for composite materials with weight exceeding 1.492 kg/m².

- Ensure the product is not classified under a more specific code (e.g., 3921902550 or 3921901100).

📦 2. HS Code: 3921902550

Description:

- UV-resistant textile plastic sheet, combined with textile materials

- Weight > 1.492 kg/m²

- Textile component contains more synthetic fiber than any other single fiber

- Plastic content > 70%

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code applies to products with a higher proportion of synthetic fibers and plastic.

- Verify the composition of the textile and plastic components to ensure correct classification.

📦 3. HS Code: 3921901100

Description:

- UV-resistant plastic-textile composite fabric

- Combined with textile materials

- Meets weight, textile composition, and plastic content requirements

Tariff Summary:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 59.2%

Key Notes:

- This code is for composite fabric with specific weight and composition criteria.

- Confirm the product meets the textile and plastic weight thresholds.

🧪 4. HS Code: 3812397000

Description:

- UV-resistant agents for plastics, used as antioxidants or stabilizers for rubber or plastics

Tariff Summary:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code applies to chemical additives, not the finished product.

- Ensure the product is not being classified as a finished UV-resistant sheet or film.

🧪 5. HS Code: 3812396000

Description:

- UV-resistant agents for plastics, used as antioxidants or stabilizers for rubber or plastics

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- Similar to 3812397000, but with a higher base tariff.

- Confirm the exact chemical composition and intended use to avoid misclassification.

⚠️ Important Alerts and Recommendations

- April 2, 2025 Special Tariff:

- All listed codes will have an additional 30.0% tariff applied after April 2, 2025.

-

This is a time-sensitive policy—ensure your import timeline is aligned accordingly.

-

Anti-Dumping Duties:

-

Not currently applicable for these HS codes, but always verify with the latest customs updates.

-

Certifications and Documentation:

- Confirm the product’s composition (e.g., weight, fiber content, plastic percentage).

-

Check if any certifications (e.g., UV resistance, safety, or environmental compliance) are required for import.

-

Unit Price and Material Verification:

- Verify the unit price and material breakdown to ensure correct HS code selection.

- Misclassification can lead to delays, penalties, or higher tariffs.

✅ Proactive Advice

- Double-check the product’s composition (e.g., weight, fiber content, and plastic percentage) to ensure the correct HS code is used.

- Review the latest customs regulations for any updates on additional tariffs or policy changes.

- Consult a customs broker or compliance expert if the product is complex or if you are unsure about the classification.

Let me know if you need help with a specific product sample or documentation.

Product Classification: UV Resistant Textile Plastic Sheets

Customs Compliance Analysis and Tax Overview

🔍 HS Code Classification Overview

Below are the HS codes and corresponding tax details for UV-resistant textile plastic sheets, based on their composition and specifications:

📦 1. HS Code: 3921902900

Description:

- UV-resistant textile plastic film or sheet, combined with other materials

- Weight > 1.492 kg/m²

Tariff Summary:

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 59.4%

Key Notes:

- Applicable for composite materials with weight exceeding 1.492 kg/m².

- Ensure the product is not classified under a more specific code (e.g., 3921902550 or 3921901100).

📦 2. HS Code: 3921902550

Description:

- UV-resistant textile plastic sheet, combined with textile materials

- Weight > 1.492 kg/m²

- Textile component contains more synthetic fiber than any other single fiber

- Plastic content > 70%

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code applies to products with a higher proportion of synthetic fibers and plastic.

- Verify the composition of the textile and plastic components to ensure correct classification.

📦 3. HS Code: 3921901100

Description:

- UV-resistant plastic-textile composite fabric

- Combined with textile materials

- Meets weight, textile composition, and plastic content requirements

Tariff Summary:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 59.2%

Key Notes:

- This code is for composite fabric with specific weight and composition criteria.

- Confirm the product meets the textile and plastic weight thresholds.

🧪 4. HS Code: 3812397000

Description:

- UV-resistant agents for plastics, used as antioxidants or stabilizers for rubber or plastics

Tariff Summary:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code applies to chemical additives, not the finished product.

- Ensure the product is not being classified as a finished UV-resistant sheet or film.

🧪 5. HS Code: 3812396000

Description:

- UV-resistant agents for plastics, used as antioxidants or stabilizers for rubber or plastics

Tariff Summary:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- Similar to 3812397000, but with a higher base tariff.

- Confirm the exact chemical composition and intended use to avoid misclassification.

⚠️ Important Alerts and Recommendations

- April 2, 2025 Special Tariff:

- All listed codes will have an additional 30.0% tariff applied after April 2, 2025.

-

This is a time-sensitive policy—ensure your import timeline is aligned accordingly.

-

Anti-Dumping Duties:

-

Not currently applicable for these HS codes, but always verify with the latest customs updates.

-

Certifications and Documentation:

- Confirm the product’s composition (e.g., weight, fiber content, plastic percentage).

-

Check if any certifications (e.g., UV resistance, safety, or environmental compliance) are required for import.

-

Unit Price and Material Verification:

- Verify the unit price and material breakdown to ensure correct HS code selection.

- Misclassification can lead to delays, penalties, or higher tariffs.

✅ Proactive Advice

- Double-check the product’s composition (e.g., weight, fiber content, and plastic percentage) to ensure the correct HS code is used.

- Review the latest customs regulations for any updates on additional tariffs or policy changes.

- Consult a customs broker or compliance expert if the product is complex or if you are unsure about the classification.

Let me know if you need help with a specific product sample or documentation.

Customer Reviews

No reviews yet.