| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112196050 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112196030 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5111117030 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5111117060 | Doc | 80.0% | CN | US | 2025-05-12 |

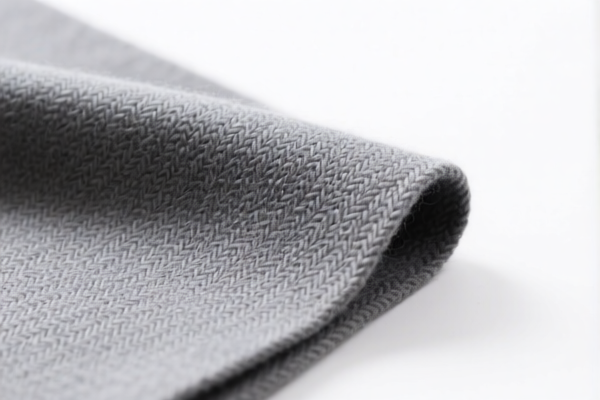

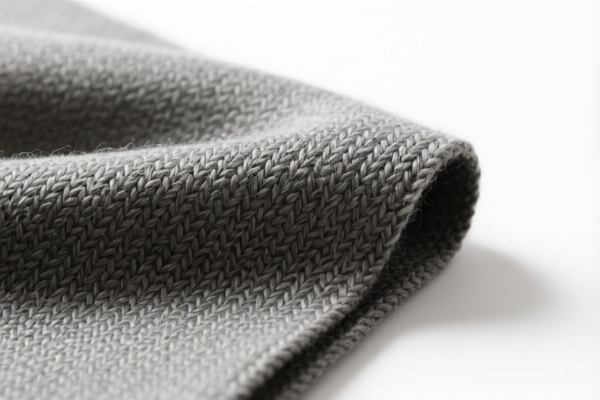

✅ Customs Classification and Tariff Analysis for Ultra Fine Wool Woven Fabric

Based on your product description:

"Ultra fine wool woven fabric (containing 85% or more by weight, average fiber diameter ≤18.5 microns, weight 270–340 g/m²)", the most appropriate HS Code is:

🔢 HS CODE: 5112196050

📌 Product Classification Summary:

- Material: Woven fabric of combed wool or combed fine animal hair

- Composition: ≥85% by weight of wool or fine animal hair

- Fiber Diameter: ≤18.5 microns

- Weight: >270 g/m² but ≤340 g/m²

- Type: Wool yarns (not containing fine animal hair)

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tariff Rate: 80.0%

⚠️ Important Notes and Alerts:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total cost of importation. -

No Anti-Dumping Duties:

No specific anti-dumping duties are currently applicable for this product category (iron and aluminum duties do not apply here).

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the fabric contains ≥85% wool or fine animal hair by weight and that the average fiber diameter is ≤18.5 microns.

- Confirm Weight: Ensure the fabric weighs between 270 g/m² and 340 g/m² to qualify for this HS code.

- Check Certification Requirements: Some countries may require textile certifications (e.g., origin, fiber content, etc.) for customs clearance.

- Monitor Tariff Changes: Keep an eye on April 11, 2025, as the special tariff will increase and affect your total import cost.

- Consider Alternative HS Codes: If the fabric contains fine animal hair, it may fall under 5112196030 (weight >340 g/m²) or 5111117030/60 (carded wool, ≤300 g/m²).

📌 Summary Table:

| Description | HS Code | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tariff |

|---|---|---|---|---|---|

| Ultra fine wool woven fabric (270–340 g/m², ≤18.5 microns, no fine animal hair) | 5112196050 | 25.0% | 25.0% | 30.0% | 80.0% |

If you have more details about the fabric (e.g., origin, exact fiber content, or whether it contains fine animal hair), I can help you further refine the classification and tariff implications.

✅ Customs Classification and Tariff Analysis for Ultra Fine Wool Woven Fabric

Based on your product description:

"Ultra fine wool woven fabric (containing 85% or more by weight, average fiber diameter ≤18.5 microns, weight 270–340 g/m²)", the most appropriate HS Code is:

🔢 HS CODE: 5112196050

📌 Product Classification Summary:

- Material: Woven fabric of combed wool or combed fine animal hair

- Composition: ≥85% by weight of wool or fine animal hair

- Fiber Diameter: ≤18.5 microns

- Weight: >270 g/m² but ≤340 g/m²

- Type: Wool yarns (not containing fine animal hair)

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff (after April 11, 2025): 30.0%

- Total Tariff Rate: 80.0%

⚠️ Important Notes and Alerts:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total cost of importation. -

No Anti-Dumping Duties:

No specific anti-dumping duties are currently applicable for this product category (iron and aluminum duties do not apply here).

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the fabric contains ≥85% wool or fine animal hair by weight and that the average fiber diameter is ≤18.5 microns.

- Confirm Weight: Ensure the fabric weighs between 270 g/m² and 340 g/m² to qualify for this HS code.

- Check Certification Requirements: Some countries may require textile certifications (e.g., origin, fiber content, etc.) for customs clearance.

- Monitor Tariff Changes: Keep an eye on April 11, 2025, as the special tariff will increase and affect your total import cost.

- Consider Alternative HS Codes: If the fabric contains fine animal hair, it may fall under 5112196030 (weight >340 g/m²) or 5111117030/60 (carded wool, ≤300 g/m²).

📌 Summary Table:

| Description | HS Code | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tariff |

|---|---|---|---|---|---|

| Ultra fine wool woven fabric (270–340 g/m², ≤18.5 microns, no fine animal hair) | 5112196050 | 25.0% | 25.0% | 30.0% | 80.0% |

If you have more details about the fabric (e.g., origin, exact fiber content, or whether it contains fine animal hair), I can help you further refine the classification and tariff implications.

Customer Reviews

No reviews yet.