| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112196010 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112196040 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5111113000 | Doc | 65.0% | CN | US | 2025-05-12 |

| 5111117030 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5801100000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5802300020 | Doc | 61.2% | CN | US | 2025-05-12 |

| 5802300090 | Doc | 61.2% | CN | US | 2025-05-12 |

| 5806103020 | Doc | 58.8% | CN | US | 2025-05-12 |

| 5806391000 | Doc | 61.6% | CN | US | 2025-05-12 |

| 6107292000 | Doc | 46.0% | CN | US | 2025-05-12 |

| 6107992000 | Doc | 43.6% | CN | US | 2025-05-12 |

| 6108995013 | Doc | 30.6% | CN | US | 2025-05-12 |

| 6108999000 | Doc | 41.3% | CN | US | 2025-05-12 |

| 6207199030 | Doc | 48.0% | CN | US | 2025-05-12 |

| 6207994000 | Doc | 43.6% | CN | US | 2025-05-12 |

| 6208192000 | Doc | 48.7% | CN | US | 2025-05-12 |

| 6208992010 | Doc | 46.0% | CN | US | 2025-05-12 |

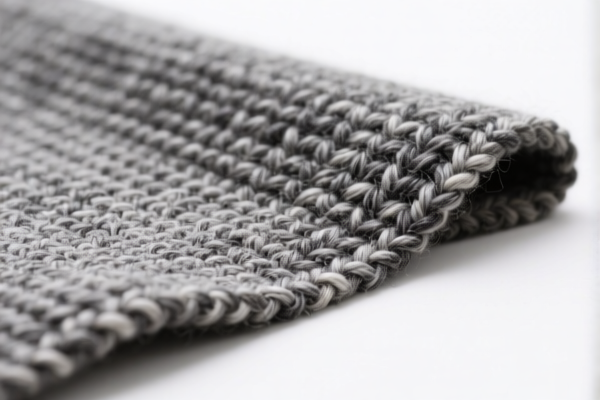

✅ Customs Classification and Tariff Analysis for Underwear Combed Wool Woven Fabrics

Based on your product description:

"Underwear Combed Wool Woven Fabrics (≥85% Wool/Fine Animal Hair, Avg. Fiber Dia. ≤18.5μm, ≤270 g/m², Other)"

The most likely HS Code is:

5112196010

(Combed wool or combed fine animal hair woven fabrics, containing ≥85% wool/fine animal hair, ≤270 g/m², of wool yarns with average fiber diameter ≤18.5μm, other)

🔍 Tariff Breakdown (as of now, with future changes noted)

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 80.0%

⚠️ Important Notes and Alerts

-

April 11, 2025 Tariff Increase:

A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in your cost planning. -

No Anti-Dumping or Countervailing Duties:

No specific anti-dumping or countervailing duties are currently listed for this product category.

📌 Proactive Advice for Importers

-

Verify Material Composition:

Ensure the fabric contains ≥85% wool or fine animal hair, and that the average fiber diameter is ≤18.5μm. This is critical for correct classification. -

Check Weight per Square Meter:

Confirm the fabric weighs ≤270 g/m². Exceeding this may reclassify the product under a different HS code. -

Documentation and Certifications:

Maintain documentation proving the material composition, fiber diameter, and weight. Some countries may require certifications or test reports for compliance. -

Consider Alternative HS Codes:

If the fabric is hand-woven or contains fine animal hair, other codes like 5111113000 or 5111117030 may apply. Ensure the weaving method and material mix are correctly classified.

📊 Comparison with Similar HS Codes

| HS Code | Description | Base Tariff | Additional Tariff | April 11 Tariff | Total Tariff |

|---|---|---|---|---|---|

| 5112196010 | Combed wool woven fabric, ≥85% wool, ≤18.5μm, ≤270g/m² | 25.0% | 25.0% | 30.0% | 80.0% |

| 5112196040 | Combed wool woven fabric, ≥85% wool, ≤18.5μm, ≤270g/m², other | 25.0% | 25.0% | 30.0% | 80.0% |

| 5111113000 | Carded wool woven fabric, hand-woven, <76cm loom width | 10.0% | 25.0% | 30.0% | 65.0% |

| 5111117030 | Carded wool woven fabric, ≤300g/m², with fine animal hair | 25.0% | 25.0% | 30.0% | 80.0% |

📌 Final Recommendation

For underwear made from combed wool or fine animal hair, with the specified fiber and weight parameters, HS Code 5112196010 is the most accurate classification. However, always double-check the fabric specifications and consult a customs broker for final confirmation, especially if the product is being imported into a country with specific textile regulations (e.g., China, EU, US).

✅ Customs Classification and Tariff Analysis for Underwear Combed Wool Woven Fabrics

Based on your product description:

"Underwear Combed Wool Woven Fabrics (≥85% Wool/Fine Animal Hair, Avg. Fiber Dia. ≤18.5μm, ≤270 g/m², Other)"

The most likely HS Code is:

5112196010

(Combed wool or combed fine animal hair woven fabrics, containing ≥85% wool/fine animal hair, ≤270 g/m², of wool yarns with average fiber diameter ≤18.5μm, other)

🔍 Tariff Breakdown (as of now, with future changes noted)

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff Rate: 80.0%

⚠️ Important Notes and Alerts

-

April 11, 2025 Tariff Increase:

A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in your cost planning. -

No Anti-Dumping or Countervailing Duties:

No specific anti-dumping or countervailing duties are currently listed for this product category.

📌 Proactive Advice for Importers

-

Verify Material Composition:

Ensure the fabric contains ≥85% wool or fine animal hair, and that the average fiber diameter is ≤18.5μm. This is critical for correct classification. -

Check Weight per Square Meter:

Confirm the fabric weighs ≤270 g/m². Exceeding this may reclassify the product under a different HS code. -

Documentation and Certifications:

Maintain documentation proving the material composition, fiber diameter, and weight. Some countries may require certifications or test reports for compliance. -

Consider Alternative HS Codes:

If the fabric is hand-woven or contains fine animal hair, other codes like 5111113000 or 5111117030 may apply. Ensure the weaving method and material mix are correctly classified.

📊 Comparison with Similar HS Codes

| HS Code | Description | Base Tariff | Additional Tariff | April 11 Tariff | Total Tariff |

|---|---|---|---|---|---|

| 5112196010 | Combed wool woven fabric, ≥85% wool, ≤18.5μm, ≤270g/m² | 25.0% | 25.0% | 30.0% | 80.0% |

| 5112196040 | Combed wool woven fabric, ≥85% wool, ≤18.5μm, ≤270g/m², other | 25.0% | 25.0% | 30.0% | 80.0% |

| 5111113000 | Carded wool woven fabric, hand-woven, <76cm loom width | 10.0% | 25.0% | 30.0% | 65.0% |

| 5111117030 | Carded wool woven fabric, ≤300g/m², with fine animal hair | 25.0% | 25.0% | 30.0% | 80.0% |

📌 Final Recommendation

For underwear made from combed wool or fine animal hair, with the specified fiber and weight parameters, HS Code 5112196010 is the most accurate classification. However, always double-check the fabric specifications and consult a customs broker for final confirmation, especially if the product is being imported into a country with specific textile regulations (e.g., China, EU, US).

Customer Reviews

No reviews yet.