| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4601298000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5305000000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4601299000 | Doc | 63.0% | CN | US | 2025-05-12 |

| 5702109020 | Doc | 55.0% | CN | US | 2025-05-12 |

| 6304910120 | Doc | 43.3% | CN | US | 2025-05-12 |

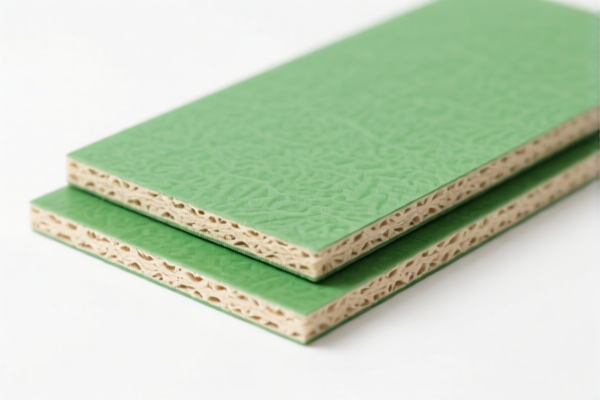

Product Classification: Vegetable Fiber Woven Floor Mats

HS CODEs and Tax Details:

- HS CODE: 4601298000 – Plant Fiber Floor Mats

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for general plant fiber floor mats, not specifically woven.

-

HS CODE: 5305000000 – Plant Fiber Woven Mats

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most appropriate code for woven vegetable fiber mats.

-

HS CODE: 4601299000 – Woven Floor Mats

- Total Tax Rate: 63.0%

- Breakdown:

- Base Tariff: 8.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code may apply to woven mats made from other materials, not specifically plant fiber.

-

HS CODE: 5702109020 – Cotton Woven Floor Mats

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for cotton-based woven mats, not vegetable fiber.

-

HS CODE: 6304910120 – Cotton Woven Floor Mats

- Total Tax Rate: 43.3%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for cotton woven mats, but with a lower base tariff, possibly for specific product types or origin.

✅ Recommendations:

- Verify Material Composition: Ensure the product is made of vegetable fiber (e.g., jute, hemp, bamboo) and not cotton or synthetic fibers, as this will determine the correct HS code.

- Check Unit Price and Certification: If the product is exported to China, ensure compliance with any required certifications (e.g., CCC, CE, etc.) and be aware of the applicable tax rates based on the HS code.

- Be Aware of April 11, 2025, Tariff Changes: The additional tariff of 30.0% will apply after this date, significantly increasing the total tax burden. Plan accordingly for import costs.

- Consider Alternative HS Codes: If the product is made of cotton, use the 6304910120 or 5702109020 codes, but only if the material is indeed cotton.

Let me know if you need help determining the correct HS code based on your product specifications.

Product Classification: Vegetable Fiber Woven Floor Mats

HS CODEs and Tax Details:

- HS CODE: 4601298000 – Plant Fiber Floor Mats

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for general plant fiber floor mats, not specifically woven.

-

HS CODE: 5305000000 – Plant Fiber Woven Mats

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most appropriate code for woven vegetable fiber mats.

-

HS CODE: 4601299000 – Woven Floor Mats

- Total Tax Rate: 63.0%

- Breakdown:

- Base Tariff: 8.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code may apply to woven mats made from other materials, not specifically plant fiber.

-

HS CODE: 5702109020 – Cotton Woven Floor Mats

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is for cotton-based woven mats, not vegetable fiber.

-

HS CODE: 6304910120 – Cotton Woven Floor Mats

- Total Tax Rate: 43.3%

- Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for cotton woven mats, but with a lower base tariff, possibly for specific product types or origin.

✅ Recommendations:

- Verify Material Composition: Ensure the product is made of vegetable fiber (e.g., jute, hemp, bamboo) and not cotton or synthetic fibers, as this will determine the correct HS code.

- Check Unit Price and Certification: If the product is exported to China, ensure compliance with any required certifications (e.g., CCC, CE, etc.) and be aware of the applicable tax rates based on the HS code.

- Be Aware of April 11, 2025, Tariff Changes: The additional tariff of 30.0% will apply after this date, significantly increasing the total tax burden. Plan accordingly for import costs.

- Consider Alternative HS Codes: If the product is made of cotton, use the 6304910120 or 5702109020 codes, but only if the material is indeed cotton.

Let me know if you need help determining the correct HS code based on your product specifications.

Customer Reviews

No reviews yet.