| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5305000000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4601298000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3921901910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921901910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 5702990500 | Doc | 61.8% | CN | US | 2025-05-12 |

Product Classification and Tax Information for "Vegetable Fiber Woven Mats"

Below is the detailed classification and tariff information for the declared product "Vegetable Fiber Woven Mats" based on the provided HS codes and tax details:

🔍 HS CODE: 5305000000

Product Description: Plant Fiber Woven Mats

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 HS CODE: 4601298000

Product Description: Plant Fiber Floor Mats

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

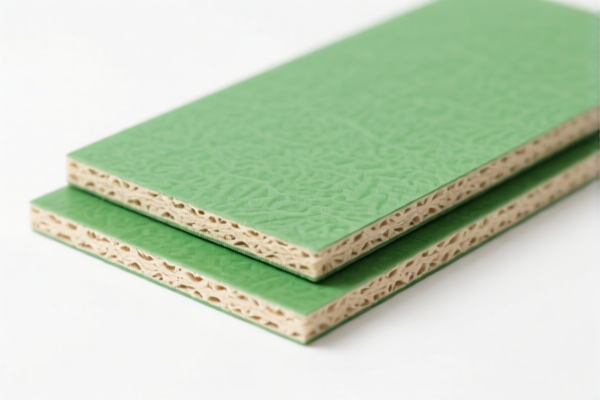

🔍 HS CODE: 3921901910

Product Description:

- Plant Fiber Plastic Mats

- Plant Fiber Plastic Table Mats

Total Tax Rate: 60.3%

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 HS CODE: 5702990500

Product Description: Cotton Woven Mats

Total Tax Rate: 61.8%

Tax Breakdown:

- Base Tariff: 6.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above products after April 11, 2025. Ensure your customs clearance is completed before this date to avoid higher costs. -

Material Verification:

Confirm the exact composition of the mats (e.g., whether they are purely plant fiber, cotton, or contain plastic components). This will determine the correct HS code and applicable tax rate. -

Unit Price and Certification:

Review the unit price and check if any certifications (e.g., environmental, safety, or quality standards) are required for import into the destination country. -

Anti-Dumping Duties:

While not explicitly mentioned in the data, be aware that anti-dumping duties may apply to certain materials (e.g., iron or aluminum) if they are part of the product. Verify if any such components are included.

✅ Proactive Advice:

- Consult a customs broker or import compliance expert to confirm the most accurate HS code and tax classification based on your product's exact specifications.

- Keep documentation (e.g., product samples, material certificates, and invoices) ready for customs inspection.

- Monitor policy updates related to import tariffs, especially around the April 11, 2025 deadline.

Let me know if you need help determining the most suitable HS code for your specific product. Product Classification and Tax Information for "Vegetable Fiber Woven Mats"

Below is the detailed classification and tariff information for the declared product "Vegetable Fiber Woven Mats" based on the provided HS codes and tax details:

🔍 HS CODE: 5305000000

Product Description: Plant Fiber Woven Mats

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 HS CODE: 4601298000

Product Description: Plant Fiber Floor Mats

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 HS CODE: 3921901910

Product Description:

- Plant Fiber Plastic Mats

- Plant Fiber Plastic Table Mats

Total Tax Rate: 60.3%

Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 HS CODE: 5702990500

Product Description: Cotton Woven Mats

Total Tax Rate: 61.8%

Tax Breakdown:

- Base Tariff: 6.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above products after April 11, 2025. Ensure your customs clearance is completed before this date to avoid higher costs. -

Material Verification:

Confirm the exact composition of the mats (e.g., whether they are purely plant fiber, cotton, or contain plastic components). This will determine the correct HS code and applicable tax rate. -

Unit Price and Certification:

Review the unit price and check if any certifications (e.g., environmental, safety, or quality standards) are required for import into the destination country. -

Anti-Dumping Duties:

While not explicitly mentioned in the data, be aware that anti-dumping duties may apply to certain materials (e.g., iron or aluminum) if they are part of the product. Verify if any such components are included.

✅ Proactive Advice:

- Consult a customs broker or import compliance expert to confirm the most accurate HS code and tax classification based on your product's exact specifications.

- Keep documentation (e.g., product samples, material certificates, and invoices) ready for customs inspection.

- Monitor policy updates related to import tariffs, especially around the April 11, 2025 deadline.

Let me know if you need help determining the most suitable HS code for your specific product.

Customer Reviews

No reviews yet.