| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919101050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919905010 | Doc | 60.8% | CN | US | 2025-05-12 |

| 8512906000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8708998180 | Doc | 57.5% | CN | US | 2025-05-12 |

| 3919101010 | Doc | 61.5% | CN | US | 2025-05-12 |

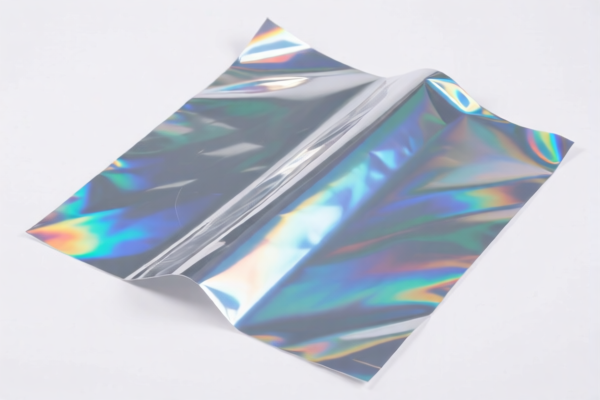

Here is the structured classification and tariff information for the Vehicle Reflectorized Plastic Sheet based on the provided HS codes and tax details:

🔍 HS CODE: 3919101050

Product Description:

Self-adhesive plastic sheets, films, tapes, strips, and other flat shapes with fully or partially reflective surfaces produced by glass beads (glass particles), whether or not wound.

Tariff Summary: - Base Tariff Rate: 6.5% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 61.5%

Key Notes: - This code is the most specific for reflectorized plastic sheets with glass beads. - Ensure the product is self-adhesive and reflective as per the description.

🔍 HS CODE: 3919905010

Product Description:

Reflective sheets (not specifically described as self-adhesive or with glass beads).

Tariff Summary: - Base Tariff Rate: 5.8% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 60.8%

Key Notes: - This code is for general reflective sheets, not necessarily self-adhesive or with glass beads. - May be applicable if the product is not explicitly described as self-adhesive or with glass beads.

🔍 HS CODE: 8512906000

Product Description:

Electrical lighting or signaling equipment.

Tariff Summary: - Base Tariff Rate: 0.0% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 55.0%

Key Notes: - This code is not suitable for the described product (reflectorized plastic sheet). - Likely misclassified unless the product is lighting or signaling equipment.

🔍 HS CODE: 8708998180

Product Description:

Other parts and accessories.

Tariff Summary: - Base Tariff Rate: 2.5% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 57.5%

Key Notes: - This code is not suitable for the described product. - Likely misclassified unless the product is a part or accessory of a vehicle.

🔍 HS CODE: 3919101010

Product Description:

Road marking tape.

Tariff Summary: - Base Tariff Rate: 6.5% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 61.5%

Key Notes: - This code is for road marking tape, which may be similar to the described product. - Ensure the product is not specifically for road marking unless it is intended for that use.

📌 Proactive Advice:

- Verify Material and Unit Price: Confirm whether the product contains glass beads or is self-adhesive, as this will determine the correct HS code.

- Check Certifications: Some reflective products may require safety or quality certifications (e.g., for road use or vehicle compliance).

- Watch for April 11, 2025, Tariff Changes: The special tariff of 30% will apply after this date, significantly increasing the total tax burden.

- Avoid Misclassification: Ensure the product is not classified under 8512 or 8708 unless it is clearly a lighting device or vehicle part.

Let me know if you need help determining the most accurate HS code based on product specifications or documentation. Here is the structured classification and tariff information for the Vehicle Reflectorized Plastic Sheet based on the provided HS codes and tax details:

🔍 HS CODE: 3919101050

Product Description:

Self-adhesive plastic sheets, films, tapes, strips, and other flat shapes with fully or partially reflective surfaces produced by glass beads (glass particles), whether or not wound.

Tariff Summary: - Base Tariff Rate: 6.5% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 61.5%

Key Notes: - This code is the most specific for reflectorized plastic sheets with glass beads. - Ensure the product is self-adhesive and reflective as per the description.

🔍 HS CODE: 3919905010

Product Description:

Reflective sheets (not specifically described as self-adhesive or with glass beads).

Tariff Summary: - Base Tariff Rate: 5.8% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 60.8%

Key Notes: - This code is for general reflective sheets, not necessarily self-adhesive or with glass beads. - May be applicable if the product is not explicitly described as self-adhesive or with glass beads.

🔍 HS CODE: 8512906000

Product Description:

Electrical lighting or signaling equipment.

Tariff Summary: - Base Tariff Rate: 0.0% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 55.0%

Key Notes: - This code is not suitable for the described product (reflectorized plastic sheet). - Likely misclassified unless the product is lighting or signaling equipment.

🔍 HS CODE: 8708998180

Product Description:

Other parts and accessories.

Tariff Summary: - Base Tariff Rate: 2.5% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 57.5%

Key Notes: - This code is not suitable for the described product. - Likely misclassified unless the product is a part or accessory of a vehicle.

🔍 HS CODE: 3919101010

Product Description:

Road marking tape.

Tariff Summary: - Base Tariff Rate: 6.5% - Additional Tariff (General): 25.0% - Special Tariff after April 11, 2025: 30.0% - Total Tax Rate: 61.5%

Key Notes: - This code is for road marking tape, which may be similar to the described product. - Ensure the product is not specifically for road marking unless it is intended for that use.

📌 Proactive Advice:

- Verify Material and Unit Price: Confirm whether the product contains glass beads or is self-adhesive, as this will determine the correct HS code.

- Check Certifications: Some reflective products may require safety or quality certifications (e.g., for road use or vehicle compliance).

- Watch for April 11, 2025, Tariff Changes: The special tariff of 30% will apply after this date, significantly increasing the total tax burden.

- Avoid Misclassification: Ensure the product is not classified under 8512 or 8708 unless it is clearly a lighting device or vehicle part.

Let me know if you need help determining the most accurate HS code based on product specifications or documentation.

Customer Reviews

No reviews yet.