| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3901306000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3905190000 | Doc | 59.0% | CN | US | 2025-05-12 |

| 3905911000 | Doc | 59.0% | CN | US | 2025-05-12 |

| 3905911000 | Doc | 59.0% | CN | US | 2025-05-12 |

| 3905911000 | Doc | 59.0% | CN | US | 2025-05-12 |

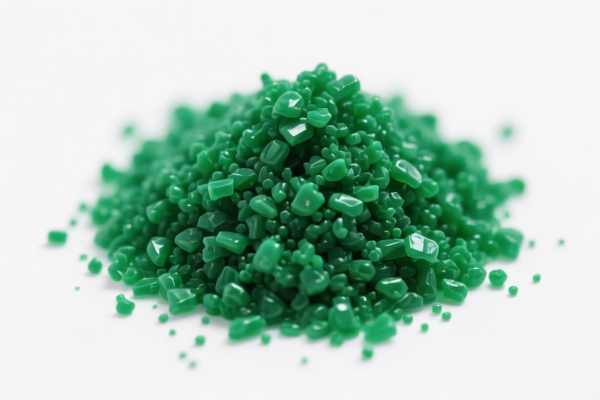

Product Name: Vinyl Acetate Copolymer Resin

Classification HS Codes and Tax Information:

- HS CODE: 3901306000

- Description: Vinyl acetate copolymer resin, falls under the category of other vinyl acetate copolymers under HS code 390190.

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3905190000

- Description: Vinyl acetate copolymer resin, classified under HS code 3905.

-

Total Tax Rate: 59.0%

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3905911000

- Description: Vinyl acetate copolymer resin, classified under HS code 3905.

-

Total Tax Rate: 59.0%

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is also applicable to vinyl acetate copolymer resin mixtures and granules under HS code 390500.

✅ Key Observations:

- Common Additional Tariff: All listed HS codes are subject to an additional 25.0% tariff.

- Special Tariff after April 11, 2025: A 30.0% additional tariff will be imposed on all these HS codes starting from April 11, 2025.

- Base Tariff Difference: HS code 3901306000 has a higher base tariff (5.3%) compared to the others (4.0%).

⚠️ Important Reminders:

- Verify Material Specifications: Ensure the product is indeed a vinyl acetate copolymer resin and not a different type of polymer or mixture.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., REACH, RoHS, or customs documentation) are required for import.

- Monitor Tariff Changes: The 30.0% special tariff after April 11, 2025, may significantly impact the total cost. Consider this in your pricing and logistics planning.

- Consult Customs Authority: For precise classification, especially if the product has mixed components or is used in specific applications.

📌 Proactive Advice:

- If your product is a mixture or granules, ensure it is correctly classified under 3905911000.

- If you are importing large quantities, consider applying for preferential tariff treatment or duty exemptions if applicable.

-

Keep updated records of product composition and origin to support customs declarations. Product Name: Vinyl Acetate Copolymer Resin

Classification HS Codes and Tax Information: -

HS CODE: 3901306000

- Description: Vinyl acetate copolymer resin, falls under the category of other vinyl acetate copolymers under HS code 390190.

-

Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3905190000

- Description: Vinyl acetate copolymer resin, classified under HS code 3905.

-

Total Tax Rate: 59.0%

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3905911000

- Description: Vinyl acetate copolymer resin, classified under HS code 3905.

-

Total Tax Rate: 59.0%

- Base Tariff: 4.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is also applicable to vinyl acetate copolymer resin mixtures and granules under HS code 390500.

✅ Key Observations:

- Common Additional Tariff: All listed HS codes are subject to an additional 25.0% tariff.

- Special Tariff after April 11, 2025: A 30.0% additional tariff will be imposed on all these HS codes starting from April 11, 2025.

- Base Tariff Difference: HS code 3901306000 has a higher base tariff (5.3%) compared to the others (4.0%).

⚠️ Important Reminders:

- Verify Material Specifications: Ensure the product is indeed a vinyl acetate copolymer resin and not a different type of polymer or mixture.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., REACH, RoHS, or customs documentation) are required for import.

- Monitor Tariff Changes: The 30.0% special tariff after April 11, 2025, may significantly impact the total cost. Consider this in your pricing and logistics planning.

- Consult Customs Authority: For precise classification, especially if the product has mixed components or is used in specific applications.

📌 Proactive Advice:

- If your product is a mixture or granules, ensure it is correctly classified under 3905911000.

- If you are importing large quantities, consider applying for preferential tariff treatment or duty exemptions if applicable.

- Keep updated records of product composition and origin to support customs declarations.

Customer Reviews

No reviews yet.