| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3904400000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3904905000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3901909000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904905000 | Doc | 61.5% | CN | US | 2025-05-12 |

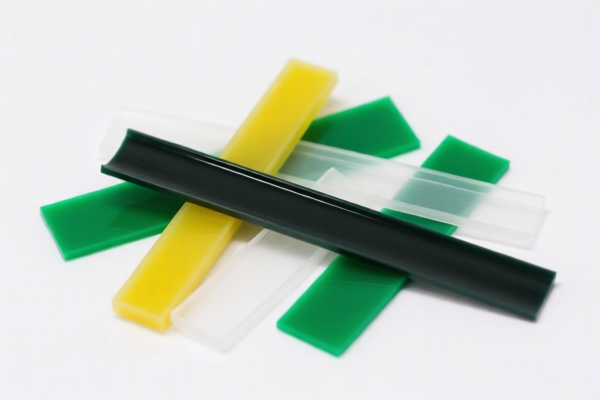

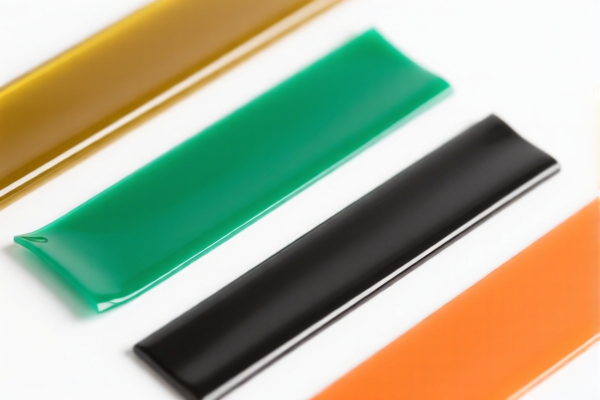

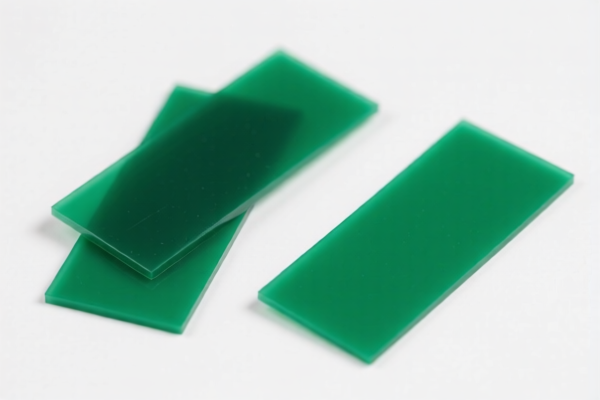

Product Name: Vinyl Chloride Polymer Parings

Classification Analysis and Tax Information:

✅ HS CODE: 3904400000

Description: Polyvinyl chloride (PVC) resin raw material particles, classified under HS 3904.40, which covers other vinyl chloride copolymers in primary form.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes:

- This code is suitable for PVC resin particles used as raw materials.

- Ensure the product is in its primary form (not processed into finished goods or profiles).

✅ HS CODE: 3904905000

Description: PVC resin particles for profile use, classified under HS 3904.90.50.00, which covers other PVC polymers in primary form.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes:

- The term "for profile use" refers to end-use, not the classification.

- Confirm the primary form of the product (not compounded or processed).

✅ HS CODE: 3904100000

Description: PVC particles, classified under HS 3904.10.00.00, which covers polyvinyl chloride in primary form.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes:

- This code is for pure PVC particles in primary form.

- Ensure the product is not modified or compounded with other materials.

✅ HS CODE: 3901909000

Description: Polyethylene resin particles, classified under HS 3901.90.90.00, which covers other polyethylene in primary form.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes:

- This code is not for PVC, but for polyethylene.

- If the product is not polyethylene, this code is not applicable.

📌 Proactive Advice:

- Verify Material: Confirm whether the product is PVC or polyethylene to avoid misclassification.

- Check Unit Price: High-value products may be subject to anti-dumping duties or additional tariffs.

- Certifications Required: Ensure compliance with customs documentation, including material specifications, origin, and certifications (e.g., REACH, RoHS).

- April 11, 2025 Deadline: Be aware of the special tariff imposed after this date. If your shipment is scheduled after this date, adjust your cost calculations accordingly.

Let me know if you need help with certification requirements or customs documentation.

Product Name: Vinyl Chloride Polymer Parings

Classification Analysis and Tax Information:

✅ HS CODE: 3904400000

Description: Polyvinyl chloride (PVC) resin raw material particles, classified under HS 3904.40, which covers other vinyl chloride copolymers in primary form.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes:

- This code is suitable for PVC resin particles used as raw materials.

- Ensure the product is in its primary form (not processed into finished goods or profiles).

✅ HS CODE: 3904905000

Description: PVC resin particles for profile use, classified under HS 3904.90.50.00, which covers other PVC polymers in primary form.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes:

- The term "for profile use" refers to end-use, not the classification.

- Confirm the primary form of the product (not compounded or processed).

✅ HS CODE: 3904100000

Description: PVC particles, classified under HS 3904.10.00.00, which covers polyvinyl chloride in primary form.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes:

- This code is for pure PVC particles in primary form.

- Ensure the product is not modified or compounded with other materials.

✅ HS CODE: 3901909000

Description: Polyethylene resin particles, classified under HS 3901.90.90.00, which covers other polyethylene in primary form.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes:

- This code is not for PVC, but for polyethylene.

- If the product is not polyethylene, this code is not applicable.

📌 Proactive Advice:

- Verify Material: Confirm whether the product is PVC or polyethylene to avoid misclassification.

- Check Unit Price: High-value products may be subject to anti-dumping duties or additional tariffs.

- Certifications Required: Ensure compliance with customs documentation, including material specifications, origin, and certifications (e.g., REACH, RoHS).

- April 11, 2025 Deadline: Be aware of the special tariff imposed after this date. If your shipment is scheduled after this date, adjust your cost calculations accordingly.

Let me know if you need help with certification requirements or customs documentation.

Customer Reviews

No reviews yet.