| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918902000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 5805004010 | Doc | 30.0% | CN | US | 2025-05-12 |

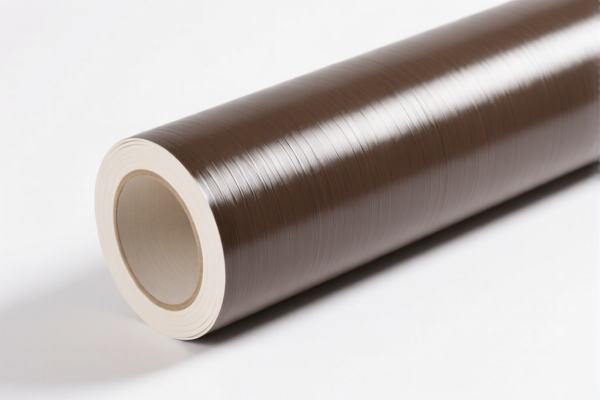

Product Name: Vinyl Man Made Fiber Wallpaper

Classification Options and Tax Details:

- HS CODE 3918902000

- Description: Plastic wall coverings with textile fiber backing.

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This classification is suitable if the product is primarily made of plastic with a textile fiber backing.

-

HS CODE 5805004010

- Description: Tapestries made of man-made fibers.

- Total Tax Rate: 30.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This classification applies if the product is more akin to a tapestry or decorative textile rather than a wall covering.

Key Considerations:

-

Classification Accuracy: The correct HS code depends on the product's primary material and intended use. If it is primarily a wall covering with a textile backing, 3918902000 is likely the correct code. If it is more decorative or resembles a tapestry, 5805004010 may apply.

-

Tariff Changes After April 11, 2025: Both classifications will be subject to an additional 30.0% tariff. This is a critical date to note for cost planning and compliance.

-

Anti-Dumping Duties: Not applicable for this product category.

-

Proactive Advice:

- Verify Material Composition: Confirm the percentage of plastic vs. textile fiber in the product.

- Check Unit Price and Certification: Ensure that the product meets any required certifications (e.g., fire safety, environmental standards) for import.

- Consult with Customs Broker: For final classification and tariff calculation, especially if the product has mixed materials or dual purposes.

Let me know if you need help determining which classification is more appropriate based on your product's specifications.

Product Name: Vinyl Man Made Fiber Wallpaper

Classification Options and Tax Details:

- HS CODE 3918902000

- Description: Plastic wall coverings with textile fiber backing.

- Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This classification is suitable if the product is primarily made of plastic with a textile fiber backing.

-

HS CODE 5805004010

- Description: Tapestries made of man-made fibers.

- Total Tax Rate: 30.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This classification applies if the product is more akin to a tapestry or decorative textile rather than a wall covering.

Key Considerations:

-

Classification Accuracy: The correct HS code depends on the product's primary material and intended use. If it is primarily a wall covering with a textile backing, 3918902000 is likely the correct code. If it is more decorative or resembles a tapestry, 5805004010 may apply.

-

Tariff Changes After April 11, 2025: Both classifications will be subject to an additional 30.0% tariff. This is a critical date to note for cost planning and compliance.

-

Anti-Dumping Duties: Not applicable for this product category.

-

Proactive Advice:

- Verify Material Composition: Confirm the percentage of plastic vs. textile fiber in the product.

- Check Unit Price and Certification: Ensure that the product meets any required certifications (e.g., fire safety, environmental standards) for import.

- Consult with Customs Broker: For final classification and tariff calculation, especially if the product has mixed materials or dual purposes.

Let me know if you need help determining which classification is more appropriate based on your product's specifications.

Customer Reviews

No reviews yet.