| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112303000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5516331000 | Doc | 67.0% | CN | US | 2025-05-12 |

| 6006909000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 6117909010 | Doc | 52.1% | CN | US | 2025-05-12 |

| 5112203000 | Doc | 80.0% | CN | US | 2025-05-12 |

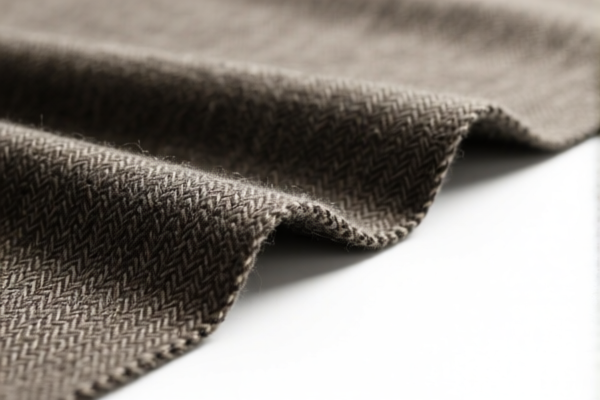

Product Name: Viscose Blended Combed Wool Woven Fabric

Classification Analysis and Tax Information:

- HS CODE: 5112303000

- Description: Combed wool blended with viscose (a man-made short fiber), matching the description of "combed wool" under heading 5112 and "blended with man-made short fibers" under 511230.

- Total Tax Rate: 80.0%

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most relevant HS code for your product, as it specifically includes both combed wool and viscose.

-

HS CODE: 5516331000

- Description: Woven fabric made of blended viscose (a man-made short fiber), matching the description of "woven fabrics of man-made short fibers, blended with other fibers."

- Total Tax Rate: 67.0%

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to woven fabrics with viscose as a component, but it does not include wool.

-

HS CODE: 6006909000

- Description: Knitted or crocheted viscose fabric, which fits the category of "other knitted or crocheted fabrics of man-made fibers."

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to knitted fabrics, not woven fabrics.

-

HS CODE: 6117909010

- Description: Knitted viscose blended fabric used for knitwear parts, such as sweaters.

- Total Tax Rate: 52.1%

- Base Tariff: 14.6%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to finished knitwear parts, not fabric.

-

HS CODE: 5112203000

- Description: Woven fabric of combed wool blended with man-made fibers, similar to 5112303000 but with a different composition or structure.

- Total Tax Rate: 80.0%

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is also applicable to blended wool fabrics, but it may not be the most accurate for viscose-blended fabric.

✅ Proactive Advice:

- Verify Material Composition: Ensure the fabric is indeed a blend of combed wool and viscose, and confirm the exact percentage of each component, as this can affect classification.

- Check Unit Price and Certification: If the product is for export, confirm whether any certifications (e.g., textile origin, eco-labels) are required.

- Monitor Tariff Changes: The additional tariff of 30.0% after April 11, 2025, is a critical date to note for cost planning.

- Consult Customs Authority: For final confirmation, consult local customs or a customs broker to ensure the correct HS code is applied for your specific product.

Let me know if you need help with customs documentation or tariff calculation tools.

Product Name: Viscose Blended Combed Wool Woven Fabric

Classification Analysis and Tax Information:

- HS CODE: 5112303000

- Description: Combed wool blended with viscose (a man-made short fiber), matching the description of "combed wool" under heading 5112 and "blended with man-made short fibers" under 511230.

- Total Tax Rate: 80.0%

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This is the most relevant HS code for your product, as it specifically includes both combed wool and viscose.

-

HS CODE: 5516331000

- Description: Woven fabric made of blended viscose (a man-made short fiber), matching the description of "woven fabrics of man-made short fibers, blended with other fibers."

- Total Tax Rate: 67.0%

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to woven fabrics with viscose as a component, but it does not include wool.

-

HS CODE: 6006909000

- Description: Knitted or crocheted viscose fabric, which fits the category of "other knitted or crocheted fabrics of man-made fibers."

- Total Tax Rate: 55.0%

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to knitted fabrics, not woven fabrics.

-

HS CODE: 6117909010

- Description: Knitted viscose blended fabric used for knitwear parts, such as sweaters.

- Total Tax Rate: 52.1%

- Base Tariff: 14.6%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to finished knitwear parts, not fabric.

-

HS CODE: 5112203000

- Description: Woven fabric of combed wool blended with man-made fibers, similar to 5112303000 but with a different composition or structure.

- Total Tax Rate: 80.0%

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is also applicable to blended wool fabrics, but it may not be the most accurate for viscose-blended fabric.

✅ Proactive Advice:

- Verify Material Composition: Ensure the fabric is indeed a blend of combed wool and viscose, and confirm the exact percentage of each component, as this can affect classification.

- Check Unit Price and Certification: If the product is for export, confirm whether any certifications (e.g., textile origin, eco-labels) are required.

- Monitor Tariff Changes: The additional tariff of 30.0% after April 11, 2025, is a critical date to note for cost planning.

- Consult Customs Authority: For final confirmation, consult local customs or a customs broker to ensure the correct HS code is applied for your specific product.

Let me know if you need help with customs documentation or tariff calculation tools.

Customer Reviews

No reviews yet.