| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4418919105 | Doc | 58.2% | CN | US | 2025-05-12 |

| 7323997000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

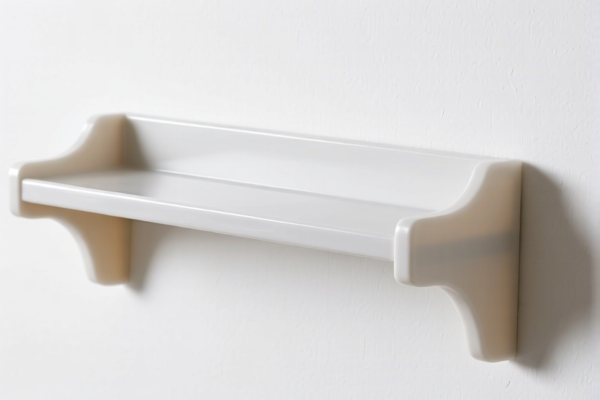

HS Code Classification & Duty Analysis for Declared Goods: WALL SHELF

Here's a breakdown of the HS codes provided for your declared goods, along with duty information and important considerations. This analysis aims to provide clarity on classification, potential tax liabilities, and necessary documentation.

Important Note: HS codes are highly specific. The accuracy of this analysis depends on the precise characteristics of your goods. Always double-check with customs authorities or a qualified broker if you have any doubts.

1. Builders' joinery and carpentry of wood, including cellular wood panels and assembled flooring panels; shingles and shakes: Other: Of bamboo: Other Wood flooring

- HS Code: 4418.91.91.05

- Breakdown:

- 44: Wood and articles of wood; wood charcoal. This chapter covers all products made primarily of wood.

- 4418: Builders' joinery and carpentry of wood, including cellular wood panels and assembled flooring panels; shingles and shakes. This specifies pre-fabricated wood structures and components.

- 4418.91: Other. This indicates the product falls into a category other than specifically listed items within 4418.

- 4418.91.91: Of bamboo. This further narrows the classification to products made of bamboo.

- 4418.91.91.05: Other Wood flooring. This is the most specific classification, indicating bamboo wood flooring.

- Duty Information:

- Basic Duty: 3.2%

- Additional Duty: 25.0% (Currently)

- Post April 2, 2025: Additional Duty increases to 30%

- Total Duty: 58.2%

- Key Considerations:

- Material Verification: Confirm the flooring is entirely made of bamboo. Any other wood components could change the HS code.

- Pricing Accuracy: Ensure the declared value is accurate, as duties are calculated based on this value.

- Certification: Depending on the destination country, you may need certifications related to wood sourcing (e.g., FSC certification for sustainable forestry).

2. Table, kitchen or other household articles and parts thereof, of iron or steel; iron or steel wool; pot scourers and scouring or polishing pads, gloves and the like, of iron or steel: Other: Other: Not coated or plated with precious metal: Other: Cookingware

- HS Code: 7323.99.70.00

- Breakdown:

- 73: Articles of iron or steel. This chapter covers a wide range of iron and steel products.

- 7323: Table, kitchen or other household articles and parts thereof, of iron or steel. This specifies household items made of iron or steel.

- 7323.99: Other. This indicates the product falls into a category other than specifically listed items within 7323.

- 7323.99.70: Other. Further specifies the item as "other" within the 7323.99 category.

- 7323.99.70.00: Other. This is the most specific classification, indicating "other" cookingware.

- Duty Information:

- Basic Duty: 5.3%

- Additional Duty: 0.0% (Currently)

- Post April 2, 2025: Additional Duty increases to 30% for steel and aluminum products.

- Total Duty: 60.3%

- Key Considerations:

- Material Composition: Verify the cookingware is primarily made of iron or steel. The presence of other materials (e.g., non-stick coatings) could affect the HS code.

- Coating Verification: Confirm the cookingware is not coated or plated with precious metals.

- Steel/Aluminum Specifics: Be aware of the increased duty on steel and aluminum products after April 2, 2025.

3. Builders' ware of plastics, not elsewhere specified or included: Other

- HS Code: 3925.90.00.00

- Breakdown:

- 39: Plastics and articles thereof. This chapter covers all products made primarily of plastic.

- 3925: Plastics, not elsewhere specified or included. This covers a broad range of plastic products not specifically classified elsewhere.

- 3925.90: Other. This indicates the product falls into a category other than specifically listed items within 3925.

- 3925.90.00: Other. This is the most specific classification, indicating "other" builders' ware of plastics.

- Duty Information:

- Basic Duty: 5.3%

- Additional Duty: 25.0% (Currently)

- Post April 2, 2025: Additional Duty increases to 30%

- Total Duty: 60.3%

- Key Considerations:

- Plastic Type: Identify the specific type of plastic used. Different plastic types may have different regulations.

- Product Function: Clearly define the function of the builders' ware. This will help ensure the correct HS code is applied.

- Material Purity: Confirm the product is primarily made of plastic. Any significant non-plastic components could change the HS code.

Disclaimer: This information is for general guidance only and does not constitute professional customs advice. Always consult with a qualified customs broker or relevant authorities for accurate and up-to-date information specific to your situation.

Customer Reviews

No reviews yet.