| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 6306905000 | Doc | 34.5% | CN | US | 2025-05-12 |

| 4008210000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 5404198080 | Doc | 61.9% | CN | US | 2025-05-12 |

| 5405003000 | Doc | 61.9% | CN | US | 2025-05-12 |

| 5405006000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 5609001000 | Doc | 57.9% | CN | US | 2025-05-12 |

| 5609002000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5609003000 | Doc | 59.5% | CN | US | 2025-05-12 |

| 5609004000 | Doc | 58.9% | CN | US | 2025-05-12 |

| 6815994170 | Doc | 55.0% | CN | US | 2025-05-12 |

| 6914908000 | Doc | 60.6% | CN | US | 2025-05-12 |

| 4823901000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 7314410080 | Doc | 80.0% | CN | US | 2025-05-12 |

| 7616995190 | Doc | 82.5% | CN | US | 2025-05-12 |

Okay, let's break down the HS codes and tax implications for your "WATER STRIP" declaration. I'll provide a structured analysis to help you understand the classifications and potential costs.

Understanding HS Codes: A Quick Primer

HS codes (Harmonized System codes) are internationally standardized codes used to classify traded products. The first 6 digits are generally consistent worldwide, while additional digits can vary by country. Here's how to interpret them:

- Chapter (First 2 digits): Broad category of the product.

- Heading (Next 2 digits): More specific classification within the chapter.

- Subheading (Next 2 digits): Even more detailed classification.

- Further Subdivisions: Country-specific details.

Analysis of Your HS Codes

Here's a breakdown of each code, with explanations and key considerations. I'll highlight potential issues and suggest what you should verify.

-

6306.90.50.00 - Tarpaulins, awnings and sunblinds; tents... of other textile materials (Total Tax: 34.5%)

- Chapter 63: Textile articles.

- Heading 6306: Articles of textile materials for furnishing.

- Subheading 6306.90: Other.

- Further Subdivision 6306.90.50: Of other textile materials.

- Note: This code is suitable if your "WATER STRIP" is made of materials other than cotton.

-

4008.21.00.00 - Plates, sheets, strip, rods and profile shapes, of vulcanized rubber other than hard rubber: Of noncellular rubber: Plates, sheets and strip (Total Tax: 55.0%)

- Chapter 40: Rubber and articles thereof.

- Heading 4008: Plates, sheets, strip, rods, profile shapes, etc., of vulcanized rubber.

- Subheading 4008.21: Of noncellular rubber.

- Further Subdivision 4008.21.00: Plates, sheets and strip.

- Note: This is appropriate if the strip is made of vulcanized rubber (natural or synthetic) and not hard rubber.

-

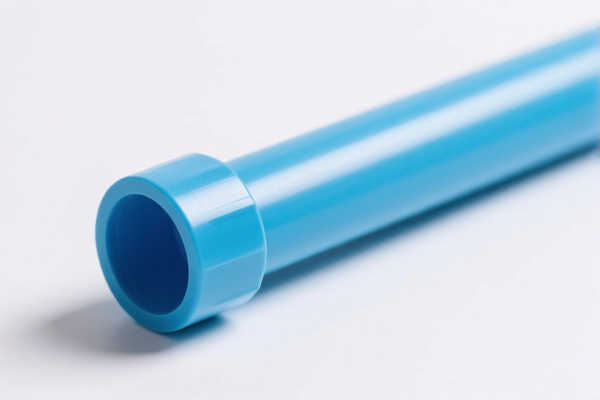

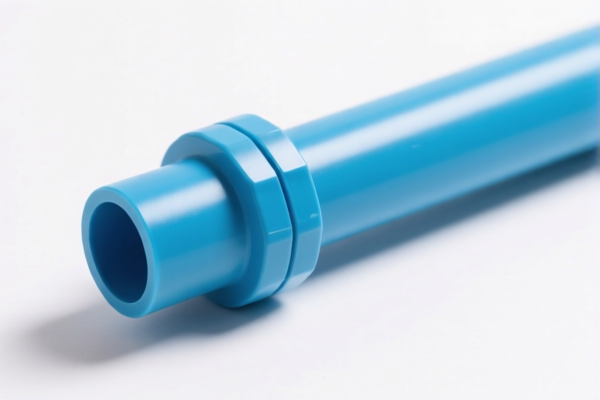

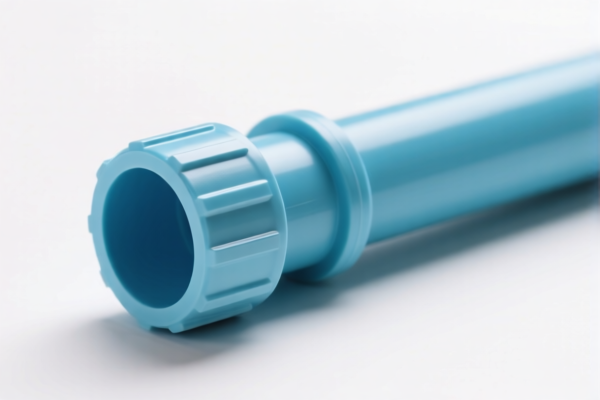

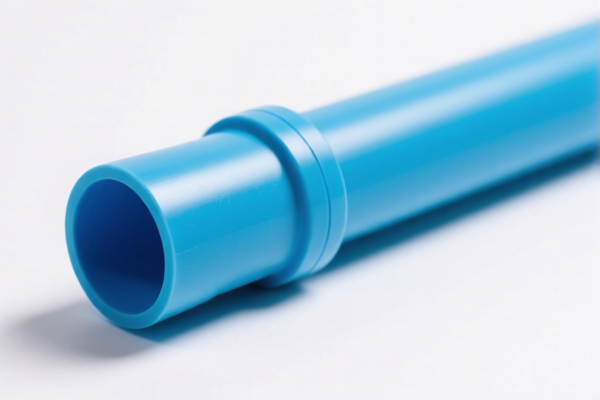

3926.90.99.89 - Other articles of plastics... (Total Tax: 42.8%)

- Chapter 39: Plastics and articles thereof.

- Heading 3926: Other articles of plastics.

- Subheading 3926.90: Other.

- Further Subdivision 3926.90.99: Other.

- Note: This is a broad category. Ensure the material is definitively plastic.

-

5404.19.80.80 - Synthetic monofilament... strip and the like (Total Tax: 61.9%)

- Chapter 54: Synthetic textile materials.

- Heading 5404: Synthetic monofilament.

- Subheading 5404.19: Other.

- Further Subdivision 5404.19.80: Other.

- Note: This applies if the strip is synthetic monofilament with a diameter less than 1mm.

-

5405.00.30.00 - Artificial monofilament... (Total Tax: 61.9%)

- Chapter 54: Artificial textile materials.

- Heading 5405: Artificial monofilament.

- Subheading 5405.00: Monofilament.

- Further Subdivision 5405.00.30: Other.

- Note: Similar to 5404, but for artificial (regenerated cellulose) monofilament.

-

5405.00.60.00 - Artificial monofilament... (Total Tax: 60.8%)

- Chapter 54: Artificial textile materials.

- Heading 5405: Artificial monofilament.

- Subheading 5405.00: Other.

- Further Subdivision 5405.00.60: Other.

- Note: This is a broader category within artificial monofilament.

-

5609.00.10.00 - Articles of yarn, strip... of cotton (Total Tax: 57.9%)

- Chapter 56: Textile waste and textile articles.

- Heading 5609: Articles of yarn, strip, etc.

- Subheading 5609.00: Of cotton.

- Further Subdivision 5609.00.10: Other.

- Note: Only applicable if the strip is made of cotton.

-

5609.00.20.00 - Articles of yarn, strip... of vegetable fibers (Total Tax: 55.0%)

- Chapter 56: Textile waste and textile articles.

- Heading 5609: Articles of yarn, strip, etc.

- Subheading 5609.00: Of vegetable fibers, except cotton.

- Further Subdivision 5609.00.20: Other.

- Note: For strips made of vegetable fibers other than cotton (e.g., jute, hemp).

-

5609.00.30.00 - Articles of yarn, strip... of man-made fibers (Total Tax: 59.5%)

- Chapter 56: Textile waste and textile articles.

- Heading 5609: Articles of yarn, strip, etc.

- Subheading 5609.00: Of man-made fibers.

- Further Subdivision 5609.00.30: Other.

- Note: For strips made of synthetic fibers (e.g., polyester, nylon).

-

5609.00.40.00 - Articles of yarn, strip... (Total Tax: 58.9%)

- Chapter 56: Textile waste and textile articles.

- Heading 5609: Articles of yarn, strip, etc.

- Subheading 5609.00: Other.

- Further Subdivision 5609.00.40: Other.

- Note: A catch-all for strips not specifically covered by the previous subdivisions.

-

6815.99.41.70 - Articles of stone... (Total Tax: 55.0%)

- Chapter 68: Articles of stone, plaster, cement, asbestos, mica or similar materials.

- Heading 6815: Other articles of stone.

- Subheading 6815.99: Other.

- Further Subdivision 6815.99.41: Other.

- Note: This is for strips made of stone or mineral substances.

-

6914.90.80.00 - Other ceramic articles (Total Tax: 60.6%)

- Chapter 69: Ceramic articles.

- Heading 6914: Other ceramic articles.

- Subheading 6914.90: Other.

- Further Subdivision 6914.90.80: Other.

- Note: For strips made of ceramic materials.

-

4823.90.10.00 - Other paper, paperboard... (Total Tax: 55.0%)

- Chapter 48: Paper and paperboard.

- Heading 4823: Other paper, paperboard, etc.

- Subheading 4823.90: Other.

- Further Subdivision 4823.90.10: Of paper pulp.

- Note: For strips made of paper pulp.

-

7314.41.00.80 - Cloth (including endless bands), grill, netting... (Total Tax: 80.0%)

- Chapter 73: Iron or steel articles.

- Heading 7314: Cloth, grill, netting, fencing, etc.

- Subheading 7314.41: Plated or coated with zinc.

- Further Subdivision 7314.41.00: Other.

- Note: For strips made of iron or steel wire, plated or coated with zinc.

-

7616.99.51.90 - Other articles of aluminum (Total Tax: 82.5%)

- Chapter 76: Aluminum and articles thereof.

- Heading 7616: Other articles of aluminum.

- Subheading 7616.99: Other.

- Further Subdivision 7616.99.51: Other.

- Note: For strips made of aluminum.

Recommendations

- Material Composition: Crucially, determine the exact material composition of your "WATER STRIP." This will dictate the correct HS code.

- Dimensions: If it's a monofilament, measure the diameter to confirm if it's less than 1mm.

- Coating/Plating: If it's metal, is it coated or plated with zinc?

- End Use: Consider the intended use of the strip. This can sometimes help narrow down the classification.

- Certifications: Depending on the material and end use, you may need certifications (e.g., REACH for plastics, RoHS for metals).

- 2025.4.2 Tariff Changes: Be aware of the increased tariffs coming into effect on April 2, 2025. Factor this into your cost calculations.

Disclaimer: I am an AI and cannot provide definitive customs classification advice. This information is for guidance only. You should consult with a licensed customs broker or your local customs authority for accurate classification and compliance.

Customer Reviews

No reviews yet.