| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8481801020 | Doc | 59.0% | CN | US | 2025-05-12 |

| 8481805060 | Doc | 58.0% | CN | US | 2025-05-12 |

| 8481905000 | Doc | 40.5% | CN | US | 2025-05-12 |

| 3922100000 | Doc | 43.8% | CN | US | 2025-05-12 |

| 7324900000 | Doc | 105.0% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for the water tap product based on the provided HS codes:

✅ HS CODE: 8481801020

Product Description:

- Manual copper water taps for pipes, boiler shells, tanks, containers, including pressure-reducing and thermostatic valves, and their parts.

- Applies to bath and shower taps made of copper, with pressure rating below 850 kPa.

Tariff Summary:

- Base Tariff Rate: 4.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.0%

Key Notes:

- This code applies specifically to copper taps used in industrial or plumbing systems, including bath and shower taps.

- No anti-dumping duties are mentioned for this code.

- Proactive Advice: Confirm the material (must be copper) and pressure rating to ensure correct classification.

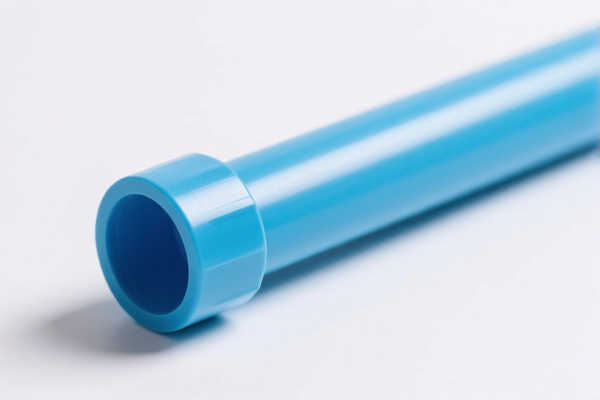

✅ HS CODE: 8481805060

Product Description:

- Manual operation taps for bath, shower, sink, and lavatory basins, made of other materials (not copper).

Tariff Summary:

- Base Tariff Rate: 3.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.0%

Key Notes:

- This code is for non-copper taps used in domestic settings (e.g., bathroom fixtures).

- Proactive Advice: Ensure the material is not copper and the intended use is for domestic purposes.

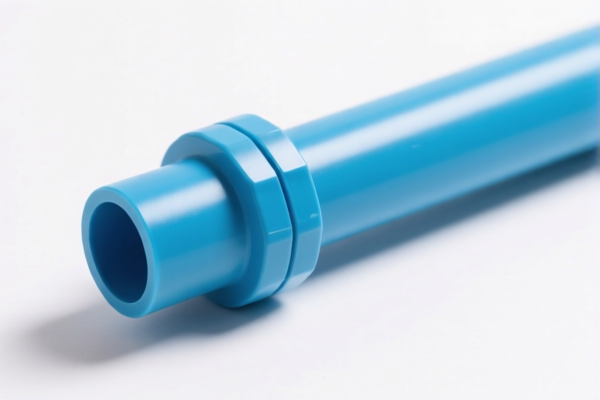

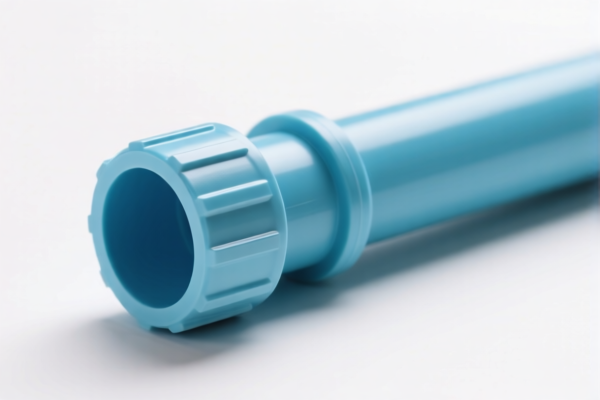

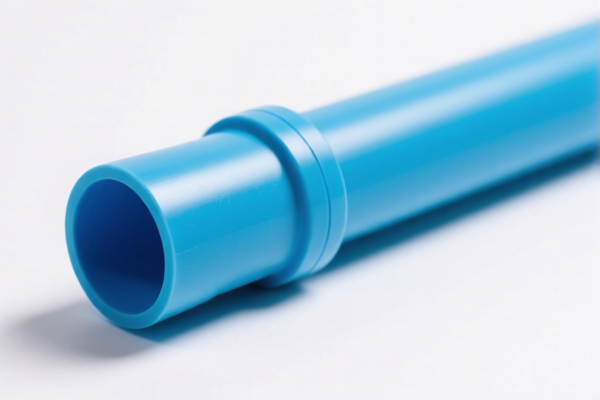

✅ HS CODE: 8481905000

Product Description:

- Parts of valves and taps used in pipes, boiler shells, tanks, etc., including manual and check valves.

Tariff Summary:

- Base Tariff Rate: 3.0%

- Additional Tariff (before April 11, 2025): 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 40.5%

Key Notes:

- This code is for parts of valves and taps used in industrial or plumbing systems.

- Proactive Advice: Confirm the product is a part and not a complete tap. Check if it is used in industrial applications.

✅ HS CODE: 7324900000

Product Description:

- Water taps that fall under HSCODE 7324900000, typically iron or steel products.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (before April 11, 2025): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Additional Tariff for Steel and Aluminum Products: 50.0%

- Total Tax Rate: 105.0%

Key Notes:

- This code applies to iron or steel taps.

- High tax rate due to anti-dumping duties on steel and aluminum products.

- Proactive Advice: Verify the material and origin of the product to avoid unexpected high tariffs.

✅ HS CODE: 3922100000

Product Description:

- Plastic sink basins (not taps, but related product).

Tariff Summary:

- Base Tariff Rate: 6.3%

- Additional Tariff (before April 11, 2025): 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 43.8%

Key Notes:

- This code is for plastic sink basins, not taps.

- Proactive Advice: Ensure the product is not a tap, but a sink basin made of plastic.

📌 Important Reminders:

- April 11, 2025 Special Tariff: All products will be subject to an additional 30% tariff after this date.

- Anti-dumping duties: Apply to steel and aluminum products (e.g., HS CODE 7324900000).

- Material and Use: Confirm the material (copper, steel, aluminum, plastic) and intended use (domestic, industrial) to avoid misclassification.

- Certifications: Check if import permits or certifications are required for the product category.

Let me know if you need help determining the correct HS code for your specific product.

Customer Reviews

No reviews yet.