| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3822190080 | Doc | 30.0% | CN | US | 2025-05-12 |

| 4823201000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4823209000 | Doc | 55.0% | CN | US | 2025-05-12 |

Okay, let's break down the HS codes and tax implications for your "WATER TEST PAPER" declaration. Here's a detailed analysis to help you understand the classification and potential costs:

Understanding HS Codes – A Quick Guide

Before we dive into specifics, remember that HS codes are standardized internationally. The first two digits generally indicate the chapter, the next two the subheading, and further digits provide more specific classifications.

1. HS Code: 3822.19.00.80 – Diagnostic or laboratory reagents on a backing

- 38: Chemicals and their products; pharmaceutical products. This chapter covers a wide range of chemical substances and preparations.

- 22: Miscellaneous chemical products. This narrows it down to specific chemical preparations not covered elsewhere.

- 19: Diagnostic or laboratory reagents. This specifically identifies reagents used for testing and analysis.

-

00.80: Other. This is a residual category within diagnostic reagents.

Tax Implications: * Basic Duty: 0.0% * Additional Duty: 0.0% * Post April 2, 2025 Additional Duty: 30% * Total Tax: 30.0%

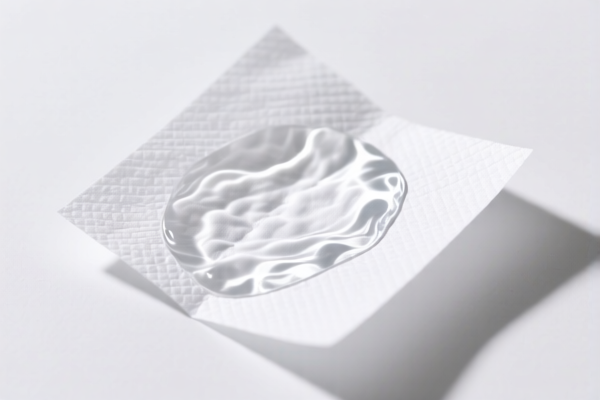

Important Notes: This code seems most appropriate if your water test paper is pre-prepared with reagents on a backing (like test strips). Please confirm if the paper has reagents already applied.

2. HS Code: 4823.20.10.00 – Paint filters and strainers

- 48: Paper and paperboard; articles of paper pulp, paper, paperboard, cellulose wadding or webs of cellulose fibers. This chapter covers products made from paper.

- 23: Paper and paperboard; articles of paper pulp, paper, paperboard, cellulose wadding or webs of cellulose fibers.

- 20: Filter paper and paperboard. This narrows it down to paper specifically used for filtration.

-

10.00: Paint filters and strainers. This is a specific type of filter paper.

Tax Implications: * Basic Duty: 0.0% * Additional Duty: 25.0% * Post April 2, 2025 Additional Duty: 30% * Total Tax: 55.0%

Important Notes: This code is suitable if your water test paper is specifically designed for filtering paint or similar viscous liquids. It's less likely to be appropriate for general water testing.

3. HS Code: 4823.20.90.00 – Other Filter paper and paperboard

- 48: Paper and paperboard; articles of paper pulp, paper, paperboard, cellulose wadding or webs of cellulose fibers.

- 23: Paper and paperboard; articles of paper pulp, paper, paperboard, cellulose wadding or webs of cellulose fibers.

- 20: Filter paper and paperboard.

-

90.00: Other. This is a residual category for filter paper not specifically classified elsewhere.

Tax Implications: * Basic Duty: 0.0% * Additional Duty: 25.0% * Post April 2, 2025 Additional Duty: 30% * Total Tax: 55.0%

Important Notes: This code is a good option if your water test paper is filter paper used for general purposes, including water testing, but doesn't fall into the "paint filters" category.

Recommendations & Key Considerations:

- Paper Composition: What is the primary material of your water test paper? Is it primarily paper pulp, or does it contain significant amounts of other materials?

- Reagent Presence: Crucially, are the reagents pre-applied to the paper, or are they applied separately by the end-user? This is the biggest factor in determining between HS Code 3822.19.00.80 and the 4823 codes.

- Intended Use: Is the paper specifically designed for a particular type of water testing (e.g., pH, chlorine, hardness)?

- Material Safety Data Sheet (MSDS): If the paper contains chemicals, an MSDS can help determine the precise chemical composition and potentially support the classification under HS Code 3822.

- Post April 2, 2025 Tariffs: Be aware of the increased tariffs coming into effect on April 2, 2025. Factor this into your cost calculations.

- Single Declaration: If you are importing multiple types of water test paper, consider whether they can be declared under a single HS code or if separate declarations are required.

Disclaimer: I am an AI assistant and cannot provide definitive customs classification advice. This information is for general guidance only. It is highly recommended to consult with a licensed customs broker or your local customs authority for a final determination of the correct HS code and applicable tariffs. They can review your specific product details and provide accurate guidance.

Customer Reviews

No reviews yet.