| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9025802000 | Doc | 57.9% | CN | US | 2025-05-12 |

| 3924905650 | Doc | 40.9% | CN | US | 2025-05-12 |

Okay, let's break down the HS codes and tax implications for your declared item "WATER TESTER". You've provided information for two potential classifications, so we'll analyze both.

Understanding HS Codes: A Quick Primer

HS codes (Harmonized System codes) are internationally standardized codes used to classify traded products. The first 6 digits are generally consistent worldwide, while additional digits are used for more specific categorization by individual countries. Here's a general breakdown of the structure:

- Chapter (First 2 digits): Broad category of the product.

- Heading (First 4 digits): More specific grouping within the chapter.

- Subheading (First 6 digits): Even more detailed classification.

- Additional Digits: Country-specific for further refinement.

1. HS Code: 9025.80.20.00 – Hydrometers and similar floating instruments

- Chapter 90: Optical, precision, medical, surgical, dental, veterinary instruments and appliances; parts and accessories thereof. This indicates the item is considered a measuring/testing instrument.

- Heading 9025: Hydrometers and similar floating instruments, thermometers, pyrometers, barometers, hygrometers and psychrometers, recording or not; any combination of these instruments; parts and accessories thereof. This narrows it down to instruments used for measuring physical properties.

- Subheading 9025.80: Other instruments. This suggests it's a type of measuring instrument not specifically covered in earlier headings.

- 9025.80.20.00: Further specifies "Hydrometers and similar floating instruments, whether or not incorporating a thermometer, non-recording".

Tax Implications (as provided):

- Basic Duty: 2.9%

- Additional Duty (Currently): 25.0%

- Additional Duty (After April 2, 2025): 30.0%

- Total Tax (Currently): 57.9%

Important Considerations for 9025.80.20.00:

- Functionality: This code is best suited if the "WATER TESTER" primarily functions as a measuring instrument (e.g., density, specific gravity).

- Recording Capability: The code specifically mentions "non-recording". If your tester does record data, a different code might be more appropriate.

- Material: The material composition of the tester could influence classification.

- Certification: Depending on the intended use of the water tester (e.g., potable water testing), you may need specific certifications (e.g., NSF, CE). Please verify the required certifications for your target market.

2. HS Code: 3924.90.56.50 – Tableware, kitchenware, other household articles and hygienic or toilet articles, of plastics

- Chapter 39: Plastics and articles thereof. This suggests the item is made of plastic.

- Heading 3924: Tableware, kitchenware, other household articles and hygienic or toilet articles, of plastics. This narrows it down to plastic household items.

- Subheading 3924.90: Other. This indicates it's a plastic item not specifically covered in earlier headings.

- 3924.90.56.50: Further specifies "Other".

Tax Implications (as provided):

- Basic Duty: 3.4%

- Additional Duty (Currently): 7.5%

- Additional Duty (After April 2, 2025): 30.0%

- Total Tax (Currently): 40.9%

Important Considerations for 3924.90.56.50:

- Material Composition: This code is only appropriate if the "WATER TESTER" is primarily made of plastic.

- Functionality: If the tester has significant measuring/testing functionality, this code is likely incorrect. It's more suited for plastic containers or simple tools.

- Intended Use: If the tester is used for food or beverage contact, ensure the plastic is food-grade and meets relevant safety standards.

- Single-use or Durable: The durability of the item may affect classification.

Recommendation & Next Steps:

Based on the description "WATER TESTER", HS Code 9025.80.20.00 is likely the more accurate classification if the primary function is measurement. However, if it's a simple plastic tool, 3924.90.56.50 might be appropriate.

To ensure correct classification, please provide the following information:

- Detailed description of the tester's functionality. What specifically does it measure?

- Material composition: What is the tester made of? (e.g., plastic type, metal components)

- Intended use: What is the tester used for? (e.g., potable water, industrial water, swimming pool water)

- Does the tester record data?

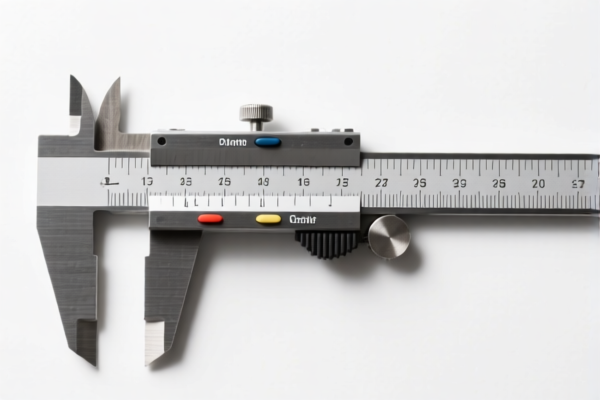

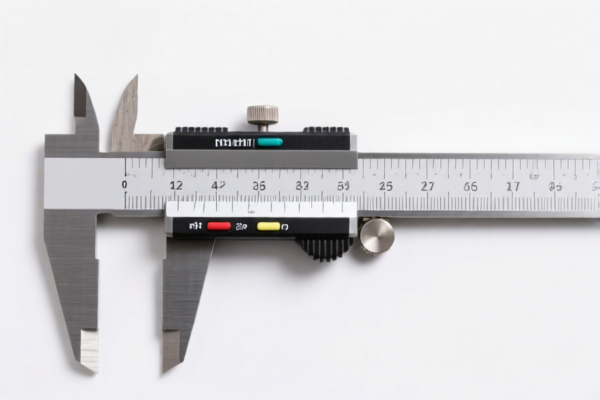

- A picture of the product would be very helpful.

Crucially, please verify the required certifications for your target market. Different countries have different regulations for water testing equipment.

Disclaimer: I am an AI and cannot provide definitive customs rulings. This information is for guidance only. You should consult with a qualified customs broker or import specialist for accurate classification and compliance advice.

Customer Reviews

No reviews yet.