| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 9025112000 | Doc | 30.0% | CN | US | 2025-05-12 |

| 9025114000 | Doc | 30.0% | CN | US | 2025-05-12 |

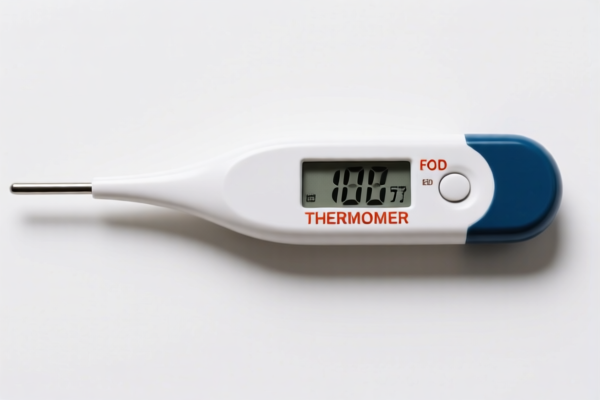

Classification and Duty Information for WATER THERMOMETER (HS Code 9025.11)

Based on the provided information, your declared item, "WATER THERMOMETER," falls under the following HS Code classifications:

1. HS Code: 9025.11.20.00 – Clinical Liquid-filled Thermometers

- 90: Optical, precision, medical, surgical, dental instruments and their parts. This chapter broadly covers instruments used in healthcare and scientific applications.

- 25: Instruments for measuring or checking physical quantities; meters and counters; parts and accessories thereof. This section specifically focuses on measuring devices.

- 11: Hydrometers and similar floating instruments, thermometers, pyrometers, barometers, hygrometers and psychrometers, recording or not. This narrows down the classification to temperature, pressure, and humidity measuring instruments.

-

20: Liquid-filled, for direct reading: Clinical. This specifically identifies clinical thermometers that display readings directly and are filled with a liquid (typically mercury or alcohol).

- Duty Information:

- Basic Duty: 0.0%

- Additional Duty: 0.0%

- Additional Duty (Post April 2, 2025): 30.0%

- Total Duty: 30.0%

- Duty Information:

2. HS Code: 9025.11.40.00 – Other Liquid-filled Thermometers (Not Clinical)

- 90, 25, 11: Same as above – indicating optical/precision instruments for measuring physical quantities, specifically temperature.

-

40: Liquid-filled, for direct reading: Other. This covers liquid-filled thermometers that are not classified as clinical thermometers. This could include thermometers for industrial use, laboratory applications, or general purpose use.

- Duty Information:

- Basic Duty: 0.0%

- Additional Duty: 0.0%

- Additional Duty (Post April 2, 2025): 30.0%

- Total Duty: 30.0%

- Duty Information:

Important Considerations & Recommendations:

- Clinical vs. Non-Clinical: The distinction between "clinical" and "other" is crucial. Clinical thermometers are specifically designed for use on the human body. If your thermometers are intended for industrial, laboratory, or general use, HS Code 9025.11.40.00 is the appropriate classification.

- Material Composition: The material of the thermometer (glass, plastic, etc.) doesn't directly affect the HS code in this case, but it may impact other import regulations.

- Accuracy & Calibration: Depending on the intended use and destination country, you may need to provide calibration certificates or other documentation to demonstrate the accuracy of the thermometers.

- Post April 2, 2025 Duty Changes: Be aware of the 30% additional duty that will be implemented on April 2, 2025. Factor this into your cost calculations.

- Single Declaration: If you are importing both clinical and non-clinical thermometers, you may need to declare them separately under their respective HS codes.

- Value Declaration: Ensure the declared value of the thermometers is accurate, as duties are calculated based on this value.

Next Steps:

- Confirm the intended use of the thermometers. This will determine the correct HS code.

- Verify the material composition and single piece price.

- Check for any specific import requirements or certifications required by the destination country.

- Contact a customs broker for assistance with the import process and to ensure compliance with all applicable regulations.

Disclaimer: This information is for general guidance only and does not constitute professional customs advice. Regulations can change, and it is your responsibility to ensure compliance with all applicable laws and regulations.

Customer Reviews

No reviews yet.