| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3917210000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3917220000 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3925100000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

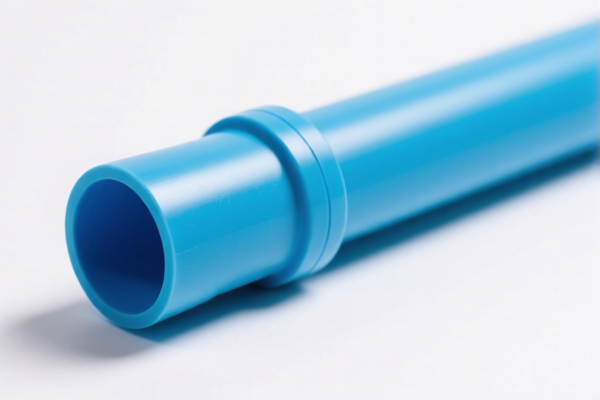

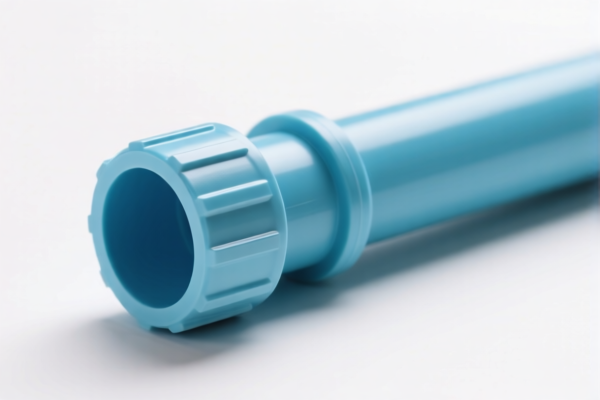

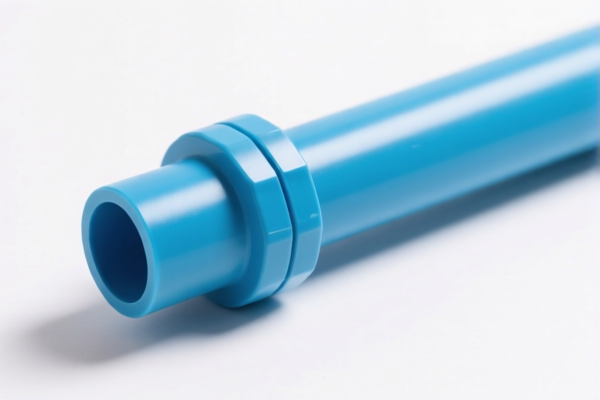

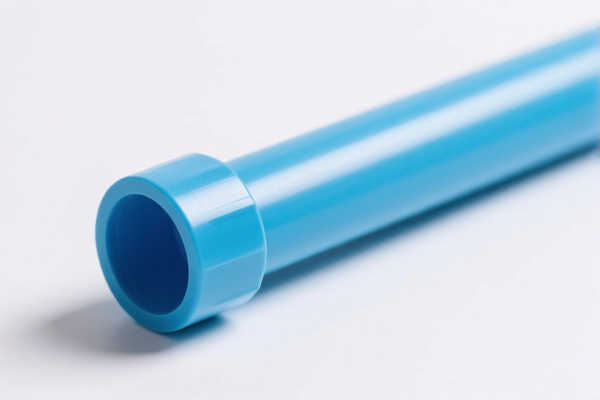

WATERPIPE HS Code Classification

Based on the provided reference data, classifying "WATERPIPE" requires considering the material and specific application. Here's a breakdown of potential HS codes, with explanations:

-

3917.21.00.00 - Tubes, pipes and hoses and fittings therefor (for example, joints, elbows, flanges), of plastics: Tubes, pipes and hoses, rigid: Of polymers of ethylene.

- 39: Plastics and articles thereof. This chapter covers a wide range of plastic products.

- 17: Tubes, pipes and hoses and fittings therefor. Specifically focuses on these types of products.

- 21: Rigid tubes, pipes and hoses made from polymers of ethylene (like polyethylene - PE). If the waterpipe is made of PE, PVC, or similar ethylene-based plastics and is rigid, this is a strong candidate.

- Tax Rate: 58.1% (3.1% base tariff + 25% additional tariff + 30% additional tariff after April 2, 2025).

-

3917.22.00.00 - Tubes, pipes and hoses and fittings therefor (for example, joints, elbows, flanges), of plastics: Tubes, pipes and hoses, rigid: Of polymers of propylene.

- 39: Plastics and articles thereof.

- 17: Tubes, pipes and hoses and fittings therefor.

- 22: Rigid tubes, pipes and hoses made from polymers of propylene (like polypropylene - PP). If the waterpipe is made of PP, this HS code applies.

- Tax Rate: 58.1% (3.1% base tariff + 25% additional tariff + 30% additional tariff after April 2, 2025).

-

3925.10.00.00 - Builders' ware of plastics, not elsewhere specified or included: Reservoirs, tanks, vats and similar containers, of a capacity exceeding 300 liters.

- 39: Plastics and articles thereof.

- 25: Builders' ware of plastics. This covers plastic items used in construction or building.

- 10: Reservoirs, tanks, vats, and similar containers exceeding 300 liters. If the waterpipe functions as a large storage container (e.g., a rainwater tank) with a capacity over 300 liters, this code is relevant.

- Tax Rate: 61.3% (6.3% base tariff + 25% additional tariff + 30% additional tariff after April 2, 2025).

-

3925.90.00.00 - Builders' ware of plastics, not elsewhere specified or included: Other.

- 39: Plastics and articles thereof.

- 25: Builders' ware of plastics.

- 90: Other builders' ware of plastics not specifically covered elsewhere. This is a broader category and might apply if the waterpipe is a plastic building component but doesn't fit the other specific classifications.

- Tax Rate: 60.3% (5.3% base tariff + 25% additional tariff + 30% additional tariff after April 2, 2025).

Important Considerations & Recommendations:

- Material Composition: The primary material of the waterpipe is crucial. Is it polyethylene (PE), polypropylene (PP), PVC, or another plastic?

- Pipe Rigidity: Is the pipe rigid (holds its shape) or flexible?

- Function: How is the waterpipe used? Is it for potable water, irrigation, drainage, or another purpose?

- Capacity: If it's used for storage, what is its capacity in liters?

- Detailed Description: Provide a more detailed description of the waterpipe (e.g., dimensions, wall thickness, connection types) to ensure accurate classification.

- Certification: Depending on the intended use (e.g., potable water), specific certifications (e.g., NSF, WRAS) may be required for import.

- Invoice Review: Carefully review the supplier's invoice for the exact material composition and product specifications.

- Customs Consultation: It is highly recommended to consult with a customs broker or local customs authorities to confirm the correct HS code before import. Incorrect classification can lead to delays, penalties, and additional costs.

Customer Reviews

No reviews yet.