| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919905060 | Doc | 60.8% | CN | US | 2025-05-12 |

| 7007190000 | Doc | 60.0% | CN | US | 2025-05-12 |

| 4814900200 | Doc | 37.5% | CN | US | 2025-05-12 |

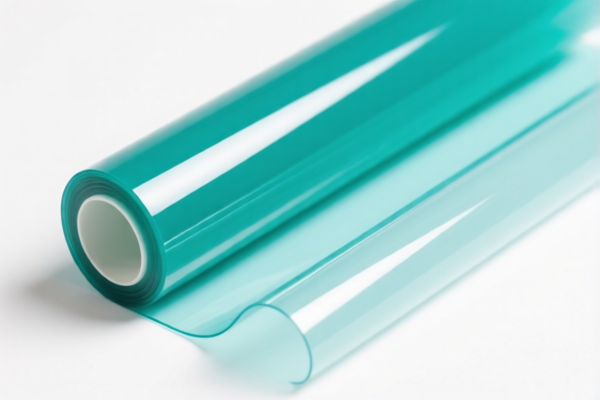

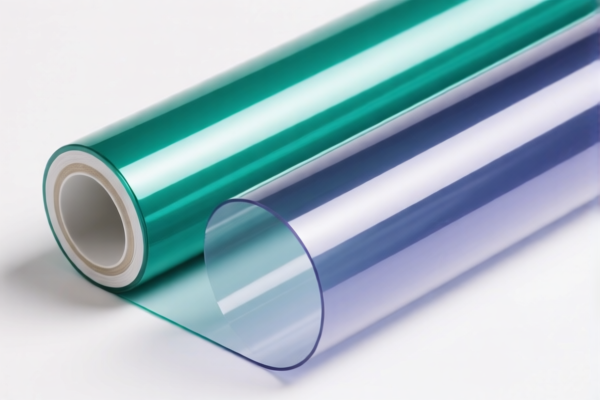

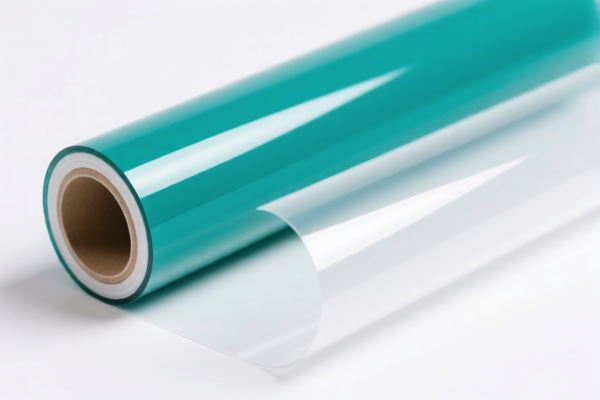

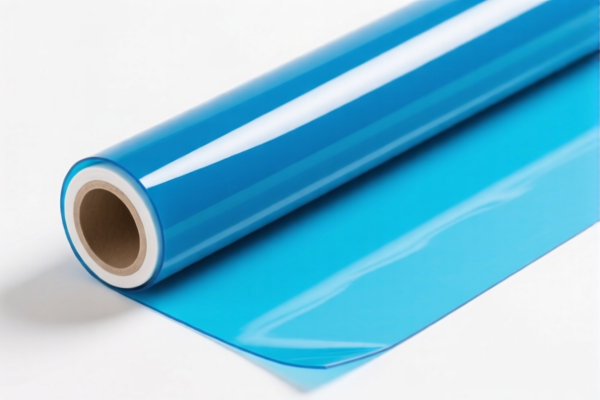

HS Code Classification & Customs Guide for Your Declared Goods: WINDOW SELF ADHESIVE FILM

Here's a breakdown of the HS codes provided for your "WINDOW SELF ADHESIVE FILM" declaration, along with relevant customs information. This guide aims to help you understand the classification, potential tax implications, and important considerations for smooth customs clearance.

Important Note: The correct HS code is crucial for accurate duty assessment and compliance. The following analysis is based on the descriptions you've provided. Final determination rests with customs officials.

1. HS Code: 3919.90.50.60 – Self-adhesive Plates, Sheets, Film, Foil, Tape, Strip and other flat shapes, of plastics.

- Chapter 39: Plastics and articles thereof. This chapter covers a wide range of plastic products.

- 3919: Plates, sheets, film, foil, tape, strip and other flat shapes of plastics. This narrows down the category to flat plastic products.

- 3919.90: Other plates, sheets, film, foil, tape, strip and other flat shapes of plastics. This indicates the product isn't specifically covered in earlier subheadings.

- 3919.90.50: Other. Further specifies the product within the "other" category.

- 3919.90.50.60: Other. This is a very broad subheading, often used for miscellaneous plastic film products.

Tax Implications:

- Basic Duty: 5.8%

- Additional Tariff: 25.0% (until April 2, 2025)

- Additional Tariff (after April 2, 2025): 30.0%

- Total Tax: 60.8%

Key Considerations:

- Plastic Composition: The exact type of plastic used is important. Different plastic types could potentially fall under different HS codes.

- Adhesive Type: The type of adhesive used should be verified.

- Application: While declared as "window film," the specific intended use (e.g., privacy, UV protection, safety) doesn't directly affect this HS code, but may be relevant for other regulations.

- Single Layer or Multi-Layer: The construction of the film (single layer vs. multiple layers) should be confirmed.

2. HS Code: 7007.19.00.00 – Safety glass, consisting of toughened (tempered) or laminated glass.

- Chapter 70: Glass and glass articles. This chapter covers all types of glass products.

- 7007: Safety glass, consisting of toughened (tempered) or laminated glass. This specifically targets glass designed for safety applications.

- 7007.19: Other safety glass. This indicates the product isn't specifically covered in earlier subheadings within safety glass.

- 7007.19.00.00: Other. This is a broad category for miscellaneous safety glass products.

Tax Implications:

- Basic Duty: 5.0%

- Additional Tariff: 25.0% (until April 2, 2025)

- Additional Tariff (after April 2, 2025): 30.0%

- Total Tax: 60.0%

Key Considerations:

- Tempered vs. Laminated: Confirm whether the glass is tempered (heat-treated for strength) or laminated (multiple layers bonded together). This is crucial for correct classification.

- Thickness: The thickness of the glass is a relevant factor.

- Intended Use: The specific application of the safety glass (e.g., automotive, building, furniture) may be relevant for other regulations.

- Certification: Safety glass often requires specific certifications (e.g., ANSI Z97.1 for tempered glass) depending on the intended market and application. Please verify required certifications for your destination country.

3. HS Code: 4814.90.02.00 – Wallpaper and similar wallcoverings; window transparencies of paper.

- Chapter 48: Manufacture of paper and paper articles. This chapter covers products made from paper.

- 4814: Wallpaper and similar wallcoverings; window transparencies of paper. This specifically targets paper-based wallcoverings and window coverings.

- 4814.90: Other. This indicates the product isn't specifically covered in earlier subheadings.

- 4814.90.02.00: Other. This is a broad category for miscellaneous paper-based wallcoverings and window coverings.

Tax Implications:

- Basic Duty: 0.0%

- Additional Tariff: 7.5% (until April 2, 2025)

- Additional Tariff (after April 2, 2025): 30.0%

- Total Tax: 37.5%

Key Considerations:

- Paper Composition: Confirm the type of paper used (e.g., kraft paper, coated paper).

- Coating/Treatment: Any coatings or treatments applied to the paper (e.g., adhesive, UV protection) should be verified.

- Adhesive Type: The type of adhesive used is relevant.

- Thickness: The thickness of the paper is a relevant factor.

Recommendations:

- Material Verification: Carefully verify the primary material composition of your "WINDOW SELF ADHESIVE FILM." Is it primarily plastic, glass, or paper? This is the most important factor in determining the correct HS code.

- Single Declaration vs. Multiple Declarations: If your product contains multiple materials (e.g., a plastic film with a paper backing), you may need to declare it as separate components under different HS codes.

- Supplier Documentation: Obtain detailed specifications and material composition information from your supplier.

- Customs Consultation: Consider consulting with a customs broker or specialist in your destination country. They can provide tailored advice based on your specific product and import regulations.

- Pricing Accuracy: Ensure the declared unit price is accurate, as it may be subject to scrutiny by customs officials.

- 2025 Tariff Changes: Be aware of the additional tariff changes scheduled for April 2, 2025, and factor them into your cost calculations.

Disclaimer: This information is for general guidance only and does not constitute professional customs advice. Customs regulations are complex and subject to change. It is your responsibility to ensure compliance with all applicable laws and regulations.

Customer Reviews

No reviews yet.