| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5212156030 | Doc | 62.8% | CN | US | 2025-05-12 |

| 5311003020 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5311003070 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5407912030 | Doc | 69.9% | CN | US | 2025-05-12 |

| 5407932030 | Doc | 67.0% | CN | US | 2025-05-12 |

| 5408312030 | Doc | 69.9% | CN | US | 2025-05-12 |

| 5408349030 | Doc | 67.0% | CN | US | 2025-05-12 |

| 5512910090 | Doc | 69.9% | CN | US | 2025-05-12 |

| 5515190020 | Doc | 67.0% | CN | US | 2025-05-12 |

| 6303120010 | Doc | 48.8% | CN | US | 2025-05-12 |

| 6303922030 | Doc | 48.8% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 4421913000 | Doc | 40.7% | CN | US | 2025-05-12 |

| 4421993000 | Doc | 48.2% | CN | US | 2025-05-12 |

| 4602900000 | Doc | 58.5% | CN | US | 2025-05-12 |

| 7326908688 | Doc | 82.9% | CN | US | 2025-05-12 |

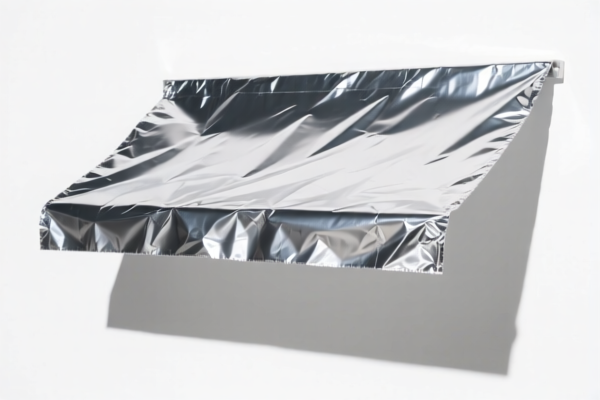

Okay, let's break down these HS codes for your "WINDOW SHADE" declarations. I'll provide a structured analysis, focusing on the key classifications and potential implications.

Understanding HS Codes: A Quick Primer

HS codes (Harmonized System codes) are internationally standardized codes used to classify traded products. The first 6 digits are generally consistent worldwide, while additional digits can vary by country. Here's how they generally work:

- Chapter (First 2 digits): Broad category of goods (e.g., 52 = Cotton, 63 = Textiles).

- Heading (Next 4 digits): More specific classification within the chapter.

- Subheading (Next 2 digits): Even more detailed classification.

- Further subdivisions: Country-specific details.

Analysis of Your HS Codes

I'll group these codes based on the material and likely intended use, and highlight key considerations. I'll also point out the impact of the upcoming tariff changes (April 2, 2025).

1. Cotton Woven Fabrics (Chapter 52)

- 5212.15.60.30: Other woven fabrics of cotton: Weighing not more than 200 g/m²: Printed: Other Other: Sheeting. This is specifically for printed cotton sheeting fabric.

- Tax: 62.8% (Base 7.8% + Additional 25% + 2025.4.2 Additional 30%)

- Note: Ensure the weight is accurately verified as being under 200 g/m².

2. Vegetable Fiber Woven Fabrics (Chapter 53)

- 5311.00.30.20: Woven fabrics of other vegetable textile fibers; woven fabrics of paper yarn: Of vegetable textile fibers: Other: Containing cotton and man-made fibers Subject to cotton restraints: Other. This code is for fabrics containing both cotton and man-made fibers.

- Tax: 55.0% (Base 0.0% + Additional 25% + 2025.4.2 Additional 30%)

- 5311.00.30.70: Woven fabrics of other vegetable textile fibers; woven fabrics of paper yarn: Of vegetable textile fibers: Other: Containing cotton and man-made fibers Subject to man-made fiber restraints: Other. Similar to the above, but potentially subject to different import restrictions.

- Tax: 55.0% (Base 0.0% + Additional 25% + 2025.4.2 Additional 30%)

- Note: The distinction between ".20" and ".70" is important. Confirm which restraint applies to your specific fabric composition.

3. Synthetic Filament Yarn Woven Fabrics (Chapter 54)

- 5407.91.20.30: Woven fabrics of synthetic filament yarn, including woven fabrics obtained from materials of heading 5404: Other woven fabrics: Unbleached or bleached: Other Other: Sheeting. For unbleached or bleached synthetic filament sheeting.

- Tax: 69.9% (Base 14.9% + Additional 25% + 2025.4.2 Additional 30%)

- 5407.93.20.30: Woven fabrics of synthetic filament yarn, including woven fabrics obtained from materials of heading 5404: Other woven fabrics: Of yarns of different colors: Other: Other Other: Sheeting. For sheeting made from yarns of different colors.

- Tax: 67.0% (Base 12.0% + Additional 25% + 2025.4.2 Additional 30%)

- 5408.31.20.30: Woven fabrics of artificial filament yarn, including woven fabrics obtained from materials of heading 5405: Other woven fabrics: Unbleached or bleached: Other Other: Sheeting. For unbleached or bleached artificial filament sheeting.

- Tax: 69.9% (Base 14.9% + Additional 25% + 2025.4.2 Additional 30%)

- 5408.34.90.30: Woven fabrics of artificial filament yarn, including woven fabrics obtained from materials of heading 5405: Other woven fabrics: Printed: Other: Other Other: Sheeting. For printed artificial filament sheeting.

- Tax: 67.0% (Base 12.0% + Additional 25% + 2025.4.2 Additional 30%)

4. Synthetic Staple Fiber Woven Fabrics (Chapter 55)

- 5512.91.00.90: Woven fabrics of synthetic staple fibers, containing 85 percent or more by weight of synthetic staple fibers: Other Other: Other.

- Tax: 69.9% (Base 14.9% + Additional 25% + 2025.4.2 Additional 30%)

- 5515.19.00.20: Other woven fabrics of synthetic staple fibers: Of polyester staple fibers: Other Other: Sheeting.

- Tax: 67.0% (Base 12.0% + Additional 25% + 2025.4.2 Additional 30%)

5. Curtains & Blinds (Chapter 63)

- 6303.12.00.10: Curtains (including drapes) and interior blinds; curtain or bed valances: Knitted or crocheted: Of synthetic fibers Window shades and window blinds. This is specifically for knitted or crocheted window shades/blinds made of synthetic fibers.

- Tax: 48.8% (Base 11.3% + Additional 7.5% + 2025.4.2 Additional 30%)

- 6303.92.20.30: Curtains (including drapes) and interior blinds; curtain or bed valances: Other: Of synthetic fibers: Other Other: Window shades and window blinds. For non-knitted/crocheted window shades/blinds made of synthetic fibers.

- Tax: 48.8% (Base 11.3% + Additional 7.5% + 2025.4.2 Additional 30%)

6. Other Materials (Chapters 39, 44, 46, 73)

- 3926.90.99.89: Other articles of plastics and articles of other materials of headings 3901 to 3914: Other: Other Other.

- Tax: 42.8% (Base 5.3% + Additional 7.5% + 2025.4.2 Additional 30%)

- 4421.91.30.00: Other articles of wood: Other: Of bamboo: Wood blinds, shutters, screens and shades, all the foregoing with or without their hardware: Consisting of wooden frames in the center of which are fixed louver boards or slats, with or without their hardware.

- Tax: 40.7% (Base 10.7% + Additional 0.0% + 2025.4.2 Additional 30%)

- 4421.99.30.00: Other articles of wood: Other: Other: Wood blinds, shutters, screens and shades, all the foregoing with or without their hardware: Consisting of wooden frames in the center of which are fixed louver boards or slats, with or without their hardware.

- Tax: 48.2% (Base 10.7% + Additional 7.5% + 2025.4.2 Additional 30%)

- 4602.90.00.00: Basketwork, wickerwork and other articles, made directly to shape from plaiting materials or made up from articles of heading 4601; articles of loofah: Other.

- Tax: 58.5% (Base 3.5% + Additional 25% + 2025.4.2 Additional 30%)

- 7326.90.86.88: Other articles of iron or steel: Other: Other: Other Other.

- Tax: 82.9% (Base 2.9% + Additional 25% + 2025.4.2 Additional 30%)

Important Considerations & Recommendations:

- Material Composition: Crucially, verify the exact material composition of each product. Even small differences can change the HS code.

- Weight Verification: For cotton fabrics, confirm the weight is under 200 g/m².

- Yarn Type: For synthetic fabrics, confirm whether they are filament or staple yarn.

- Construction Method: For curtains/blinds, confirm whether they are knitted/crocheted or woven/other.

- Hardware: The presence or absence of hardware can affect the HS code.

- 2025 Tariff Changes: Be aware of the significant tariff increases coming into effect on April 2, 2025. Factor these into your cost calculations.

- Certifications: Depending on the destination country, you may need certifications (e.g., origin certificates, safety standards).

- Local Regulations: Always check the specific import regulations of the country you are importing into.

Disclaimer: I am an AI assistant and cannot provide definitive customs advice. This information is for general guidance only. It is essential to consult with a qualified customs broker or import specialist for accurate classification and compliance.

Customer Reviews

This page made it easy to understand the HS code and tariff for plastic doors. Highly recommend it for exporters.

The details on export tariffs were good, but I wish there was more info on how to apply for duty exemptions.

The way the information is structured is very helpful. I found the section on plastic builder’s doors particularly useful.

The page had all the necessary info on HS codes and trade regulations. It’s a good resource for anyone exporting plastic products.

I really appreciated the specific details about the 5% tariff rate. It saved me time and confusion when preparing my shipment.