| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4412312610 | Doc | 63.0% | CN | US | 2025-05-12 |

| 4412913120 | Doc | 63.0% | CN | US | 2025-05-12 |

| 4408900145 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4408900187 | Doc | 55.0% | CN | US | 2025-05-12 |

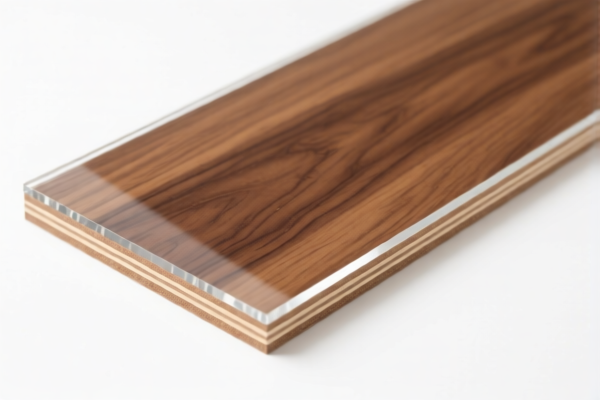

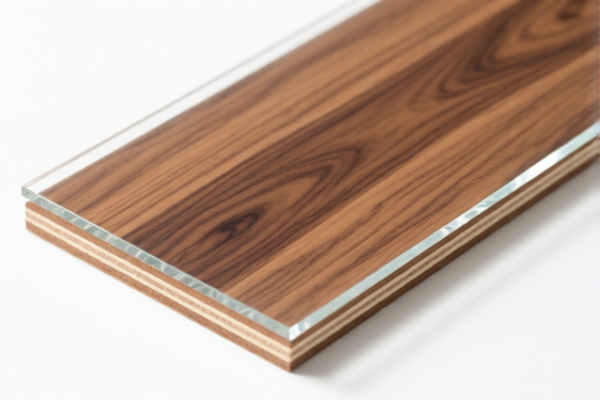

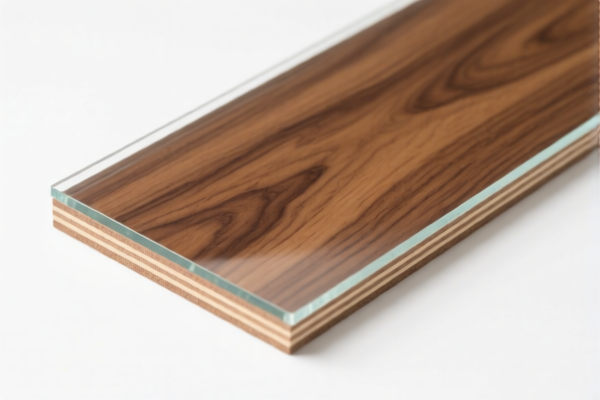

Customs Classification and Tariff Analysis for Walnut Veneer Plywood (Transparent Coating)

Below is a structured breakdown of the HS codes and associated tariffs for the walnut veneer plywood (transparent coating) based on your provided product descriptions.

1. HS Code: 4412.31.26.10

Product Description:

- Plywood, veneered panels, and similar laminated wood

- Other plywood consisting solely of sheets of wood (other than bamboo)

- With at least one outer ply of tropical wood

- Not surface covered, or surface covered with a clear or transparent material that does not obscure the grain, texture, or markings of the face ply

- With a face ply of Spanish cedar (Cedrela spp.) or walnut (Juglans spp.)

- With a face ply of Spanish cedar (Cedrela spp.)

Tariff Details:

- Base Tariff Rate: 8.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 63.0%

Key Notes: - This code applies specifically to Spanish cedar-faced plywood, not walnut. - If the product is walnut-faced, this code may not be applicable.

2. HS Code: 4412.91.31.20

Product Description:

- Plywood, veneered panels, and similar laminated wood

- Other

- With at least one outer ply of tropical wood

- Other

- Plywood

- Not surface covered, or surface covered with a clear or transparent material that does not obscure the grain, texture, or markings of the face ply

- Other with a face ply of walnut (Juglans spp.)

Tariff Details:

- Base Tariff Rate: 8.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 63.0%

Key Notes: - This is the correct code for walnut-faced plywood with a transparent coating. - Ensure the face ply is clearly walnut (Juglans spp.) and not another tropical wood. - The transparent coating must not obscure the grain or texture of the face ply.

3. HS Code: 4408.90.01.45

Product Description:

- Sheets for veneering (including those obtained by slicing laminated wood), for plywood or similar laminated wood and other wood

- Sawn lengthwise, sliced or peeled, whether or not planed, sanded, spliced or end-jointed

- Thickness not exceeding 6 mm

- Other spliced or end-jointed

- Walnut (Juglans spp.)

Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 55.0%

Key Notes: - This code applies to veneer sheets (not finished plywood), specifically spliced or end-jointed walnut veneer. - If the product is finished plywood, this code is not applicable.

4. HS Code: 4408.90.01.87

Product Description:

- Sheets for veneering (including those obtained by slicing laminated wood), for plywood or similar laminated wood and other wood

- Sawn lengthwise, sliced or peeled, whether or not planed, sanded, spliced or end-jointed

- Thickness not exceeding 6 mm

- Other other

- Walnut (Juglans spp.)

Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 55.0%

Key Notes: - This code applies to veneer sheets (not finished plywood), not spliced or end-jointed. - Again, this is for veneer sheets, not finished products like plywood.

✅ Proactive Advice for Importers:

- Verify the product type: Is it veneer sheets or finished plywood? This determines the correct HS code.

- Confirm the face ply material: Ensure it is walnut (Juglans spp.) and not another tropical wood.

- Check the coating: The transparent coating must not obscure the grain or texture of the face ply.

- Review the thickness: If the product is veneer sheets, ensure the thickness is ≤6 mm.

- Check for splicing or end-jointing: This affects whether 4408.90.01.45 or 4408.90.01.87 applies.

- Be aware of the April 11, 2025, tariff increase: This will increase the total tariff by 5% for all applicable codes.

- Check for certifications: Some countries may require wood product certifications (e.g., FSC, CITES, etc.) for tropical wood.

📌 Summary of Tax Rates (April 11, 2025, onwards):

| HS Code | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tariff |

|---|---|---|---|---|

| 4412.31.26.10 | 8.0% | 25.0% | 30.0% | 63.0% |

| 4412.91.31.20 | 8.0% | 25.0% | 30.0% | 63.0% |

| 4408.90.01.45 | 0.0% | 25.0% | 30.0% | 55.0% |

| 4408.90.01.87 | 0.0% | 25.0% | 30.0% | 55.0% |

Let me know if you need help with certification requirements or customs documentation for these products.

Customs Classification and Tariff Analysis for Walnut Veneer Plywood (Transparent Coating)

Below is a structured breakdown of the HS codes and associated tariffs for the walnut veneer plywood (transparent coating) based on your provided product descriptions.

1. HS Code: 4412.31.26.10

Product Description:

- Plywood, veneered panels, and similar laminated wood

- Other plywood consisting solely of sheets of wood (other than bamboo)

- With at least one outer ply of tropical wood

- Not surface covered, or surface covered with a clear or transparent material that does not obscure the grain, texture, or markings of the face ply

- With a face ply of Spanish cedar (Cedrela spp.) or walnut (Juglans spp.)

- With a face ply of Spanish cedar (Cedrela spp.)

Tariff Details:

- Base Tariff Rate: 8.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 63.0%

Key Notes: - This code applies specifically to Spanish cedar-faced plywood, not walnut. - If the product is walnut-faced, this code may not be applicable.

2. HS Code: 4412.91.31.20

Product Description:

- Plywood, veneered panels, and similar laminated wood

- Other

- With at least one outer ply of tropical wood

- Other

- Plywood

- Not surface covered, or surface covered with a clear or transparent material that does not obscure the grain, texture, or markings of the face ply

- Other with a face ply of walnut (Juglans spp.)

Tariff Details:

- Base Tariff Rate: 8.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 63.0%

Key Notes: - This is the correct code for walnut-faced plywood with a transparent coating. - Ensure the face ply is clearly walnut (Juglans spp.) and not another tropical wood. - The transparent coating must not obscure the grain or texture of the face ply.

3. HS Code: 4408.90.01.45

Product Description:

- Sheets for veneering (including those obtained by slicing laminated wood), for plywood or similar laminated wood and other wood

- Sawn lengthwise, sliced or peeled, whether or not planed, sanded, spliced or end-jointed

- Thickness not exceeding 6 mm

- Other spliced or end-jointed

- Walnut (Juglans spp.)

Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 55.0%

Key Notes: - This code applies to veneer sheets (not finished plywood), specifically spliced or end-jointed walnut veneer. - If the product is finished plywood, this code is not applicable.

4. HS Code: 4408.90.01.87

Product Description:

- Sheets for veneering (including those obtained by slicing laminated wood), for plywood or similar laminated wood and other wood

- Sawn lengthwise, sliced or peeled, whether or not planed, sanded, spliced or end-jointed

- Thickness not exceeding 6 mm

- Other other

- Walnut (Juglans spp.)

Tariff Details:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tariff: 55.0%

Key Notes: - This code applies to veneer sheets (not finished plywood), not spliced or end-jointed. - Again, this is for veneer sheets, not finished products like plywood.

✅ Proactive Advice for Importers:

- Verify the product type: Is it veneer sheets or finished plywood? This determines the correct HS code.

- Confirm the face ply material: Ensure it is walnut (Juglans spp.) and not another tropical wood.

- Check the coating: The transparent coating must not obscure the grain or texture of the face ply.

- Review the thickness: If the product is veneer sheets, ensure the thickness is ≤6 mm.

- Check for splicing or end-jointing: This affects whether 4408.90.01.45 or 4408.90.01.87 applies.

- Be aware of the April 11, 2025, tariff increase: This will increase the total tariff by 5% for all applicable codes.

- Check for certifications: Some countries may require wood product certifications (e.g., FSC, CITES, etc.) for tropical wood.

📌 Summary of Tax Rates (April 11, 2025, onwards):

| HS Code | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.11) | Total Tariff |

|---|---|---|---|---|

| 4412.31.26.10 | 8.0% | 25.0% | 30.0% | 63.0% |

| 4412.91.31.20 | 8.0% | 25.0% | 30.0% | 63.0% |

| 4408.90.01.45 | 0.0% | 25.0% | 30.0% | 55.0% |

| 4408.90.01.87 | 0.0% | 25.0% | 30.0% | 55.0% |

Let me know if you need help with certification requirements or customs documentation for these products.

Customer Reviews

No reviews yet.