| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3903190000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3905300000 | Doc | 58.2% | CN | US | 2025-05-12 |

| 3909400000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907995050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3905998000 | Doc | 60.3% | CN | US | 2025-05-12 |

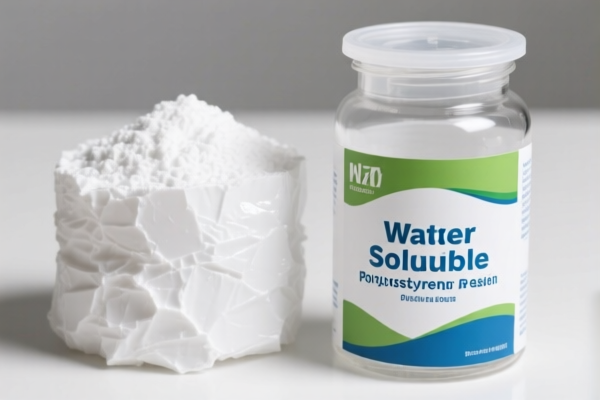

Product Name: Water Soluble Polystyrene Resin

Classification Task: HS Code Determination and Tariff Analysis

✅ HS Code Classification Options:

- HS CODE: 3903190000

- Description: Modified polystyrene resin, which is a primary form of styrene polymer.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is most suitable if the product is a modified form of polystyrene.

-

HS CODE: 3905300000

- Description: Water-soluble polyvinyl alcohol (PVA), a primary form of vinyl polymer.

- Total Tax Rate: 58.2%

- Tax Breakdown:

- Base Tariff: 3.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to water-soluble PVA, not polystyrene.

-

HS CODE: 3909400000

- Description: Water-soluble phenolic resin, which falls under the category of amino resins, phenolic resins, and polyurethanes in their primary form.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for phenolic resins, not polystyrene.

-

HS CODE: 3907995050

- Description: Polyester resin solution, which falls under the category of other polyesters in their primary form.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for polyester resins, not polystyrene.

-

HS CODE: 3905998000

- Description: Water-based polyvinyl alcohol resin, which is a primary form of vinyl polymer.

- Total Tax Rate: 60.3%

- Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for water-based PVA, not polystyrene.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-Dumping Duties Mentioned: No specific anti-dumping duties for iron or aluminum are applicable to this product.

- Material Verification Required: Confirm the exact chemical composition and form of the product (e.g., modified, water-soluble, etc.) to ensure correct HS code classification.

- Certifications: Check if any customs certifications or product compliance documents are required for import.

📌 Proactive Advice:

- Verify the product's chemical structure and physical form (e.g., modified, water-soluble, etc.) to ensure accurate HS code selection.

- Review the unit price and total tax impact before finalizing the classification.

- Consult with customs brokers or legal advisors if the product is borderline between categories or if there are uncertainties in classification.

Let me know if you need help with HS code selection based on a specific product specification.

Product Name: Water Soluble Polystyrene Resin

Classification Task: HS Code Determination and Tariff Analysis

✅ HS Code Classification Options:

- HS CODE: 3903190000

- Description: Modified polystyrene resin, which is a primary form of styrene polymer.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is most suitable if the product is a modified form of polystyrene.

-

HS CODE: 3905300000

- Description: Water-soluble polyvinyl alcohol (PVA), a primary form of vinyl polymer.

- Total Tax Rate: 58.2%

- Tax Breakdown:

- Base Tariff: 3.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code applies to water-soluble PVA, not polystyrene.

-

HS CODE: 3909400000

- Description: Water-soluble phenolic resin, which falls under the category of amino resins, phenolic resins, and polyurethanes in their primary form.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for phenolic resins, not polystyrene.

-

HS CODE: 3907995050

- Description: Polyester resin solution, which falls under the category of other polyesters in their primary form.

- Total Tax Rate: 61.5%

- Tax Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Note: This code is for polyester resins, not polystyrene.

-

HS CODE: 3905998000

- Description: Water-based polyvinyl alcohol resin, which is a primary form of vinyl polymer.

- Total Tax Rate: 60.3%

- Tax Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for water-based PVA, not polystyrene.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: A 30% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-Dumping Duties Mentioned: No specific anti-dumping duties for iron or aluminum are applicable to this product.

- Material Verification Required: Confirm the exact chemical composition and form of the product (e.g., modified, water-soluble, etc.) to ensure correct HS code classification.

- Certifications: Check if any customs certifications or product compliance documents are required for import.

📌 Proactive Advice:

- Verify the product's chemical structure and physical form (e.g., modified, water-soluble, etc.) to ensure accurate HS code selection.

- Review the unit price and total tax impact before finalizing the classification.

- Consult with customs brokers or legal advisors if the product is borderline between categories or if there are uncertainties in classification.

Let me know if you need help with HS code selection based on a specific product specification.

Customer Reviews

No reviews yet.