Found 6 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4807009400 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 4412525100 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4412524100 | Doc | 63.0% | CN | US | 2025-05-12 |

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 4811413000 | Doc | 55.0% | CN | US | 2025-05-12 |

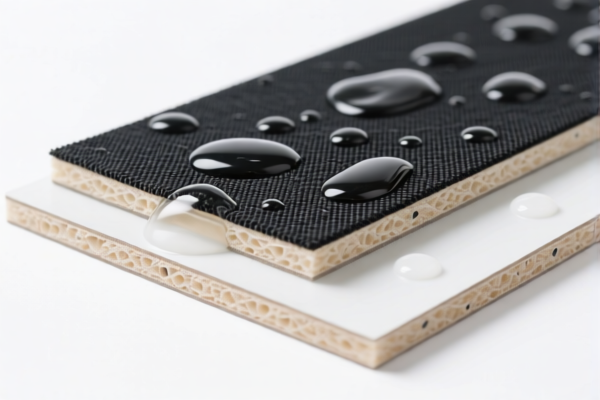

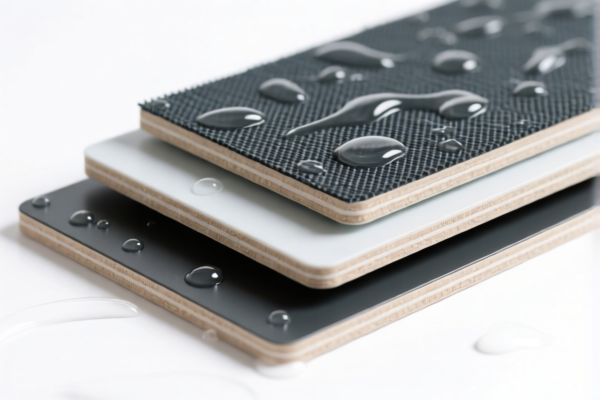

Here is the structured analysis and classification for Waterproof Composite Boards based on the provided HS codes and tariff details:

📦 Product Classification Overview: Waterproof Composite Boards

Below are the HS codes and associated tariff details for various types of waterproof composite boards:

🔢 HS Code 4807009400 – Waterproof Composite Paper Sheets, Waterproof Composite Paper Rolls

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Notes: This classification is for paper-based composite products used in waterproofing applications.

🔢 HS Code 3921904010 – Waterproof Paper-Plastic Composite Board

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

- Notes: This is a plastic-paper composite board with waterproof properties.

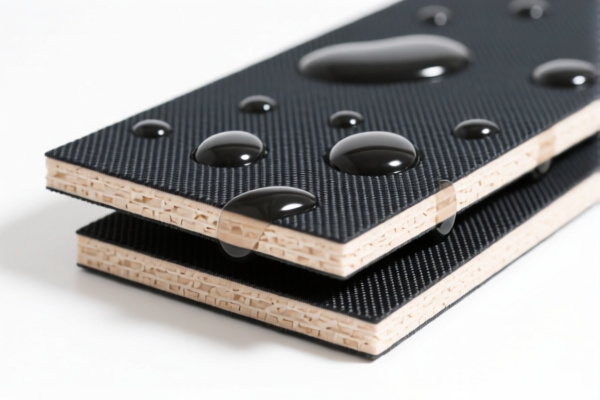

🔢 HS Code 4412525100 – Waterproof Plywood

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Notes: This is a type of waterproof plywood, likely made from wood veneers.

🔢 HS Code 4412524100 – Waterproof Plywood

- Base Tariff Rate: 8.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 63.0%

- Notes: Similar to the above, but with a higher base tariff rate, possibly due to material or origin differences.

🔢 HS Code 3921131500 – Waterproof Polyurethane Textile Composite Board

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Notes: This is a composite board combining polyurethane and textile materials for waterproofing.

🔢 HS Code 4811413000 – Waterproof Paperboard

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Notes: This is a type of thick paperboard used for waterproofing applications.

⚠️ Important Notes and Recommendations:

- April 11 Special Tariff: A 30% additional tariff will apply to all the above products after April 11, 2025. Ensure your import timeline is aligned with this policy.

- Anti-Dumping Duties: If the product contains iron or aluminum, check for any applicable anti-dumping duties, which may vary by country and product type.

- Material Verification: Confirm the exact composition of the waterproof composite board (e.g., paper, plastic, wood, textile) to ensure correct HS code classification.

- Certifications: Some products may require customs certifications or technical documentation (e.g., material safety data sheets, product standards).

- Unit Price: Be aware that tariff rates are often based on unit price, so ensure accurate pricing is used for customs valuation.

✅ Proactive Advice:

- Double-check the product composition and intended use to ensure the correct HS code is applied.

- Consult with customs brokers or trade compliance experts if the product is complex or involves multiple materials.

- Monitor policy updates after April 11, 2025, as the 30% additional tariff may affect your cost structure.

Let me know if you need help with HS code selection or tariff calculation for a specific product. Here is the structured analysis and classification for Waterproof Composite Boards based on the provided HS codes and tariff details:

📦 Product Classification Overview: Waterproof Composite Boards

Below are the HS codes and associated tariff details for various types of waterproof composite boards:

🔢 HS Code 4807009400 – Waterproof Composite Paper Sheets, Waterproof Composite Paper Rolls

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Notes: This classification is for paper-based composite products used in waterproofing applications.

🔢 HS Code 3921904010 – Waterproof Paper-Plastic Composite Board

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 34.2%

- Notes: This is a plastic-paper composite board with waterproof properties.

🔢 HS Code 4412525100 – Waterproof Plywood

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Notes: This is a type of waterproof plywood, likely made from wood veneers.

🔢 HS Code 4412524100 – Waterproof Plywood

- Base Tariff Rate: 8.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 63.0%

- Notes: Similar to the above, but with a higher base tariff rate, possibly due to material or origin differences.

🔢 HS Code 3921131500 – Waterproof Polyurethane Textile Composite Board

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Notes: This is a composite board combining polyurethane and textile materials for waterproofing.

🔢 HS Code 4811413000 – Waterproof Paperboard

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

- Notes: This is a type of thick paperboard used for waterproofing applications.

⚠️ Important Notes and Recommendations:

- April 11 Special Tariff: A 30% additional tariff will apply to all the above products after April 11, 2025. Ensure your import timeline is aligned with this policy.

- Anti-Dumping Duties: If the product contains iron or aluminum, check for any applicable anti-dumping duties, which may vary by country and product type.

- Material Verification: Confirm the exact composition of the waterproof composite board (e.g., paper, plastic, wood, textile) to ensure correct HS code classification.

- Certifications: Some products may require customs certifications or technical documentation (e.g., material safety data sheets, product standards).

- Unit Price: Be aware that tariff rates are often based on unit price, so ensure accurate pricing is used for customs valuation.

✅ Proactive Advice:

- Double-check the product composition and intended use to ensure the correct HS code is applied.

- Consult with customs brokers or trade compliance experts if the product is complex or involves multiple materials.

- Monitor policy updates after April 11, 2025, as the 30% additional tariff may affect your cost structure.

Let me know if you need help with HS code selection or tariff calculation for a specific product.

Customer Reviews

No reviews yet.