| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918103250 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3918103150 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918103150 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918103150 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3918103150 | Doc | 59.2% | CN | US | 2025-05-12 |

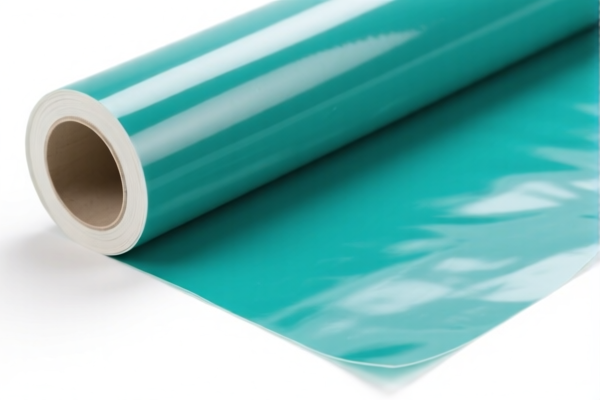

Product Classification and Customs Tariff Analysis for "Wear Resistant PVC Wall Covering Film (Synthetic Fiber Backing)"

HS CODE: 3918.10.31.50

Product Description:

- PVC wall covering film with synthetic fiber backing (e.g., textile fiber backing, >70% plastic content)

Tariff Breakdown (as of current regulations):

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tax Rate: 59.2%

Key Notes and Alerts:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost. -

No Anti-Dumping Duties Mentioned:

As of now, there are no specific anti-dumping duties reported for this product category (iron or aluminum-related).

Proactive Advice for Importers:

-

Verify Material Composition:

Ensure the product contains more than 70% plastic and has a synthetic fiber backing (e.g., textile fiber), as this is a key criterion for classification under HS 3918.10.31.50. -

Check Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., safety, environmental compliance) are required for import into the destination country. -

Monitor Tariff Updates:

Stay informed about tariff changes after April 11, 2025, as this could significantly impact your import costs. -

Consider Alternative HS Codes:

If your product has a different composition (e.g., less than 70% plastic or a different backing material), it may fall under a different HS code (e.g., 3918.10.32.50 for PVC wall film with synthetic fiber backing).

Comparison with Similar HS Code: 3918.10.32.50

- Product Description: PVC wall film with synthetic fiber backing (may have different specifications or uses)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff: 30.0%

- Total Tax Rate: 61.5%

Note: This code may apply if the product is classified under a slightly different category (e.g., different use or composition).

Conclusion:

For PVC wall covering film with synthetic fiber backing and >70% plastic content, the most appropriate HS code is 3918.10.31.50, with a total tax rate of 59.2%. However, be mindful of the 30.0% additional tariff after April 11, 2025, and ensure your product meets the classification criteria.

Product Classification and Customs Tariff Analysis for "Wear Resistant PVC Wall Covering Film (Synthetic Fiber Backing)"

HS CODE: 3918.10.31.50

Product Description:

- PVC wall covering film with synthetic fiber backing (e.g., textile fiber backing, >70% plastic content)

Tariff Breakdown (as of current regulations):

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tax Rate: 59.2%

Key Notes and Alerts:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on this product after April 11, 2025. This is a time-sensitive policy and may significantly increase the total import cost. -

No Anti-Dumping Duties Mentioned:

As of now, there are no specific anti-dumping duties reported for this product category (iron or aluminum-related).

Proactive Advice for Importers:

-

Verify Material Composition:

Ensure the product contains more than 70% plastic and has a synthetic fiber backing (e.g., textile fiber), as this is a key criterion for classification under HS 3918.10.31.50. -

Check Unit Price and Certification:

Confirm the unit price and whether any certifications (e.g., safety, environmental compliance) are required for import into the destination country. -

Monitor Tariff Updates:

Stay informed about tariff changes after April 11, 2025, as this could significantly impact your import costs. -

Consider Alternative HS Codes:

If your product has a different composition (e.g., less than 70% plastic or a different backing material), it may fall under a different HS code (e.g., 3918.10.32.50 for PVC wall film with synthetic fiber backing).

Comparison with Similar HS Code: 3918.10.32.50

- Product Description: PVC wall film with synthetic fiber backing (may have different specifications or uses)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff: 30.0%

- Total Tax Rate: 61.5%

Note: This code may apply if the product is classified under a slightly different category (e.g., different use or composition).

Conclusion:

For PVC wall covering film with synthetic fiber backing and >70% plastic content, the most appropriate HS code is 3918.10.31.50, with a total tax rate of 59.2%. However, be mindful of the 30.0% additional tariff after April 11, 2025, and ensure your product meets the classification criteria.

Customer Reviews

No reviews yet.