| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112192000 | Doc | 62.0% | CN | US | 2025-05-12 |

| 5112302000 | Doc | 62.0% | CN | US | 2025-05-12 |

| 5112301000 | Doc | 62.0% | CN | US | 2025-05-12 |

| 5112201000 | Doc | 62.0% | CN | US | 2025-05-12 |

| 5112302000 | Doc | 62.0% | CN | US | 2025-05-12 |

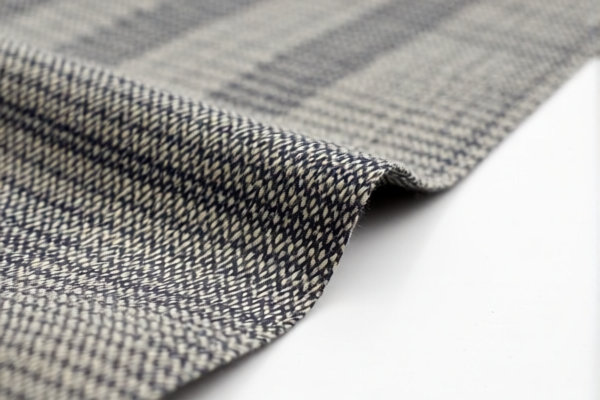

Here is the detailed classification and tariff information for the Wear resistant Woven Combed Wool Blend Staple Fiber Tapestry Fabric based on the provided HS codes and tax details:

✅ HS CODE: 5112192000

Product Description: 精梳羊毛编织耐磨挂毯 (Woven combed wool tapestry with wear resistance)

Total Tax Rate: 62.0%

Breakdown of Tariffs:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies to this product after April 11, 2025

✅ HS CODE: 5112302000

Product Description: 梳羊毛混纺挂毯面料 (Woven blended wool tapestry fabric)

Total Tax Rate: 62.0%

Breakdown of Tariffs:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies to this product after April 11, 2025

✅ HS CODE: 5112301000

Product Description: 精梳羊毛混纺高耐磨挂毯 (High wear-resistant woven combed wool blend tapestry)

Total Tax Rate: 62.0%

Breakdown of Tariffs:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies to this product after April 11, 2025

✅ HS CODE: 5112201000

Product Description: 精梳羊毛混纺挂毯面料 (Woven combed wool blend tapestry fabric)

Total Tax Rate: 62.0%

Breakdown of Tariffs:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies to this product after April 11, 2025

✅ HS CODE: 5112302000 (Duplicate Entry)

Product Description: 精梳羊毛混纺耐磨挂毯 (Woven combed wool blend wear-resistant tapestry)

Total Tax Rate: 62.0%

Breakdown of Tariffs:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies to this product after April 11, 2025

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the fabric is indeed a wool blend and not 100% wool or a different fiber blend, as this can affect the HS code.

- Check Unit Price: Tariff rates may vary based on the declared value and classification.

- Certifications Required: Confirm if any certifications (e.g., textile standards, origin documentation) are needed for customs clearance.

- Monitor April 11, 2025 Deadline: Be aware that the special tariff of 30% will apply after this date, which could significantly increase import costs.

- Consult a Customs Broker: For complex classifications or large shipments, it's advisable to seek professional customs compliance support.

Let me know if you need help with customs documentation or further classification details. Here is the detailed classification and tariff information for the Wear resistant Woven Combed Wool Blend Staple Fiber Tapestry Fabric based on the provided HS codes and tax details:

✅ HS CODE: 5112192000

Product Description: 精梳羊毛编织耐磨挂毯 (Woven combed wool tapestry with wear resistance)

Total Tax Rate: 62.0%

Breakdown of Tariffs:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies to this product after April 11, 2025

✅ HS CODE: 5112302000

Product Description: 梳羊毛混纺挂毯面料 (Woven blended wool tapestry fabric)

Total Tax Rate: 62.0%

Breakdown of Tariffs:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies to this product after April 11, 2025

✅ HS CODE: 5112301000

Product Description: 精梳羊毛混纺高耐磨挂毯 (High wear-resistant woven combed wool blend tapestry)

Total Tax Rate: 62.0%

Breakdown of Tariffs:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies to this product after April 11, 2025

✅ HS CODE: 5112201000

Product Description: 精梳羊毛混纺挂毯面料 (Woven combed wool blend tapestry fabric)

Total Tax Rate: 62.0%

Breakdown of Tariffs:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies to this product after April 11, 2025

✅ HS CODE: 5112302000 (Duplicate Entry)

Product Description: 精梳羊毛混纺耐磨挂毯 (Woven combed wool blend wear-resistant tapestry)

Total Tax Rate: 62.0%

Breakdown of Tariffs:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable

- April 11 Special Tariff: Applies to this product after April 11, 2025

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the fabric is indeed a wool blend and not 100% wool or a different fiber blend, as this can affect the HS code.

- Check Unit Price: Tariff rates may vary based on the declared value and classification.

- Certifications Required: Confirm if any certifications (e.g., textile standards, origin documentation) are needed for customs clearance.

- Monitor April 11, 2025 Deadline: Be aware that the special tariff of 30% will apply after this date, which could significantly increase import costs.

- Consult a Customs Broker: For complex classifications or large shipments, it's advisable to seek professional customs compliance support.

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.