| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3904100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3904100000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3917320010 | Doc | 58.1% | CN | US | 2025-05-12 |

| 3902900010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3902100000 | Doc | 61.5% | CN | US | 2025-05-12 |

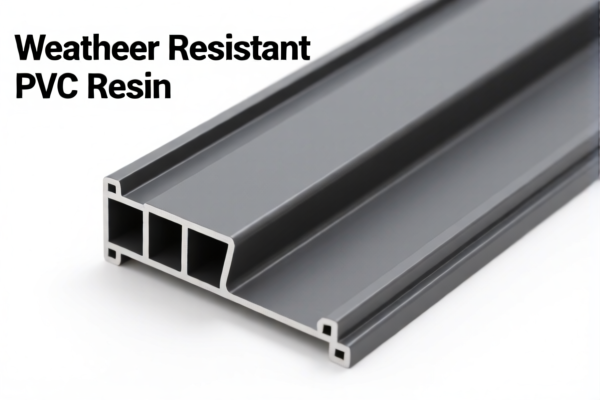

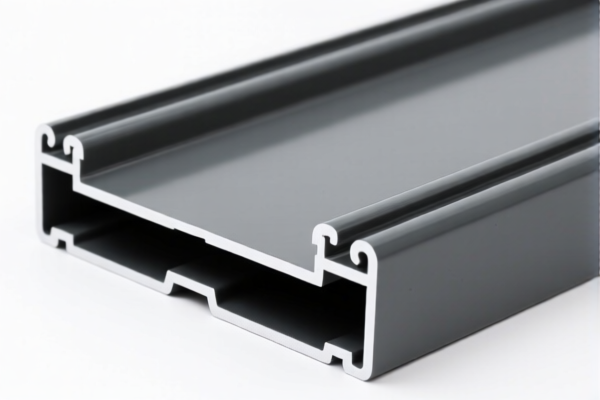

Product Classification and Customs Duty Analysis for Weather Resistant PVC Resin

Based on the provided HS codes and tax details, here is a structured breakdown of the customs duties and classification for the declared product: Weather Resistant PVC Resin.

🔍 HS CODE: 3904100000

Product Description: PVC Resin (Weather Resistant / Weather Resistant Grade)

Total Tax Rate: 61.5%

Breakdown of Tariffs:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is PVC resin, not metal-based)

Key Notes: - This HS code applies to PVC resins that are specifically weather-resistant, meaning they are designed to withstand outdoor conditions such as UV exposure, moisture, and temperature fluctuations. - The additional tariffs are part of broader trade policies and are not specific to this product. - The special tariff after April 11, 2025, is a time-sensitive policy and may be subject to change.

📌 Proactive Advice:

- Verify Material Specifications: Ensure the product is indeed PVC resin and not a composite or modified version that might fall under a different HS code.

- Check Unit Price and Certification: Confirm whether any additional certifications (e.g., environmental, safety, or performance standards) are required for import.

- Monitor Policy Updates: Stay informed about any changes in the April 11, 2025 special tariff, as it may affect your total import cost.

- Consider Alternative HS Codes: If the product is used in a finished product (e.g., PVC pipes), check if HS CODE 3917320010 (PVC Weather Resistant Pipe) might be more appropriate.

📊 Other Related HS Codes:

- HS CODE: 3917320010 – PVC Weather Resistant Pipe

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff (After April 11, 2025): 30.0%

-

Note: This code applies to finished products made from PVC resin, not the raw resin itself.

-

HS CODE: 3902900010 – Weather Resistant Polybutene Resin

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff (After April 11, 2025): 30.0%

-

Note: This is a different type of resin (polybutene), but it shares the same tariff structure as PVC resin.

-

HS CODE: 3902100000 – Weather Resistant Polypropylene Resin

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: This is another type of polymer resin, but it is taxed similarly to PVC resin.

✅ Summary of Key Actions:

- Confirm the exact chemical composition and intended use of the product to ensure correct HS code classification.

- Be aware of the April 11, 2025 special tariff and its potential impact on your import costs.

- If importing finished goods, consider the 3917320010 code for PVC pipes.

- Always verify with customs authorities or a qualified customs broker for the most up-to-date and accurate classification. Product Classification and Customs Duty Analysis for Weather Resistant PVC Resin

Based on the provided HS codes and tax details, here is a structured breakdown of the customs duties and classification for the declared product: Weather Resistant PVC Resin.

🔍 HS CODE: 3904100000

Product Description: PVC Resin (Weather Resistant / Weather Resistant Grade)

Total Tax Rate: 61.5%

Breakdown of Tariffs:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Anti-dumping duties on iron and aluminum: Not applicable (this product is PVC resin, not metal-based)

Key Notes: - This HS code applies to PVC resins that are specifically weather-resistant, meaning they are designed to withstand outdoor conditions such as UV exposure, moisture, and temperature fluctuations. - The additional tariffs are part of broader trade policies and are not specific to this product. - The special tariff after April 11, 2025, is a time-sensitive policy and may be subject to change.

📌 Proactive Advice:

- Verify Material Specifications: Ensure the product is indeed PVC resin and not a composite or modified version that might fall under a different HS code.

- Check Unit Price and Certification: Confirm whether any additional certifications (e.g., environmental, safety, or performance standards) are required for import.

- Monitor Policy Updates: Stay informed about any changes in the April 11, 2025 special tariff, as it may affect your total import cost.

- Consider Alternative HS Codes: If the product is used in a finished product (e.g., PVC pipes), check if HS CODE 3917320010 (PVC Weather Resistant Pipe) might be more appropriate.

📊 Other Related HS Codes:

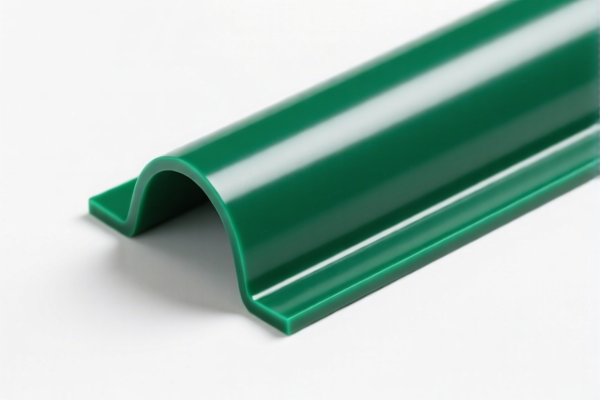

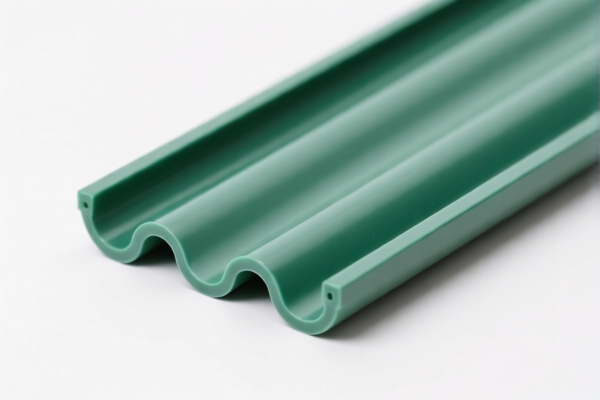

- HS CODE: 3917320010 – PVC Weather Resistant Pipe

- Total Tax Rate: 58.1%

- Breakdown:

- Base Tariff: 3.1%

- Additional Tariff: 25.0%

- Special Tariff (After April 11, 2025): 30.0%

-

Note: This code applies to finished products made from PVC resin, not the raw resin itself.

-

HS CODE: 3902900010 – Weather Resistant Polybutene Resin

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff (After April 11, 2025): 30.0%

-

Note: This is a different type of resin (polybutene), but it shares the same tariff structure as PVC resin.

-

HS CODE: 3902100000 – Weather Resistant Polypropylene Resin

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Note: This is another type of polymer resin, but it is taxed similarly to PVC resin.

✅ Summary of Key Actions:

- Confirm the exact chemical composition and intended use of the product to ensure correct HS code classification.

- Be aware of the April 11, 2025 special tariff and its potential impact on your import costs.

- If importing finished goods, consider the 3917320010 code for PVC pipes.

- Always verify with customs authorities or a qualified customs broker for the most up-to-date and accurate classification.

Customer Reviews

No reviews yet.