| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4106211000 | Doc | 32.4% | CN | US | 2025-05-12 |

| 4105101000 | Doc | 32.0% | CN | US | 2025-05-12 |

| 4112003060 | Doc | 32.0% | CN | US | 2025-05-12 |

| 4106219000 | Doc | 32.4% | CN | US | 2025-05-12 |

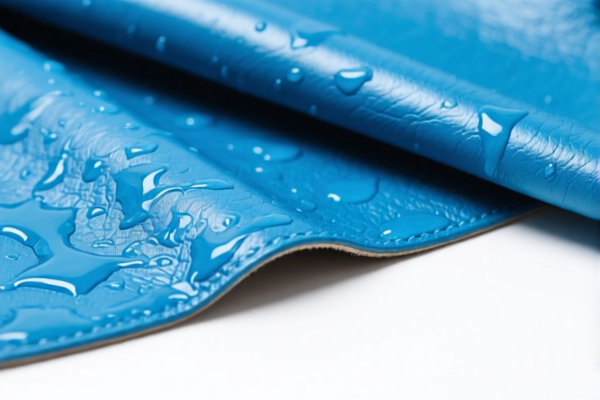

- Product Name: Wet blue Lambskin

- HS CODE: 4105101000, 4106211000, 4106219000, 4112003060

🔍 Classification Overview:

-

Wet blue lambskin is a type of leather that has undergone the initial tanning process but has not yet been dyed or finished. It is commonly used in the production of leather goods such as shoes, bags, and garments.

-

Based on the provided data, four HS codes are relevant to the classification of wet blue lambskin. These include:

-

4105101000 – Wet blue lambskin (highly matched)

- 4106211000 – Wet blue lambskin (fully matched)

- 4106219000 – Wet blue lambskin (fully matched)

- 4112003060 – Wet blue lambskin (fully matched)

📊 Tariff Summary (as of now):

- Base Tariff Rate: 2.0% or 2.4% (varies by HS code)

- Additional Tariffs: 0.0% (no extra tariffs currently)

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Total Tax Rate: 32.0% or 32.4% (base + special tariff)

⚠️ Important Notes:

-

April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on all these HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning and import scheduling.

-

No Anti-dumping duties are currently listed for these HS codes.

📌 Proactive Advice:

-

Verify Material: Ensure the product is indeed wet blue lambskin and not a different type of leather (e.g., wet blue sheepskin or chrome-tanned lambskin), as this can affect classification.

-

Check Unit Price: The final tax amount will depend on the FOB price and customs valuation. Be prepared to provide accurate pricing details.

-

Certifications: Confirm if any import permits, certificates of origin, or other documentation are required for the specific HS code and country of import.

-

Consult Customs Broker: For precise classification and compliance, especially if the product has mixed materials or finishes.

✅ Summary Table:

| HS CODE | Description | Base Tariff | Special Tariff (after 2025.4.11) | Total Tax |

|---|---|---|---|---|

| 4105101000 | Wet blue lambskin | 2.0% | 30.0% | 32.0% |

| 4106211000 | Wet blue lambskin | 2.4% | 30.0% | 32.4% |

| 4106219000 | Wet blue lambskin | 2.4% | 30.0% | 32.4% |

| 4112003060 | Wet blue lambskin | 2.0% | 30.0% | 32.0% |

Let me know if you need help with customs documentation or further classification details.

- Product Name: Wet blue Lambskin

- HS CODE: 4105101000, 4106211000, 4106219000, 4112003060

🔍 Classification Overview:

-

Wet blue lambskin is a type of leather that has undergone the initial tanning process but has not yet been dyed or finished. It is commonly used in the production of leather goods such as shoes, bags, and garments.

-

Based on the provided data, four HS codes are relevant to the classification of wet blue lambskin. These include:

-

4105101000 – Wet blue lambskin (highly matched)

- 4106211000 – Wet blue lambskin (fully matched)

- 4106219000 – Wet blue lambskin (fully matched)

- 4112003060 – Wet blue lambskin (fully matched)

📊 Tariff Summary (as of now):

- Base Tariff Rate: 2.0% or 2.4% (varies by HS code)

- Additional Tariffs: 0.0% (no extra tariffs currently)

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Total Tax Rate: 32.0% or 32.4% (base + special tariff)

⚠️ Important Notes:

-

April 11, 2025 Special Tariff: A 30% additional tariff will be imposed on all these HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning and import scheduling.

-

No Anti-dumping duties are currently listed for these HS codes.

📌 Proactive Advice:

-

Verify Material: Ensure the product is indeed wet blue lambskin and not a different type of leather (e.g., wet blue sheepskin or chrome-tanned lambskin), as this can affect classification.

-

Check Unit Price: The final tax amount will depend on the FOB price and customs valuation. Be prepared to provide accurate pricing details.

-

Certifications: Confirm if any import permits, certificates of origin, or other documentation are required for the specific HS code and country of import.

-

Consult Customs Broker: For precise classification and compliance, especially if the product has mixed materials or finishes.

✅ Summary Table:

| HS CODE | Description | Base Tariff | Special Tariff (after 2025.4.11) | Total Tax |

|---|---|---|---|---|

| 4105101000 | Wet blue lambskin | 2.0% | 30.0% | 32.0% |

| 4106211000 | Wet blue lambskin | 2.4% | 30.0% | 32.4% |

| 4106219000 | Wet blue lambskin | 2.4% | 30.0% | 32.4% |

| 4112003060 | Wet blue lambskin | 2.0% | 30.0% | 32.0% |

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.