| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4104111020 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4104192000 | Doc | 57.4% | CN | US | 2025-05-12 |

| 4104195030 | Doc | 33.3% | CN | US | 2025-05-12 |

| 4104115070 | Doc | 33.3% | CN | US | 2025-05-12 |

| 4104195030 | Doc | 33.3% | CN | US | 2025-05-12 |

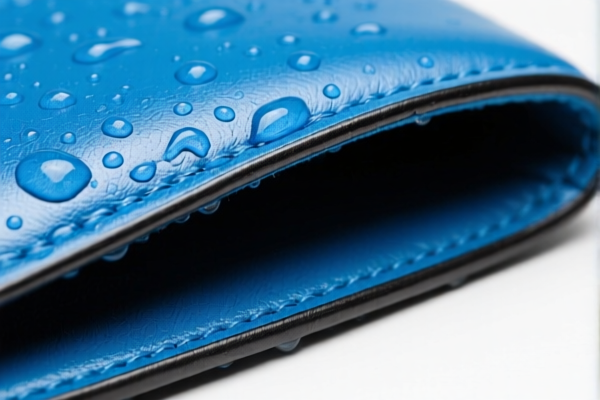

Product Name: Wet blue bovine leather lining leather for footwear

Classification: Wet blue bovine leather (wet state, including wet blue)

HS CODE: 4104.11.10.20 (for bovine leather in wet state, including wet blue)

🔍 HS Code Classification Summary:

- HS CODE: 4104.11.10.20

- Description: Wet state (including wet blue) bovine leather

- Total Tax Rate: 55.0%

📊 Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate (after April 11, 2025): 55.0%

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be imposed on all imports of this product after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs clearance planning.

- No Anti-dumping duties are currently listed for this product category.

- No specific anti-dumping duties on iron or aluminum apply here, as this is leather, not metal.

📌 Proactive Advice for Importers:

- Verify Material: Ensure the leather is indeed in the "wet blue" stage and not further processed (e.g., dyed, finished, or tanned beyond the wet blue stage).

- Check Unit Price: Confirm the unit price and whether it includes any additional costs (e.g., packaging, transportation).

- Certifications Required: Some countries may require specific certifications (e.g., origin, environmental compliance, or animal welfare standards) for leather imports.

- Consult Customs Broker: For accurate classification and tariff calculation, especially if the product may fall under multiple HS codes.

📋 Alternative HS Codes for Reference:

| HS CODE | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 4104.19.20.00 | Wet state (including wet blue) of bovine (including water buffalo) leather | 57.4% | Base tariff: 2.4% |

| 4104.19.50.30 | Tanned or矾-treated bovine (including water buffalo) or horse leather, hairless, in wet state (including wet blue) | 33.3% | Base tariff: 3.3% |

| 4104.11.50.70 | Tanned or矾-treated bovine (including water buffalo) or horse leather, hairless, in wet state (including wet blue) | 33.3% | Base tariff: 3.3% |

Note: The correct HS code depends on the exact processing stage and type of leather. Ensure the product is not further processed beyond the "wet blue" stage, as this may change the classification.

If you have more details about the leather (e.g., tanning method, origin, or intended use), I can help refine the classification further.

Product Name: Wet blue bovine leather lining leather for footwear

Classification: Wet blue bovine leather (wet state, including wet blue)

HS CODE: 4104.11.10.20 (for bovine leather in wet state, including wet blue)

🔍 HS Code Classification Summary:

- HS CODE: 4104.11.10.20

- Description: Wet state (including wet blue) bovine leather

- Total Tax Rate: 55.0%

📊 Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate (after April 11, 2025): 55.0%

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be imposed on all imports of this product after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs clearance planning.

- No Anti-dumping duties are currently listed for this product category.

- No specific anti-dumping duties on iron or aluminum apply here, as this is leather, not metal.

📌 Proactive Advice for Importers:

- Verify Material: Ensure the leather is indeed in the "wet blue" stage and not further processed (e.g., dyed, finished, or tanned beyond the wet blue stage).

- Check Unit Price: Confirm the unit price and whether it includes any additional costs (e.g., packaging, transportation).

- Certifications Required: Some countries may require specific certifications (e.g., origin, environmental compliance, or animal welfare standards) for leather imports.

- Consult Customs Broker: For accurate classification and tariff calculation, especially if the product may fall under multiple HS codes.

📋 Alternative HS Codes for Reference:

| HS CODE | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 4104.19.20.00 | Wet state (including wet blue) of bovine (including water buffalo) leather | 57.4% | Base tariff: 2.4% |

| 4104.19.50.30 | Tanned or矾-treated bovine (including water buffalo) or horse leather, hairless, in wet state (including wet blue) | 33.3% | Base tariff: 3.3% |

| 4104.11.50.70 | Tanned or矾-treated bovine (including water buffalo) or horse leather, hairless, in wet state (including wet blue) | 33.3% | Base tariff: 3.3% |

Note: The correct HS code depends on the exact processing stage and type of leather. Ensure the product is not further processed beyond the "wet blue" stage, as this may change the classification.

If you have more details about the leather (e.g., tanning method, origin, or intended use), I can help refine the classification further.

Customer Reviews

No reviews yet.