| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4104192000 | Doc | 57.4% | CN | US | 2025-05-12 |

| 4104195030 | Doc | 33.3% | CN | US | 2025-05-12 |

| 4104115070 | Doc | 33.3% | CN | US | 2025-05-12 |

| 4104111020 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4104193000 | Doc | 32.4% | CN | US | 2025-05-12 |

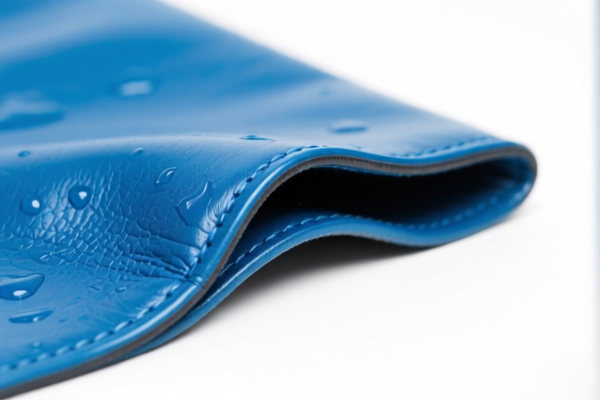

Here is the structured classification and tax information for "Wet blue bovine leather lining leather for luggage", based on the provided HS codes and tariff details:

✅ HS CODE: 4104192000

Product Description: Wet blue bovine leather (for luggage)

Total Tax Rate: 57.4%

- Base Tariff Rate: 2.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code has the highest total tax rate due to both base and additional tariffs.

✅ HS CODE: 4104195030

Product Description: Wet blue bovine leather for luggage

Total Tax Rate: 33.3%

- Base Tariff Rate: 3.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lower base tariff, but still subject to the April 11 special tariff.

✅ HS CODE: 4104115070

Product Description: Wet blue bovine leather for luggage

Total Tax Rate: 33.3%

- Base Tariff Rate: 3.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Similar to 4104195030, with the same tax structure.

✅ HS CODE: 4104111020

Product Description: Wet blue bovine leather (for luggage)

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No base tariff, but high additional and special tariffs.

✅ HS CODE: 4104193000

Product Description: Wet blue water buffalo leather (for luggage)

Total Tax Rate: 32.4%

- Base Tariff Rate: 2.4%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly lower total tax rate due to no additional tariff.

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in your cost planning.

-

Material Verification: Ensure the leather is wet blue bovine leather and not misclassified as water buffalo or other types, as this can affect the correct HS code and tax rate.

-

Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., origin, environmental compliance) are required for customs clearance.

-

Tariff Variability: The base and additional tariffs vary by HS code, so selecting the correct code is crucial for accurate tax calculation.

🛑 Proactive Advice:

- Double-check the material type (bovine vs. water buffalo) and intended use (luggage lining) to ensure the correct HS code is applied.

- Consult with customs brokers or tax consultants for the most up-to-date and accurate tariff information, especially with the upcoming April 11, 2025 policy change.

- Keep records of product specifications and supplier documentation to support your classification and avoid delays in customs clearance. Here is the structured classification and tax information for "Wet blue bovine leather lining leather for luggage", based on the provided HS codes and tariff details:

✅ HS CODE: 4104192000

Product Description: Wet blue bovine leather (for luggage)

Total Tax Rate: 57.4%

- Base Tariff Rate: 2.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code has the highest total tax rate due to both base and additional tariffs.

✅ HS CODE: 4104195030

Product Description: Wet blue bovine leather for luggage

Total Tax Rate: 33.3%

- Base Tariff Rate: 3.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Lower base tariff, but still subject to the April 11 special tariff.

✅ HS CODE: 4104115070

Product Description: Wet blue bovine leather for luggage

Total Tax Rate: 33.3%

- Base Tariff Rate: 3.3%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Similar to 4104195030, with the same tax structure.

✅ HS CODE: 4104111020

Product Description: Wet blue bovine leather (for luggage)

Total Tax Rate: 55.0%

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: No base tariff, but high additional and special tariffs.

✅ HS CODE: 4104193000

Product Description: Wet blue water buffalo leather (for luggage)

Total Tax Rate: 32.4%

- Base Tariff Rate: 2.4%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly lower total tax rate due to no additional tariff.

📌 Important Notes and Recommendations:

-

April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in your cost planning.

-

Material Verification: Ensure the leather is wet blue bovine leather and not misclassified as water buffalo or other types, as this can affect the correct HS code and tax rate.

-

Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., origin, environmental compliance) are required for customs clearance.

-

Tariff Variability: The base and additional tariffs vary by HS code, so selecting the correct code is crucial for accurate tax calculation.

🛑 Proactive Advice:

- Double-check the material type (bovine vs. water buffalo) and intended use (luggage lining) to ensure the correct HS code is applied.

- Consult with customs brokers or tax consultants for the most up-to-date and accurate tariff information, especially with the upcoming April 11, 2025 policy change.

- Keep records of product specifications and supplier documentation to support your classification and avoid delays in customs clearance.

Customer Reviews

No reviews yet.