| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4104115080 | Doc | 33.3% | CN | US | 2025-05-12 |

| 4104195030 | Doc | 33.3% | CN | US | 2025-05-12 |

| 4104192000 | Doc | 57.4% | CN | US | 2025-05-12 |

| 4104115070 | Doc | 33.3% | CN | US | 2025-05-12 |

| 4104115030 | Doc | 33.3% | CN | US | 2025-05-12 |

| 4104194060 | Doc | 35.0% | CN | US | 2025-05-12 |

| 4104114060 | Doc | 35.0% | CN | US | 2025-05-12 |

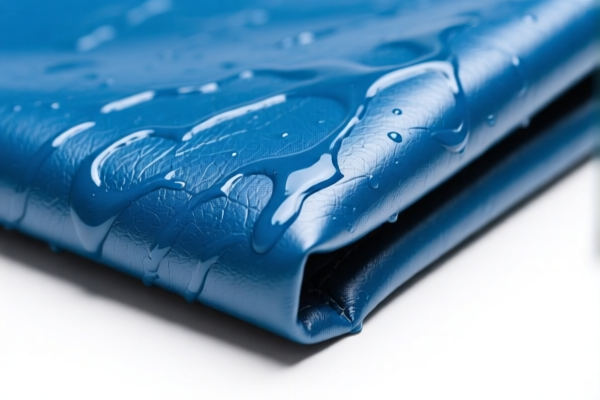

Product Classification: Wet Blue Bovine Raw Leather

HS CODE: 4104.11.50.80, 4104.19.50.30, 4104.19.20.00, 4104.11.50.70, 4104.11.50.30, 4104.19.40.60, 4104.11.40.60

Key Classification Details

- Product Description: Wet blue bovine raw leather, tanned or chrome-tanned, without hair, unsplit, and not further processed.

- State: Wet (including wet blue), typically used as raw material for further leather processing.

- Material: Bovine (cattle, water buffalo, etc.), not split, not further processed.

Tariff Overview (as of now)

1. Base Tariff Rate

- 3.3% to 5.0%, depending on the specific HS code.

2. Additional Tariffs (Currently 0.0%)

- No additional tariffs are currently applied (as of now).

3. April 11, 2025 Special Tariff

- 30.0% additional tariff will be imposed after April 11, 2025 for all these HS codes.

4. Anti-dumping duties on iron and aluminum

- Not applicable for leather products.

Tariff Breakdown by HS Code

| HS CODE | Base Tariff | Additional Tariff (now) | April 11, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|

| 4104.11.50.80 | 3.3% | 0.0% | 30.0% | 33.3% |

| 4104.19.50.30 | 3.3% | 0.0% | 30.0% | 33.3% |

| 4104.19.20.00 | 2.4% | 25.0% | 30.0% | 57.4% |

| 4104.11.50.70 | 3.3% | 0.0% | 30.0% | 33.3% |

| 4104.11.50.30 | 3.3% | 0.0% | 30.0% | 33.3% |

| 4104.19.40.60 | 5.0% | 0.0% | 30.0% | 35.0% |

| 4104.11.40.60 | 5.0% | 0.0% | 30.0% | 35.0% |

Proactive Advice for Importers

- Verify Material and Unit Price: Ensure the leather is indeed in the "wet blue" state and not further processed (e.g., dyed, split, or finished).

- Check Required Certifications: Confirm if any documentation (e.g., origin certificate, product standard compliance) is required for customs clearance.

- Monitor April 11, 2025 Tariff Changes: Plan your import schedule accordingly to avoid unexpected cost increases.

- Consider HS Code Selection: Choose the most accurate HS code based on the exact product description to avoid classification disputes.

Summary

Wet blue bovine raw leather is classified under HS codes 4104.11.50.80 to 4104.19.40.60, with base tariffs ranging from 2.4% to 5.0% and a 30.0% additional tariff after April 11, 2025. The highest total tax rate is 57.4% for certain classifications. Always confirm the exact product description and HS code to ensure compliance and cost accuracy.

Product Classification: Wet Blue Bovine Raw Leather

HS CODE: 4104.11.50.80, 4104.19.50.30, 4104.19.20.00, 4104.11.50.70, 4104.11.50.30, 4104.19.40.60, 4104.11.40.60

Key Classification Details

- Product Description: Wet blue bovine raw leather, tanned or chrome-tanned, without hair, unsplit, and not further processed.

- State: Wet (including wet blue), typically used as raw material for further leather processing.

- Material: Bovine (cattle, water buffalo, etc.), not split, not further processed.

Tariff Overview (as of now)

1. Base Tariff Rate

- 3.3% to 5.0%, depending on the specific HS code.

2. Additional Tariffs (Currently 0.0%)

- No additional tariffs are currently applied (as of now).

3. April 11, 2025 Special Tariff

- 30.0% additional tariff will be imposed after April 11, 2025 for all these HS codes.

4. Anti-dumping duties on iron and aluminum

- Not applicable for leather products.

Tariff Breakdown by HS Code

| HS CODE | Base Tariff | Additional Tariff (now) | April 11, 2025 Tariff | Total Tax Rate |

|---|---|---|---|---|

| 4104.11.50.80 | 3.3% | 0.0% | 30.0% | 33.3% |

| 4104.19.50.30 | 3.3% | 0.0% | 30.0% | 33.3% |

| 4104.19.20.00 | 2.4% | 25.0% | 30.0% | 57.4% |

| 4104.11.50.70 | 3.3% | 0.0% | 30.0% | 33.3% |

| 4104.11.50.30 | 3.3% | 0.0% | 30.0% | 33.3% |

| 4104.19.40.60 | 5.0% | 0.0% | 30.0% | 35.0% |

| 4104.11.40.60 | 5.0% | 0.0% | 30.0% | 35.0% |

Proactive Advice for Importers

- Verify Material and Unit Price: Ensure the leather is indeed in the "wet blue" state and not further processed (e.g., dyed, split, or finished).

- Check Required Certifications: Confirm if any documentation (e.g., origin certificate, product standard compliance) is required for customs clearance.

- Monitor April 11, 2025 Tariff Changes: Plan your import schedule accordingly to avoid unexpected cost increases.

- Consider HS Code Selection: Choose the most accurate HS code based on the exact product description to avoid classification disputes.

Summary

Wet blue bovine raw leather is classified under HS codes 4104.11.50.80 to 4104.19.40.60, with base tariffs ranging from 2.4% to 5.0% and a 30.0% additional tariff after April 11, 2025. The highest total tax rate is 57.4% for certain classifications. Always confirm the exact product description and HS code to ensure compliance and cost accuracy.

Customer Reviews

No reviews yet.