| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3908902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3908907000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920920000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 5402510000 | Doc | 63.8% | CN | US | 2025-05-12 |

| 3908907000 | Doc | 61.5% | CN | US | 2025-05-12 |

Here is the structured analysis and customs compliance guidance for White Polyamide Raw Material based on the provided HS codes and tariff information:

✅ HS CODE: 3908902000

Product Description: Polyamide plastic raw material

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this code

- April 11 Special Tariff: Applies after April 11, 2025

Key Notes: - This code is for polyamide raw material in its primary form. - The base tariff is 0%, but additional tariffs are applied. - Tariff increases significantly after April 11, 2025, so import timing is critical.

✅ HS CODE: 3908907000

Product Description: Other primary forms of polyamide (e.g., polyamide tube material)

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this code

- April 11 Special Tariff: Applies after April 11, 2025

Key Notes: - This code is for other primary forms of polyamide, such as tube material. - Base tariff is 6.5%, with additional tariffs and special tariffs after April 11, 2025. - Higher total tax rate compared to 3908902000.

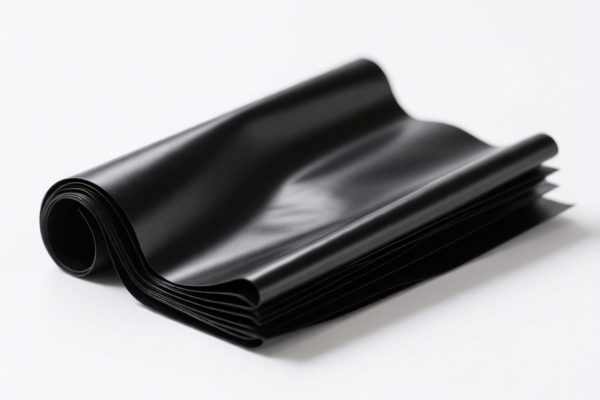

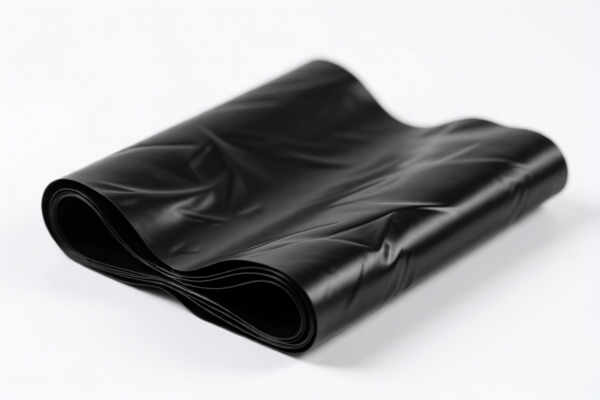

✅ HS CODE: 3920920000

Product Description: Polyamide-made plastic sheets, films, etc., not cellular or reinforced

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this code

- April 11 Special Tariff: Applies after April 11, 2025

Key Notes: - This code is for finished polyamide plastic products like films, sheets, or foils. - Base tariff is 4.2%, with additional tariffs and special tariffs after April 11, 2025. - Higher tax rate than raw material codes.

✅ HS CODE: 5402510000

Product Description: Nylon or other polyamide material

Total Tax Rate: 63.8%

Tariff Breakdown:

- Base Tariff: 8.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this code

- April 11 Special Tariff: Applies after April 11, 2025

Key Notes: - This code is for nylon or other polyamide materials, possibly in textile or fiber form. - Highest total tax rate among the listed codes. - Base tariff is 8.8%, with additional and special tariffs after April 11, 2025.

📌 Proactive Advice for Importers:

- Verify the exact product form (raw material, tube, sheet, etc.) to ensure correct HS code classification.

- Check the unit price and material composition to avoid misclassification.

- Confirm if any certifications (e.g., REACH, RoHS) are required for import.

- Plan import timing carefully, especially if importing after April 11, 2025, to avoid higher tariffs.

- Review anti-dumping duty regulations for polyamide products, even if not directly applicable here.

Let me know if you need help with certification requirements or customs documentation for these products. Here is the structured analysis and customs compliance guidance for White Polyamide Raw Material based on the provided HS codes and tariff information:

✅ HS CODE: 3908902000

Product Description: Polyamide plastic raw material

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this code

- April 11 Special Tariff: Applies after April 11, 2025

Key Notes: - This code is for polyamide raw material in its primary form. - The base tariff is 0%, but additional tariffs are applied. - Tariff increases significantly after April 11, 2025, so import timing is critical.

✅ HS CODE: 3908907000

Product Description: Other primary forms of polyamide (e.g., polyamide tube material)

Total Tax Rate: 61.5%

Tariff Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this code

- April 11 Special Tariff: Applies after April 11, 2025

Key Notes: - This code is for other primary forms of polyamide, such as tube material. - Base tariff is 6.5%, with additional tariffs and special tariffs after April 11, 2025. - Higher total tax rate compared to 3908902000.

✅ HS CODE: 3920920000

Product Description: Polyamide-made plastic sheets, films, etc., not cellular or reinforced

Total Tax Rate: 59.2%

Tariff Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this code

- April 11 Special Tariff: Applies after April 11, 2025

Key Notes: - This code is for finished polyamide plastic products like films, sheets, or foils. - Base tariff is 4.2%, with additional tariffs and special tariffs after April 11, 2025. - Higher tax rate than raw material codes.

✅ HS CODE: 5402510000

Product Description: Nylon or other polyamide material

Total Tax Rate: 63.8%

Tariff Breakdown:

- Base Tariff: 8.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not applicable for this code

- April 11 Special Tariff: Applies after April 11, 2025

Key Notes: - This code is for nylon or other polyamide materials, possibly in textile or fiber form. - Highest total tax rate among the listed codes. - Base tariff is 8.8%, with additional and special tariffs after April 11, 2025.

📌 Proactive Advice for Importers:

- Verify the exact product form (raw material, tube, sheet, etc.) to ensure correct HS code classification.

- Check the unit price and material composition to avoid misclassification.

- Confirm if any certifications (e.g., REACH, RoHS) are required for import.

- Plan import timing carefully, especially if importing after April 11, 2025, to avoid higher tariffs.

- Review anti-dumping duty regulations for polyamide products, even if not directly applicable here.

Let me know if you need help with certification requirements or customs documentation for these products.

Customer Reviews

No reviews yet.