| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5516310510 | Doc | 74.8% | CN | US | 2025-05-12 |

| 5112903000 | Doc | 61.9% | CN | US | 2025-05-12 |

| 5212131020 | Doc | 71.5% | CN | US | 2025-05-12 |

| 5211590090 | Doc | 63.1% | CN | US | 2025-05-12 |

| 5514210020 | Doc | 69.9% | CN | US | 2025-05-12 |

| 5516940070 | Doc | 67.0% | CN | US | 2025-05-12 |

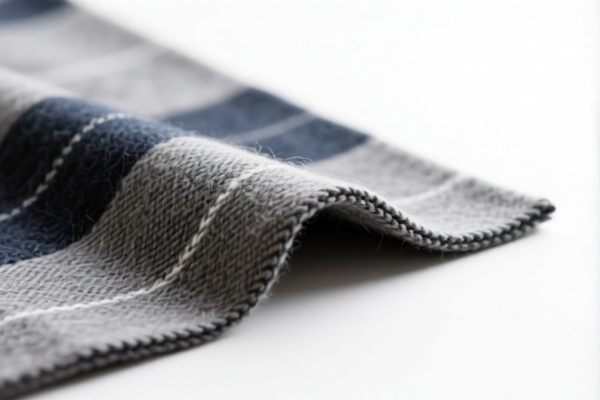

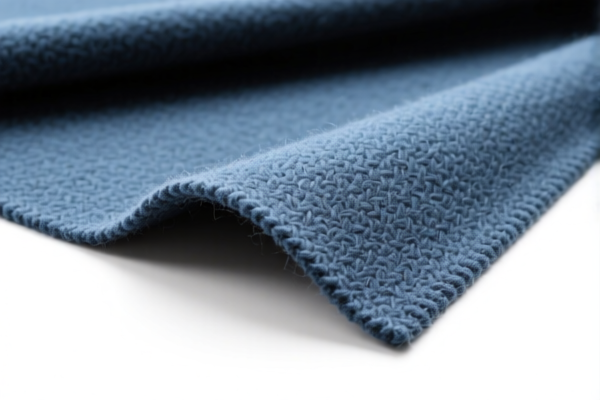

Here is the structured analysis and classification for the Wool Blended Aircraft Interior Fabric based on the provided HS codes and tariff details:

✅ HS CODE: 5516310510

Product Description:

- Fabric with less than 85% synthetic short fibers, mainly or solely blended with wool or fine animal hair.

- Not bleached or bleached, and contains 36% or more (by weight) wool or fine animal hair.

Tariff Summary:

- Base Tariff Rate: 19.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 74.8%

Key Notes:

- This is the most likely classification for your product, given the wool content and blended fabric description.

- Ensure the material composition (e.g., wool percentage) is clearly documented for customs compliance.

📌 Other Possible HS Codes (for reference):

1. HS CODE: 5112903000

Product Description:

- Fabric containing 30% or more silk or silk waste, with a value over $33/kg.

Tariff Summary:

- Base Tariff Rate: 6.9%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.9%

Key Notes:

- Not applicable unless the fabric contains silk and meets the value threshold.

2. HS CODE: 5212131020

Product Description:

- Dyed cotton woven fabric, with 36% or more wool or fine animal hair, weight ≤ 200g/m², and combed.

Tariff Summary:

- Base Tariff Rate: 16.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 71.5%

Key Notes:

- Not applicable unless the fabric is cotton-based, dyed, and combed.

3. HS CODE: 5211590090

Product Description:

- Printed blended fabric, with cotton content < 85%, weight > 200g/m².

Tariff Summary:

- Base Tariff Rate: 8.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 63.1%

Key Notes:

- Not applicable unless the fabric is printed, cotton-based, and heavier than 200g/m².

4. HS CODE: 5514210020

Product Description:

- Dyed polyester short fiber plain weave fabric, mainly or solely blended with cotton, weight > 170g/m².

Tariff Summary:

- Base Tariff Rate: 14.9%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 69.9%

Key Notes:

- Not applicable unless the fabric is polyester-cotton blend, dyed, and heavier than 170g/m².

5. HS CODE: 5516940070

Product Description:

- Other man-made short fiber woven fabric, printed, oxford fabric.

Tariff Summary:

- Base Tariff Rate: 12.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 67.0%

Key Notes:

- Not applicable unless the fabric is printed, man-made fiber, and classified as oxford fabric.

🚨 Important Reminders:

- Verify the exact composition of the fabric (e.g., wool percentage, fiber types, weight, and finish).

- Check the fabric weight (grams per square meter) to ensure it aligns with the HS code description.

- Confirm if the fabric is dyed, printed, or bleached, as this affects classification.

- Review the April 11, 2025, special tariff and ensure your import timeline accounts for this.

- Check if any anti-dumping duties apply (not listed here, but may be relevant for certain materials).

- Ensure compliance with any required certifications (e.g., fire resistance, safety standards for aircraft interiors).

✅ Recommended Action:

- Confirm the fabric composition and specifications with your supplier.

- Consult a customs broker or classification expert for final confirmation, especially for high-value or sensitive goods like aircraft interior materials.

- Keep documentation ready for customs inspection (e.g., material certificates, weight, and finish details). Here is the structured analysis and classification for the Wool Blended Aircraft Interior Fabric based on the provided HS codes and tariff details:

✅ HS CODE: 5516310510

Product Description:

- Fabric with less than 85% synthetic short fibers, mainly or solely blended with wool or fine animal hair.

- Not bleached or bleached, and contains 36% or more (by weight) wool or fine animal hair.

Tariff Summary:

- Base Tariff Rate: 19.8%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 74.8%

Key Notes:

- This is the most likely classification for your product, given the wool content and blended fabric description.

- Ensure the material composition (e.g., wool percentage) is clearly documented for customs compliance.

📌 Other Possible HS Codes (for reference):

1. HS CODE: 5112903000

Product Description:

- Fabric containing 30% or more silk or silk waste, with a value over $33/kg.

Tariff Summary:

- Base Tariff Rate: 6.9%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.9%

Key Notes:

- Not applicable unless the fabric contains silk and meets the value threshold.

2. HS CODE: 5212131020

Product Description:

- Dyed cotton woven fabric, with 36% or more wool or fine animal hair, weight ≤ 200g/m², and combed.

Tariff Summary:

- Base Tariff Rate: 16.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 71.5%

Key Notes:

- Not applicable unless the fabric is cotton-based, dyed, and combed.

3. HS CODE: 5211590090

Product Description:

- Printed blended fabric, with cotton content < 85%, weight > 200g/m².

Tariff Summary:

- Base Tariff Rate: 8.1%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 63.1%

Key Notes:

- Not applicable unless the fabric is printed, cotton-based, and heavier than 200g/m².

4. HS CODE: 5514210020

Product Description:

- Dyed polyester short fiber plain weave fabric, mainly or solely blended with cotton, weight > 170g/m².

Tariff Summary:

- Base Tariff Rate: 14.9%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 69.9%

Key Notes:

- Not applicable unless the fabric is polyester-cotton blend, dyed, and heavier than 170g/m².

5. HS CODE: 5516940070

Product Description:

- Other man-made short fiber woven fabric, printed, oxford fabric.

Tariff Summary:

- Base Tariff Rate: 12.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 67.0%

Key Notes:

- Not applicable unless the fabric is printed, man-made fiber, and classified as oxford fabric.

🚨 Important Reminders:

- Verify the exact composition of the fabric (e.g., wool percentage, fiber types, weight, and finish).

- Check the fabric weight (grams per square meter) to ensure it aligns with the HS code description.

- Confirm if the fabric is dyed, printed, or bleached, as this affects classification.

- Review the April 11, 2025, special tariff and ensure your import timeline accounts for this.

- Check if any anti-dumping duties apply (not listed here, but may be relevant for certain materials).

- Ensure compliance with any required certifications (e.g., fire resistance, safety standards for aircraft interiors).

✅ Recommended Action:

- Confirm the fabric composition and specifications with your supplier.

- Consult a customs broker or classification expert for final confirmation, especially for high-value or sensitive goods like aircraft interior materials.

- Keep documentation ready for customs inspection (e.g., material certificates, weight, and finish details).

Customer Reviews

No reviews yet.