| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5516320510 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5516310510 | Doc | 74.8% | CN | US | 2025-05-12 |

| 5407910510 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5408311000 | Doc | 67.0% | CN | US | 2025-05-12 |

| 5407920510 | Doc | 80.0% | CN | US | 2025-05-12 |

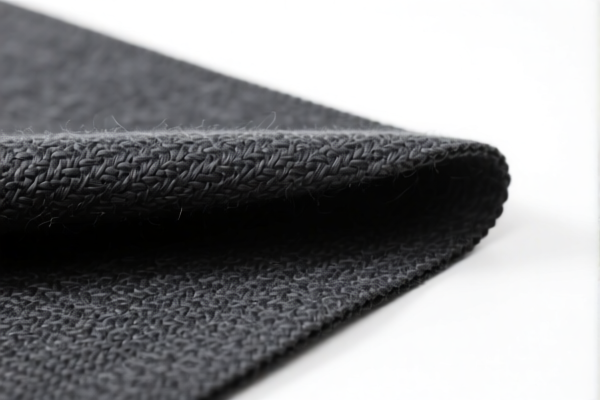

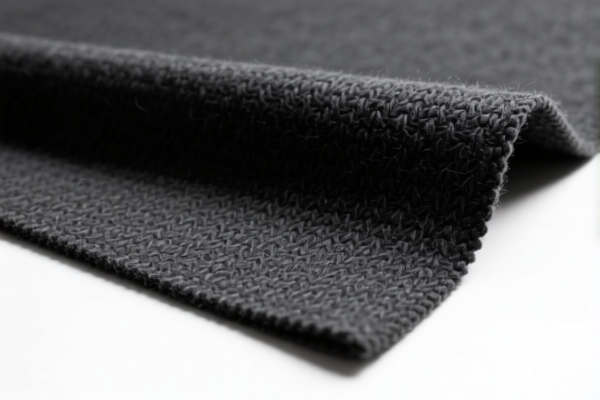

Product Name: Wool Blended Automotive Interior Fabric

Classification: Based on the provided HS codes and descriptions, the product is a woven fabric containing wool or fine animal hair blended with synthetic or man-made short fibers, and is dyed or not dyed depending on the specific code.

✅ HS CODES & TAX DETAILS (April 2025 Update)

1. HS CODE: 5516.32.05.10

- Description: Dyed woven fabric containing less than 85% by weight of synthetic short fibers, mainly or solely blended with wool or fine animal hair.

- Total Tax Rate: 80.0%

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code applies to dyed fabrics with wool or fine animal hair as the main component.

- High tax rate due to both base and additional tariffs.

2. HS CODE: 5516.31.05.10

- Description: Woven fabric with less than 85% synthetic short fibers, blended with wool or fine animal hair (≥36% by weight), undyed or bleached.

- Total Tax Rate: 74.8%

- Base Tariff: 19.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is for undyed or bleached fabrics with wool content ≥36%.

- Lower base tariff compared to 5516.32.05.10, but still high overall due to additional tariffs.

3. HS CODE: 5407.91.05.10

- Description: Woven fabric with wool or fine animal hair (≥36%), blended with other fibers, undyed or bleached, not carded.

- Total Tax Rate: 80.0%

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code applies to undyed or bleached fabrics with wool content ≥36%.

- Not carded is a key qualifier for this code.

4. HS CODE: 5408.31.10.00

- Description: Woven fabric mainly or solely blended with wool or fine animal hair.

- Total Tax Rate: 67.0%

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is for woven fabric with wool or fine animal hair as the main component.

- Lower base tariff compared to others, but still subject to additional and special tariffs.

5. HS CODE: 5407.92.05.10

- Description: Dyed woven fabric of synthetic long staple fibers, blended with wool or fine animal hair.

- Total Tax Rate: 80.0%

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code applies to dyed fabrics with synthetic long fibers and wool or fine animal hair.

- High tax rate due to multiple layers of tariffs.

⚠️ Important Alerts & Proactive Advice

- Time-sensitive policy:

-

Additional tariffs of 30.0% will be applied after April 11, 2025. Ensure your customs clearance is completed before this date to avoid higher costs.

-

Material Verification:

- Confirm the exact composition (wool percentage, fiber type, dyeing status) to ensure correct HS code classification.

-

Example: If the fabric is dyed, it may fall under 5516.32.05.10 or 5407.92.05.10, not 5516.31.05.10 or 5407.91.05.10.

-

Certifications Required:

- Check if certifications (e.g., origin, environmental compliance) are required for import.

-

Be aware of anti-dumping duties if the product is from countries under such measures (e.g., China, Vietnam).

-

Unit Price & Tax Calculation:

- Verify the unit price and total value of the product to calculate total import tax accurately.

- Use the total tax rate (base + additional + special) for final cost estimation.

✅ Summary of Tax Rates (April 2025)

| HS Code | Total Tax Rate | Base Tariff | Additional Tariff | Special Tariff (after April 11, 2025) |

|---|---|---|---|---|

| 5516.32.05.10 | 80.0% | 25.0% | 25.0% | 30.0% |

| 5516.31.05.10 | 74.8% | 19.8% | 25.0% | 30.0% |

| 5407.91.05.10 | 80.0% | 25.0% | 25.0% | 30.0% |

| 5408.31.10.00 | 67.0% | 12.0% | 25.0% | 30.0% |

| 5407.92.05.10 | 80.0% | 25.0% | 25.0% | 30.0% |

If you need help selecting the correct HS code based on your product’s exact specifications, feel free to provide more details.

Product Name: Wool Blended Automotive Interior Fabric

Classification: Based on the provided HS codes and descriptions, the product is a woven fabric containing wool or fine animal hair blended with synthetic or man-made short fibers, and is dyed or not dyed depending on the specific code.

✅ HS CODES & TAX DETAILS (April 2025 Update)

1. HS CODE: 5516.32.05.10

- Description: Dyed woven fabric containing less than 85% by weight of synthetic short fibers, mainly or solely blended with wool or fine animal hair.

- Total Tax Rate: 80.0%

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code applies to dyed fabrics with wool or fine animal hair as the main component.

- High tax rate due to both base and additional tariffs.

2. HS CODE: 5516.31.05.10

- Description: Woven fabric with less than 85% synthetic short fibers, blended with wool or fine animal hair (≥36% by weight), undyed or bleached.

- Total Tax Rate: 74.8%

- Base Tariff: 19.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is for undyed or bleached fabrics with wool content ≥36%.

- Lower base tariff compared to 5516.32.05.10, but still high overall due to additional tariffs.

3. HS CODE: 5407.91.05.10

- Description: Woven fabric with wool or fine animal hair (≥36%), blended with other fibers, undyed or bleached, not carded.

- Total Tax Rate: 80.0%

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code applies to undyed or bleached fabrics with wool content ≥36%.

- Not carded is a key qualifier for this code.

4. HS CODE: 5408.31.10.00

- Description: Woven fabric mainly or solely blended with wool or fine animal hair.

- Total Tax Rate: 67.0%

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is for woven fabric with wool or fine animal hair as the main component.

- Lower base tariff compared to others, but still subject to additional and special tariffs.

5. HS CODE: 5407.92.05.10

- Description: Dyed woven fabric of synthetic long staple fibers, blended with wool or fine animal hair.

- Total Tax Rate: 80.0%

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code applies to dyed fabrics with synthetic long fibers and wool or fine animal hair.

- High tax rate due to multiple layers of tariffs.

⚠️ Important Alerts & Proactive Advice

- Time-sensitive policy:

-

Additional tariffs of 30.0% will be applied after April 11, 2025. Ensure your customs clearance is completed before this date to avoid higher costs.

-

Material Verification:

- Confirm the exact composition (wool percentage, fiber type, dyeing status) to ensure correct HS code classification.

-

Example: If the fabric is dyed, it may fall under 5516.32.05.10 or 5407.92.05.10, not 5516.31.05.10 or 5407.91.05.10.

-

Certifications Required:

- Check if certifications (e.g., origin, environmental compliance) are required for import.

-

Be aware of anti-dumping duties if the product is from countries under such measures (e.g., China, Vietnam).

-

Unit Price & Tax Calculation:

- Verify the unit price and total value of the product to calculate total import tax accurately.

- Use the total tax rate (base + additional + special) for final cost estimation.

✅ Summary of Tax Rates (April 2025)

| HS Code | Total Tax Rate | Base Tariff | Additional Tariff | Special Tariff (after April 11, 2025) |

|---|---|---|---|---|

| 5516.32.05.10 | 80.0% | 25.0% | 25.0% | 30.0% |

| 5516.31.05.10 | 74.8% | 19.8% | 25.0% | 30.0% |

| 5407.91.05.10 | 80.0% | 25.0% | 25.0% | 30.0% |

| 5408.31.10.00 | 67.0% | 12.0% | 25.0% | 30.0% |

| 5407.92.05.10 | 80.0% | 25.0% | 25.0% | 30.0% |

If you need help selecting the correct HS code based on your product’s exact specifications, feel free to provide more details.

Customer Reviews

No reviews yet.