| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5516310510 | Doc | 74.8% | CN | US | 2025-05-12 |

| 5516330510 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112303000 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5111300500 | Doc | 62.0% | CN | US | 2025-05-12 |

| 5407920510 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5515991020 | Doc | 67.0% | CN | US | 2025-05-12 |

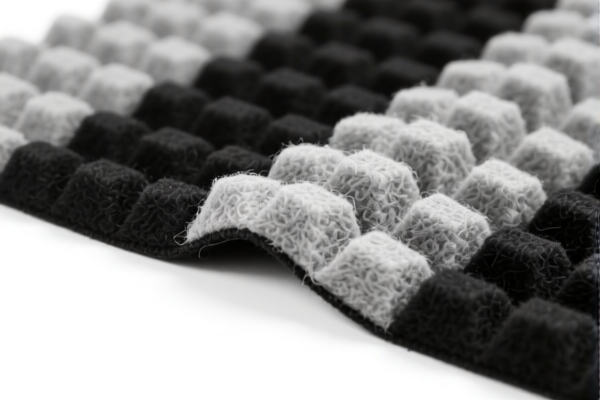

Product Name: Wool Blended KTV Room Soundproofing Fabric

Classification HS Code Analysis and Tax Overview:

- HS CODE: 5516310510

- Description: Woven fabrics of man-made short fibers containing less than 85% by weight, mainly or solely blended with wool or fine animal hair.

- Total Tax Rate: 74.8%

- Breakdown:

- Base Tariff: 19.8%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: This is a common classification for blended fabrics with wool and synthetic fibers.

-

HS CODE: 5516330510

- Description: Woven fabrics of synthetic short fibers containing less than 85% by weight, mainly or solely blended with wool or fine animal hair.

- Total Tax Rate: 80.0%

- Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: Higher tax rate due to synthetic fiber content.

-

HS CODE: 5112303000

- Description: Woven fabrics of combed wool or combed fine animal hair, other woven fabrics.

- Total Tax Rate: 80.0%

- Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: High tax rate for pure wool or fine animal hair blends.

-

HS CODE: 5111300500

- Description: Woven fabrics of carded wool or carded fine animal hair.

- Total Tax Rate: 62.0%

- Breakdown:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: Lower base tariff but still subject to additional tariffs.

-

HS CODE: 5407920510

- Description: Dyed woven fabrics of synthetic filament, containing mainly or entirely wool or fine animal hair.

- Total Tax Rate: 80.0%

- Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: High tax rate for synthetic filament blended with wool.

-

HS CODE: 5515991020

- Description: Woven fabrics of other fibers, mainly or solely blended with wool or fine animal hair.

- Total Tax Rate: 67.0%

- Breakdown:

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: Lower base tariff but still subject to additional tariffs.

Key Policy Notes:

- April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30.0% tariff after this date.

- Anti-dumping duties: Not explicitly mentioned in the data, but always verify if applicable for wool or synthetic fiber products.

- Material Verification: Confirm the exact composition (e.g., wool percentage, type of synthetic fiber) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., soundproofing standards, textile certifications) are required for import or use in KTV rooms.

Proactive Advice:

- Verify Material Composition: Ensure the fabric's exact blend (e.g., wool percentage, fiber type) to match the correct HS code.

- Check Unit Price: High tax rates may affect cost; consider sourcing or duty optimization strategies.

-

Consult Customs Authority: For final confirmation, especially if the product is used for specialized purposes like soundproofing. Product Name: Wool Blended KTV Room Soundproofing Fabric

Classification HS Code Analysis and Tax Overview: -

HS CODE: 5516310510

- Description: Woven fabrics of man-made short fibers containing less than 85% by weight, mainly or solely blended with wool or fine animal hair.

- Total Tax Rate: 74.8%

- Breakdown:

- Base Tariff: 19.8%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: This is a common classification for blended fabrics with wool and synthetic fibers.

-

HS CODE: 5516330510

- Description: Woven fabrics of synthetic short fibers containing less than 85% by weight, mainly or solely blended with wool or fine animal hair.

- Total Tax Rate: 80.0%

- Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: Higher tax rate due to synthetic fiber content.

-

HS CODE: 5112303000

- Description: Woven fabrics of combed wool or combed fine animal hair, other woven fabrics.

- Total Tax Rate: 80.0%

- Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: High tax rate for pure wool or fine animal hair blends.

-

HS CODE: 5111300500

- Description: Woven fabrics of carded wool or carded fine animal hair.

- Total Tax Rate: 62.0%

- Breakdown:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: Lower base tariff but still subject to additional tariffs.

-

HS CODE: 5407920510

- Description: Dyed woven fabrics of synthetic filament, containing mainly or entirely wool or fine animal hair.

- Total Tax Rate: 80.0%

- Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

Note: High tax rate for synthetic filament blended with wool.

-

HS CODE: 5515991020

- Description: Woven fabrics of other fibers, mainly or solely blended with wool or fine animal hair.

- Total Tax Rate: 67.0%

- Breakdown:

- Base Tariff: 12.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: Lower base tariff but still subject to additional tariffs.

Key Policy Notes:

- April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30.0% tariff after this date.

- Anti-dumping duties: Not explicitly mentioned in the data, but always verify if applicable for wool or synthetic fiber products.

- Material Verification: Confirm the exact composition (e.g., wool percentage, type of synthetic fiber) to ensure correct HS code classification.

- Certifications: Check if any certifications (e.g., soundproofing standards, textile certifications) are required for import or use in KTV rooms.

Proactive Advice:

- Verify Material Composition: Ensure the fabric's exact blend (e.g., wool percentage, fiber type) to match the correct HS code.

- Check Unit Price: High tax rates may affect cost; consider sourcing or duty optimization strategies.

- Consult Customs Authority: For final confirmation, especially if the product is used for specialized purposes like soundproofing.

Customer Reviews

No reviews yet.