| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5111201000 | Doc | 62.0% | CN | US | 2025-05-12 |

| 5111200500 | Doc | 62.0% | CN | US | 2025-05-12 |

| 5516320510 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5111201000 | Doc | 62.0% | CN | US | 2025-05-12 |

| 5111201000 | Doc | 62.0% | CN | US | 2025-05-12 |

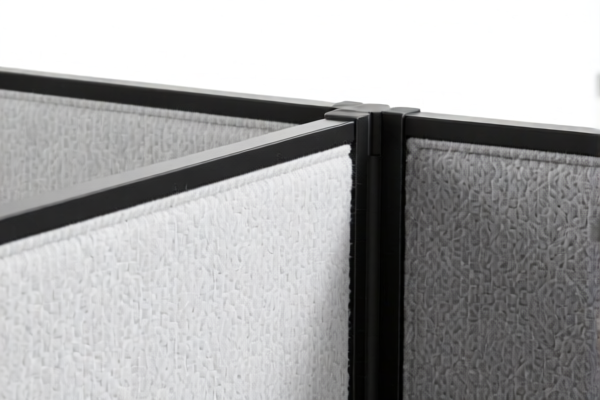

Product Classification: Wool Blended Office Partition Fabric

HS CODEs and Tax Details:

- HS CODE: 5111201000

- Description: Combed wool blended office partition fabric, blended with man-made fibers, possibly a plush fabric, weight less than 140g/m².

- Total Tax Rate: 62.0%

- Breakdown:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to lighter weight fabrics (under 140g/m²) and is repeated in the list.

-

HS CODE: 5111200500

- Description: Fine wool blended partition fabric, blended with man-made fibers, weight over 300g/m².

- Total Tax Rate: 62.0%

- Breakdown:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to heavier weight fabrics (over 300g/m²).

-

HS CODE: 5516320510

- Description: Wool blended dyed partition fabric, containing 36% or more wool or fine animal hair, uncombed, containing less than 85% by weight of man-made short fibers.

- Total Tax Rate: 80.0%

- Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code applies to fabrics with a higher wool content and specific fiber composition.

Key Tax Rate Changes (April 11, 2025 onwards):

- All listed HS codes will see an additional 30.0% tariff after April 11, 2025.

- This is a time-sensitive policy, so ensure your import timeline aligns with this change.

Proactive Advice:

- Verify Material Composition: Confirm the exact wool and fiber content, as this determines the correct HS code.

- Check Fabric Weight: The weight per square meter (g/m²) is critical for classification (e.g., under 140g/m² vs. over 300g/m²).

- Review Certification Requirements: Some HS codes may require specific certifications (e.g., origin, fiber content, or environmental compliance).

-

Consult with Customs Broker: For accurate classification and to avoid delays or penalties, especially with the upcoming tariff changes. Product Classification: Wool Blended Office Partition Fabric

HS CODEs and Tax Details: -

HS CODE: 5111201000

- Description: Combed wool blended office partition fabric, blended with man-made fibers, possibly a plush fabric, weight less than 140g/m².

- Total Tax Rate: 62.0%

- Breakdown:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to lighter weight fabrics (under 140g/m²) and is repeated in the list.

-

HS CODE: 5111200500

- Description: Fine wool blended partition fabric, blended with man-made fibers, weight over 300g/m².

- Total Tax Rate: 62.0%

- Breakdown:

- Base Tariff: 7.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

Notes: This code applies to heavier weight fabrics (over 300g/m²).

-

HS CODE: 5516320510

- Description: Wool blended dyed partition fabric, containing 36% or more wool or fine animal hair, uncombed, containing less than 85% by weight of man-made short fibers.

- Total Tax Rate: 80.0%

- Breakdown:

- Base Tariff: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Notes: This code applies to fabrics with a higher wool content and specific fiber composition.

Key Tax Rate Changes (April 11, 2025 onwards):

- All listed HS codes will see an additional 30.0% tariff after April 11, 2025.

- This is a time-sensitive policy, so ensure your import timeline aligns with this change.

Proactive Advice:

- Verify Material Composition: Confirm the exact wool and fiber content, as this determines the correct HS code.

- Check Fabric Weight: The weight per square meter (g/m²) is critical for classification (e.g., under 140g/m² vs. over 300g/m²).

- Review Certification Requirements: Some HS codes may require specific certifications (e.g., origin, fiber content, or environmental compliance).

- Consult with Customs Broker: For accurate classification and to avoid delays or penalties, especially with the upcoming tariff changes.

Customer Reviews

No reviews yet.