| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5516310510 | Doc | 74.8% | CN | US | 2025-05-12 |

| 5212131020 | Doc | 71.5% | CN | US | 2025-05-12 |

| 5111196060 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5516320510 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5407920510 | Doc | 80.0% | CN | US | 2025-05-12 |

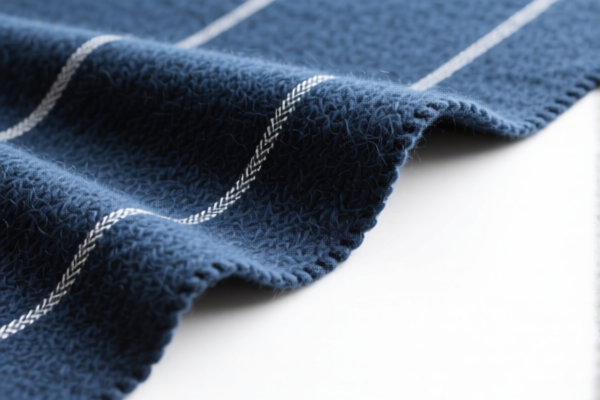

Product Classification: Wool Blended Yacht Interior Fabric

HS CODEs and Tax Details (as of current regulations):

✅ HS CODE: 5516.31.05.10

Description:

- Contains less than 85% (by weight) of man-made short staple fibers, mainly or solely blended with wool or fine animal hair.

- Applicable if the fabric is primarily made of synthetic fibers blended with wool or fine animal hair.

Tariff Breakdown:

- Base Tariff Rate: 19.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 74.8%

✅ HS CODE: 5212.13.10.20

Description:

- Contains cotton and wool, and the description includes "blended with wool."

- Applicable if the fabric is a blend of cotton and wool, with fine combed cotton also acceptable.

Tariff Breakdown:

- Base Tariff Rate: 16.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 71.5%

✅ HS CODE: 5111.19.60.60

Description:

- Woven fabrics made of Merino wool or fine animal hair.

- Applicable if the fabric is made of Merino wool or fine animal hair.

Tariff Breakdown:

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 80.0%

✅ HS CODE: 5516.32.05.10

Description:

- Dyed, containing less than 85% (by weight) of man-made short staple fibers, mainly or solely blended with wool or fine animal hair.

- Applicable if the fabric is dyed and made of synthetic fibers blended with wool or fine animal hair.

Tariff Breakdown:

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 80.0%

✅ HS CODE: 5407.92.05.10

Description:

- Dyed synthetic filament woven fabrics, blended mainly or entirely with wool or fine animal hair.

- Applicable if the fabric is made of synthetic long filament blended with wool or fine animal hair.

Tariff Breakdown:

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 80.0%

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025.

-

This is a time-sensitive policy and may significantly increase the total tax burden.

-

Anti-Dumping Duties:

-

If the fabric contains iron or aluminum components, check for anti-dumping duties that may apply. These are not included in the above tax details and require separate verification.

-

Material Verification:

- Confirm the exact composition of the fabric (e.g., wool percentage, type of synthetic fiber, and whether it is dyed or not).

-

Ensure the unit price and certifications (e.g., origin, textile standards) are in line with customs requirements.

-

Customs Clearance:

- Provide detailed product descriptions, material breakdowns, and certifications to avoid classification disputes or delays.

📌 Proactive Advice:

- Verify the fabric composition (e.g., wool percentage, fiber type, and whether it is dyed or not) to determine the correct HS code.

- Check the origin of the fabric, as this may affect the applicable tariff rate.

- Consult a customs broker or tax expert for accurate classification and compliance, especially if the product is being imported into China.

Product Classification: Wool Blended Yacht Interior Fabric

HS CODEs and Tax Details (as of current regulations):

✅ HS CODE: 5516.31.05.10

Description:

- Contains less than 85% (by weight) of man-made short staple fibers, mainly or solely blended with wool or fine animal hair.

- Applicable if the fabric is primarily made of synthetic fibers blended with wool or fine animal hair.

Tariff Breakdown:

- Base Tariff Rate: 19.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 74.8%

✅ HS CODE: 5212.13.10.20

Description:

- Contains cotton and wool, and the description includes "blended with wool."

- Applicable if the fabric is a blend of cotton and wool, with fine combed cotton also acceptable.

Tariff Breakdown:

- Base Tariff Rate: 16.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 71.5%

✅ HS CODE: 5111.19.60.60

Description:

- Woven fabrics made of Merino wool or fine animal hair.

- Applicable if the fabric is made of Merino wool or fine animal hair.

Tariff Breakdown:

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 80.0%

✅ HS CODE: 5516.32.05.10

Description:

- Dyed, containing less than 85% (by weight) of man-made short staple fibers, mainly or solely blended with wool or fine animal hair.

- Applicable if the fabric is dyed and made of synthetic fibers blended with wool or fine animal hair.

Tariff Breakdown:

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 80.0%

✅ HS CODE: 5407.92.05.10

Description:

- Dyed synthetic filament woven fabrics, blended mainly or entirely with wool or fine animal hair.

- Applicable if the fabric is made of synthetic long filament blended with wool or fine animal hair.

Tariff Breakdown:

- Base Tariff Rate: 25.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 80.0%

⚠️ Important Notes and Recommendations:

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff will be imposed on all the above HS codes after April 11, 2025.

-

This is a time-sensitive policy and may significantly increase the total tax burden.

-

Anti-Dumping Duties:

-

If the fabric contains iron or aluminum components, check for anti-dumping duties that may apply. These are not included in the above tax details and require separate verification.

-

Material Verification:

- Confirm the exact composition of the fabric (e.g., wool percentage, type of synthetic fiber, and whether it is dyed or not).

-

Ensure the unit price and certifications (e.g., origin, textile standards) are in line with customs requirements.

-

Customs Clearance:

- Provide detailed product descriptions, material breakdowns, and certifications to avoid classification disputes or delays.

📌 Proactive Advice:

- Verify the fabric composition (e.g., wool percentage, fiber type, and whether it is dyed or not) to determine the correct HS code.

- Check the origin of the fabric, as this may affect the applicable tariff rate.

- Consult a customs broker or tax expert for accurate classification and compliance, especially if the product is being imported into China.

Customer Reviews

No reviews yet.