| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5112909010 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112909010 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112909010 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112909010 | Doc | 80.0% | CN | US | 2025-05-12 |

| 5112909010 | Doc | 80.0% | CN | US | 2025-05-12 |

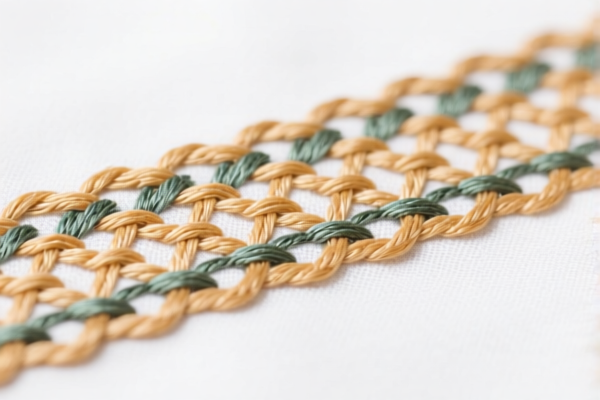

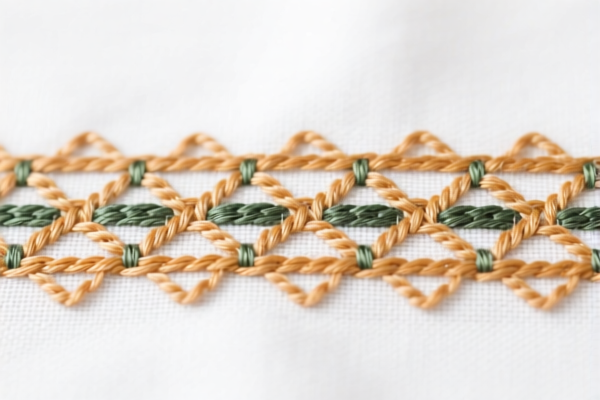

Product Name: Woven fabrics of combed wool blended — Embroidery fabric

HS CODE: 5112909010

🔍 Classification Summary:

- Product Type: Woven fabrics of combed wool blended with cotton, with embroidery.

- HS Code: 5112909010 (10-digit code).

- Tariff Applicability: This code applies to all variations of woven fabrics made from combed wool and cotton, including those with embroidery, jacquard patterns, twill weave, or pile fabric.

📊 Tariff Breakdown:

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 80.0%

⚠️ Important Note: The additional 30.0% tariff applies after April 11, 2025. Ensure your customs clearance is completed before this date to avoid the higher rate.

📌 Key Considerations:

- Material Composition: Must be combed wool blended with cotton. Verify the exact percentage of wool and cotton in the fabric to ensure correct classification.

- Embroidery: The presence of embroidery does not change the HS code, as it is already included in the general description of this code.

- Certifications: Check if any import licenses or textile certifications (e.g., origin, sustainability) are required for your specific market.

- Unit Price: Confirm the unit price of the fabric, as this may affect the application of anti-dumping duties or other trade measures.

🛑 Proactive Advice:

- Verify Material Composition: Ensure the fabric is indeed made of combed wool and cotton and not blended with other fibers (e.g., synthetic).

- Check for Additional Tariffs: If importing after April 11, 2025, be prepared for the 30.0% additional tariff.

- Consult Customs Broker: For complex cases, especially if the fabric has multiple features (e.g., embroidery + pile fabric), consult a customs broker or expert for accurate classification.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Name: Woven fabrics of combed wool blended — Embroidery fabric

HS CODE: 5112909010

🔍 Classification Summary:

- Product Type: Woven fabrics of combed wool blended with cotton, with embroidery.

- HS Code: 5112909010 (10-digit code).

- Tariff Applicability: This code applies to all variations of woven fabrics made from combed wool and cotton, including those with embroidery, jacquard patterns, twill weave, or pile fabric.

📊 Tariff Breakdown:

- Base Tariff Rate: 25.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 80.0%

⚠️ Important Note: The additional 30.0% tariff applies after April 11, 2025. Ensure your customs clearance is completed before this date to avoid the higher rate.

📌 Key Considerations:

- Material Composition: Must be combed wool blended with cotton. Verify the exact percentage of wool and cotton in the fabric to ensure correct classification.

- Embroidery: The presence of embroidery does not change the HS code, as it is already included in the general description of this code.

- Certifications: Check if any import licenses or textile certifications (e.g., origin, sustainability) are required for your specific market.

- Unit Price: Confirm the unit price of the fabric, as this may affect the application of anti-dumping duties or other trade measures.

🛑 Proactive Advice:

- Verify Material Composition: Ensure the fabric is indeed made of combed wool and cotton and not blended with other fibers (e.g., synthetic).

- Check for Additional Tariffs: If importing after April 11, 2025, be prepared for the 30.0% additional tariff.

- Consult Customs Broker: For complex cases, especially if the fabric has multiple features (e.g., embroidery + pile fabric), consult a customs broker or expert for accurate classification.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.